Compare Landis.com and HomeVestors.com

For Buyers

Answer: Landis.com is a rent-to-own program that does not provide real estate services while HomeVestors.com is a direct home cash buyer that buys select homes off-market with cash offers and resells them at a profit to homebuyers

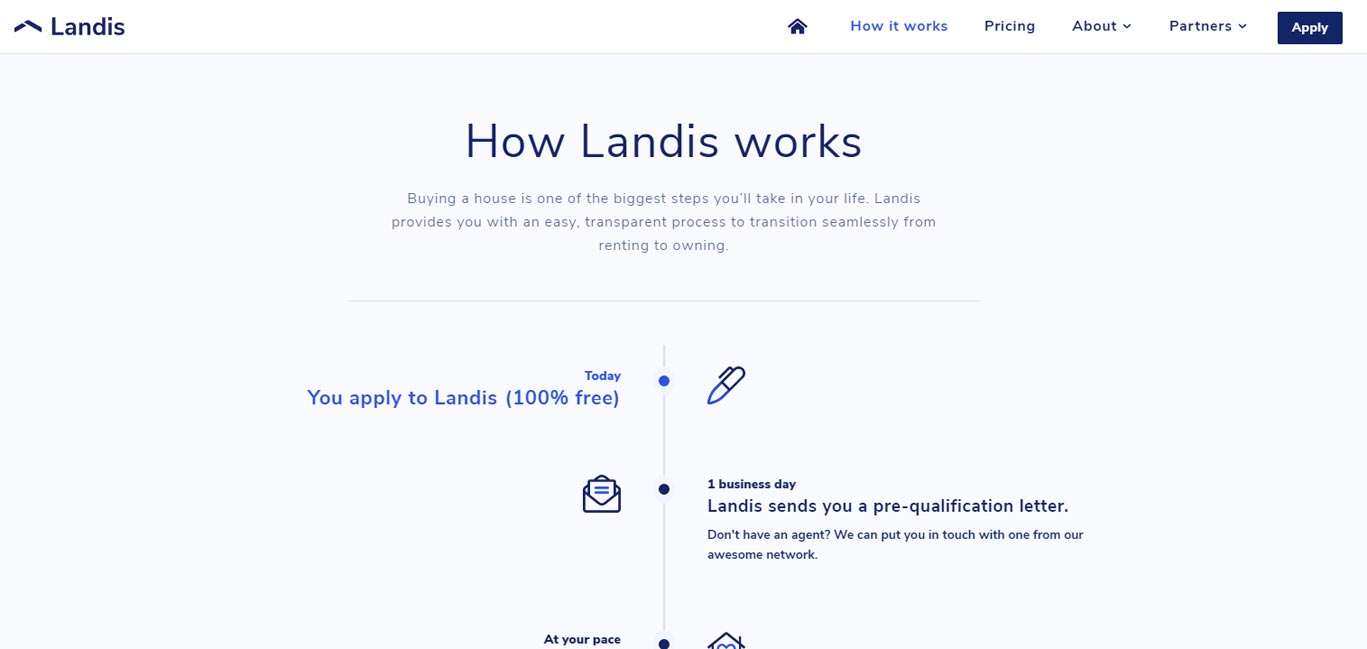

Buying with Landis

Landis is a rent-to-own program that purchases the home and then rents it out to you as a tenant. Landis claims to operate a one-year program for the tenants to buy the property once they can afford a down payment. A common complaint with all rent-to-own programs is an inability of the tenant to secure a loan in time to purchase the property, at which point the tenant is either forced to walk away with a loss or continues to rent.

Landis may sometimes suggest that a customer reach out to someone (e.g. a lender) who can help them, but the company doesn’t make money from it, and only gives the info to the customer, not the customer's info to anyone else. Landis does not receive any referral fees from third parties (such as lenders, real estate brokers, etc.) and keenly guards customers' information. This is a refreshing approach that adds value to consumers. Landis states that: "companies at our stage don't have any incentive to charge hidden fees: growth and customer experience simply matter much more than revenue."

Landis Pricing

Landis revenue comes from the price of rent and a 3% increase between the price of the home when Landis buys it and the price it sells it to the tenant after a year.

