Compare Landis.com and Houwzer.com

For Buyers

For Buyers

Answer: Landis.com is a rent-to-own program that does not provide real estate services while Houwzer.com is a full-service real estate agent that offers savings to homebuyers and home sellers

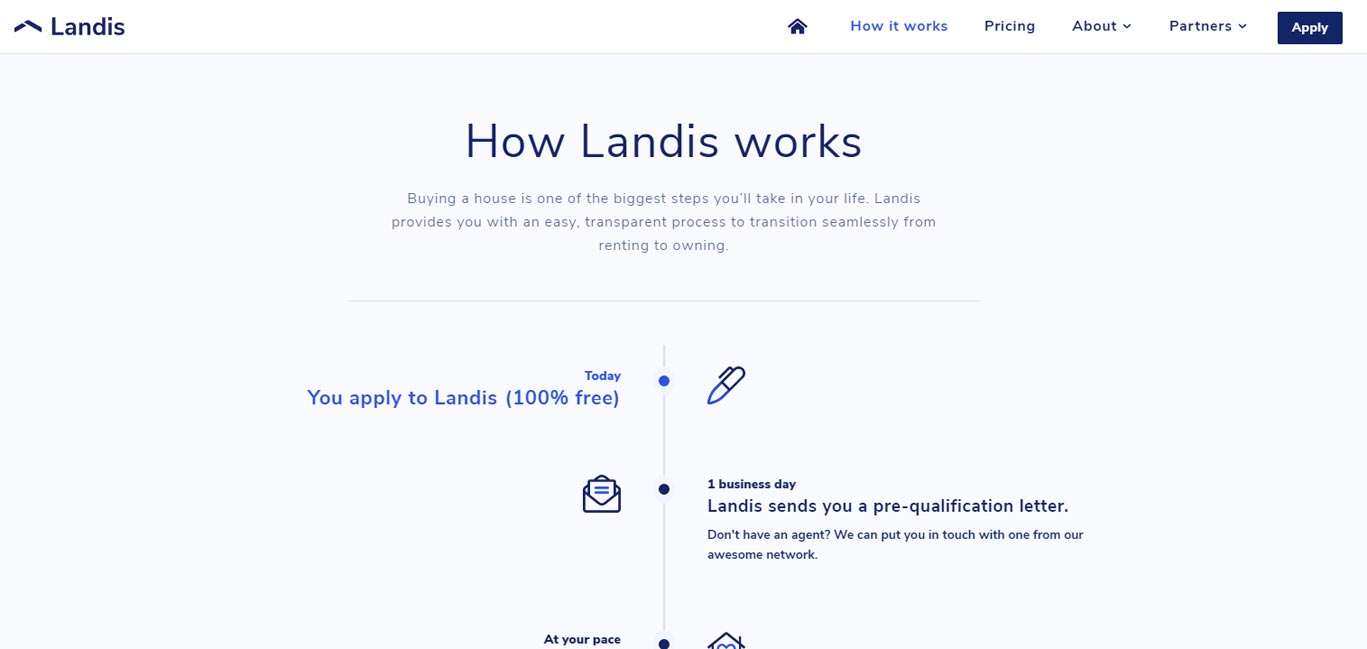

Buying with Landis

Landis is a rent-to-own program that purchases the home and then rents it out to you as a tenant. Landis claims to operate a one-year program for the tenants to buy the property once they can afford a down payment. A common complaint with all rent-to-own programs is an inability of the tenant to secure a loan in time to purchase the property, at which point the tenant is either forced to walk away with a loss or continues to rent.

Landis may sometimes suggest that a customer reach out to someone (e.g. a lender) who can help them, but the company doesn’t make money from it, and only gives the info to the customer, not the customer's info to anyone else. Landis does not receive any referral fees from third parties (such as lenders, real estate brokers, etc.) and keenly guards customers' information. This is a refreshing approach that adds value to consumers. Landis states that: "companies at our stage don't have any incentive to charge hidden fees: growth and customer experience simply matter much more than revenue."

Landis Pricing

Landis revenue comes from the price of rent and a 3% increase between the price of the home when Landis buys it and the price it sells it to the tenant after a year.

Landis is silent on what happens in a situation when the price of the home drops before the tenant can buy it, or if the mortgage rates increase during the tenancy period. When consumers use Landis, they are unable to take advantage of a buyer’s commission rebate from a real estate agent because the company is the one actually buying the home.

Landis states that it receives "no rebates or commissions from agents, we pay agents their full commission, as though they were working with the customer."

When it comes to the cost of rent Landis says that "we're very upfront with our users that during the 12 months of the program, we are more expensive than owning, or even renting. That's because we need our customers to put money to the side for their down payment … our only revenue is market rent and 3% appreciation at the end of the year. The economics work out because we're in areas where average rents are high."