Landis is silent on what happens in a situation when the price of the home drops before the tenant can buy it, or if the mortgage rates increase during the tenancy period. When consumers use Landis, they are unable to take advantage of a buyer’s commission rebate from a real estate agent because the company is the one actually buying the home.

Landis states that it receives "no rebates or commissions from agents, we pay agents their full commission, as though they were working with the customer."

When it comes to the cost of rent Landis says that "we're very upfront with our users that during the 12 months of the program, we are more expensive than owning, or even renting. That's because we need our customers to put money to the side for their down payment … our only revenue is market rent and 3% appreciation at the end of the year. The economics work out because we're in areas where average rents are high."

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Landis.com Editor's Review:

Landis program purchases the home and rents it to the tenant with an option to buy. Landis reviews full financial, credit, and work history of each potential tenant. Those few applicants who pass the screening may select a home within the allowed amount Landis sets. A tenant pays rent, a portion of which becomes a down payment to eventually buy the home. After a year, if the tenant decides to move out, Landis deducts half of the down payment amount saved, as an added fee. When purchasing a house from Landis, a tenant must and pay closing costs of the sale.

Landis has only enough cash on hand (structured as debt) to place offers against a handful of properties. This is why the company likely rejects the majority of applications as a way to reduce risk. It is safe to assume that only a very small number of applications with Landis are approved.

According to the company, "lenders send us customers that want to buy a home but can't close on a loan. It could be due to a low credit score, insufficient down payment, a recent bankruptcy, self-employment, or some other reason."

To secure a mortgage on competitive terms is a primary and the best option to buy a home. Yes, the down payment is difficult, but adding Landis to the mix doesn't solve the overall affordability. Landis claims that owning a home is always cheaper than renting it, but Landis is a landlord.

There is nothing to substantiate that renting a home from Landis is less expensive to own it during that same time frame. There is also nothing to suggest that Landis is offering reduced rent to the tenant at any given time. Buying a property is a risk, and Landis must account for this risk with added fees. The true costs of this rent-to-buy program are incredibly difficult to estimate by anyone other than Landis, and these costs are absolutely real.

Buyers are unlikely to receive a buyer's rebate from a real estate agent when buying with Landis program.

Buying a home is one of the most important transactions in people's lives, especially the first home. By adding Landis rent-to-own proposition, buyers are subjecting their transaction to the additional 3% appreciation fees, paying rent, and a possible loss of half of the down payment amount if moving out.

Landis receives a neutral editor's score because of several factors. When asked, the company declined to disclose its application volume and applicant success rates. Lack of this information makes it difficult to estimate the “weight” of overall operations and the returns the company is required to make against the total number of participants.

An undisputed positive is that the company doesn’t make money from referrals, making their claims to hold consumers’ best interest viable.

Landis claims that owning in the long term is cheaper than renting, especially in the markets where it operates. However, there is no clear evidence money is saved and there is no evidence that consumers who choose the Landis model end up with a higher chance of purchasing the home.

Landis states: “We completely agree that a mortgage is better. That's why we coach all our customers to do what they need to get a mortgage. It's the whole point of the company. We work with those who simply can't get a mortgage (because of credit score, down payment, etc.) and we coach them to fix what prevents them from getting one. As soon as they can get one, they graduate from the program.”

We find no solid evidence that Landis offers home buyers tangible savings as part of their rent-to-own program, but at the same time, some home buyers may decide for themselves that the program is worth the added fees.

Geodoma editorial staff remains overall neutral on the subject: we can neither recommend Landis nor suggest that buyers refrain from using the program.

Where does Landis.com operate?

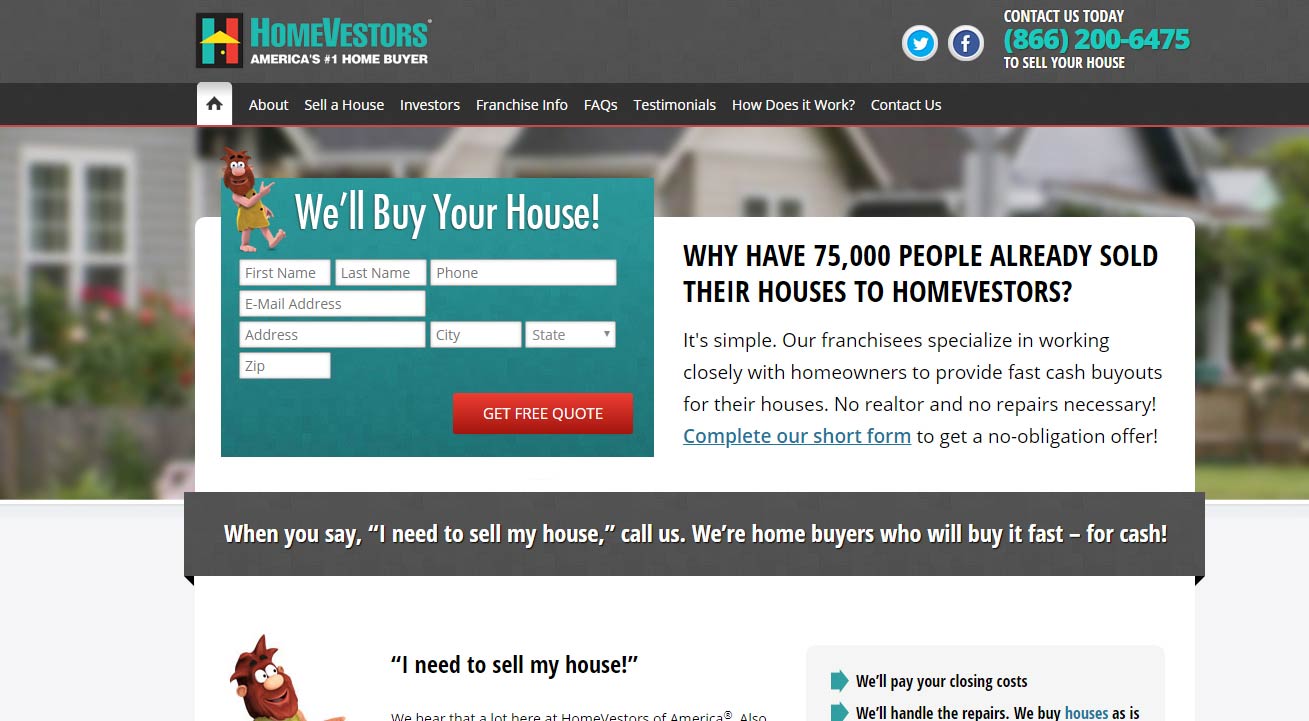

Buying and Selling with HomeVestors

HomeVestors (also known as We Buy Ugly Houses) is a franchise network where each individual local franchisee considers the condition of a home and makes an offer to pay cash for the property. In determining the offer, each franchisee discounts from the estimated retail value after it’s fully renovated.

HomeVestors Pricing

HomeVestors franchisees make money with a difference between buying and selling each home. Typically an offer equal to 70% of home value is expected from this type of sale after any cost of the repairs and resale.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeVestors.com Editor's Review:

HomeVestors franchisee will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. After the franchisee buys the home, it renovates and resells it for a profit or rents it out to qualified tenants.

With the low offer price, comes a convenience of an all-cash closing when selling a home. HomeVestors franchisee typically closes a home in 30 days of receiving cash offer.

Typically each franchisee uses the following factors when determining the offer: existing condition of the home including repairs needed, time it will take to finish needed repairs, value of a home compared to other comparable homes in the area, real estate commission required to resell, costs associated with maintaining a home during repairs, including taxes, payments, insurance, utilities and homeowner dues.

The main disadvantage of using HomeVestors is high losses in homeowners' equity. HomeVestors is a "heavy" model, ready to buy homes in all-cash transactions.

As any real estate investor, HomeVestors franchisee is susceptible to losing money in any given transaction. This model is prone to a number of risk factors, high operational costs and a continued need for higher-than-average Return on Investment (ROI) with each flip.

HomeVestors franchisee is not legally bound to represent consumers, its main legal obligation is to its stakeholders. Moreover, because most homes in the United States are financed, homeowners own only partial net equity in their home.

Banks receive the same amount of the remaining mortgage sum regardless of how any given home is sold, or how much of homeowners' net equity is lost in the transaction with HomeVestors.

Today, there are a number of highly qualified real estate agents who offer competitive listing rates and flat fee listings across the United States. Unless a situation absolutely requires a quick sale, Geodoma recommends that consumers first consider using a licensed real estate agent working on competitive terms to properly list their homes on the open market before turning to HomeVestors option.