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Landis.com Editor's Review:

Landis program purchases the home and rents it to the tenant with an option to buy. Landis reviews full financial, credit, and work history of each potential tenant. Those few applicants who pass the screening may select a home within the allowed amount Landis sets. A tenant pays rent, a portion of which becomes a down payment to eventually buy the home. After a year, if the tenant decides to move out, Landis deducts half of the down payment amount saved, as an added fee. When purchasing a house from Landis, a tenant must and pay closing costs of the sale.

Landis has only enough cash on hand (structured as debt) to place offers against a handful of properties. This is why the company likely rejects the majority of applications as a way to reduce risk. It is safe to assume that only a very small number of applications with Landis are approved.

According to the company, "lenders send us customers that want to buy a home but can't close on a loan. It could be due to a low credit score, insufficient down payment, a recent bankruptcy, self-employment, or some other reason."

To secure a mortgage on competitive terms is a primary and the best option to buy a home. Yes, the down payment is difficult, but adding Landis to the mix doesn't solve the overall affordability. Landis claims that owning a home is always cheaper than renting it, but Landis is a landlord.

There is nothing to substantiate that renting a home from Landis is less expensive to own it during that same time frame. There is also nothing to suggest that Landis is offering reduced rent to the tenant at any given time. Buying a property is a risk, and Landis must account for this risk with added fees. The true costs of this rent-to-buy program are incredibly difficult to estimate by anyone other than Landis, and these costs are absolutely real.

Buyers are unlikely to receive a buyer's rebate from a real estate agent when buying with Landis program.

Buying a home is one of the most important transactions in people's lives, especially the first home. By adding Landis rent-to-own proposition, buyers are subjecting their transaction to the additional 3% appreciation fees, paying rent, and a possible loss of half of the down payment amount if moving out.

Landis receives a neutral editor's score because of several factors. When asked, the company declined to disclose its application volume and applicant success rates. Lack of this information makes it difficult to estimate the “weight” of overall operations and the returns the company is required to make against the total number of participants.

An undisputed positive is that the company doesn’t make money from referrals, making their claims to hold consumers’ best interest viable.

Landis claims that owning in the long term is cheaper than renting, especially in the markets where it operates. However, there is no clear evidence money is saved and there is no evidence that consumers who choose the Landis model end up with a higher chance of purchasing the home.

Landis states: “We completely agree that a mortgage is better. That's why we coach all our customers to do what they need to get a mortgage. It's the whole point of the company. We work with those who simply can't get a mortgage (because of credit score, down payment, etc.) and we coach them to fix what prevents them from getting one. As soon as they can get one, they graduate from the program.”

We find no solid evidence that Landis offers home buyers tangible savings as part of their rent-to-own program, but at the same time, some home buyers may decide for themselves that the program is worth the added fees.

Geodoma editorial staff remains overall neutral on the subject: we can neither recommend Landis nor suggest that buyers refrain from using the program.

Where does Landis.com operate?

Buying and Selling with Houwzer

Houwzer is a multi-state savings broker, offers consumers listing savings and buyer’s refunds in select areas across Pennsylvania, Washington, D.C., and New Jersey.

Houwzer Pricing

Houwzer offers savings to sellers ($5,000 flat listing fee)

Listing Services

- MLS Listing

- Zillow, Trulia, etc. Listing

- Accept and Deliver All Offers and Counteroffers

- Hold Open Houses

- Professional Photography

- Professional Floor Plans

- Yard Signage Installation

- Spare Key Lock-box Installation

- Schedule Inspection Services

- Schedule Private Showings

- Closing Duties

Buyer's Agent Services

- Find the Property

- Accept and Deliver All Offers and Counteroffers

- Recommend Other Professionals

- Attend Inspection Services

- Schedule Private Showings

- Negotiate Needed Repairs

- Closing Duties

Houwzer.com Editor's Review:

Houwzer is a consumer-focused flat fee real estate listing broker. Houwzer does not openly offer buyer’s refunds to buyers.

As a listing agent, Houwzer works with a seller to prepare homes for listing, including taking professional photos, pricing home, and publishing marketing materials. Houwzer lists all homes on the local MLS as well as typical MLS Aggregators.

Houwzer does not openly offer buyer's refunds and keeps the entire Buyer's Agent Commission when it represents home buyers unless individually negotiated.

Houwzer offers a “bundle” rebate applied to the cost of listing if a consumers buys new home first. In order to qualify, a buyer must purchase a home with Houwzer and the company will reduce listing fee by $2,500 to sell buyer’s current home on the open market.