Landis.com Reviews

Buying with Landis

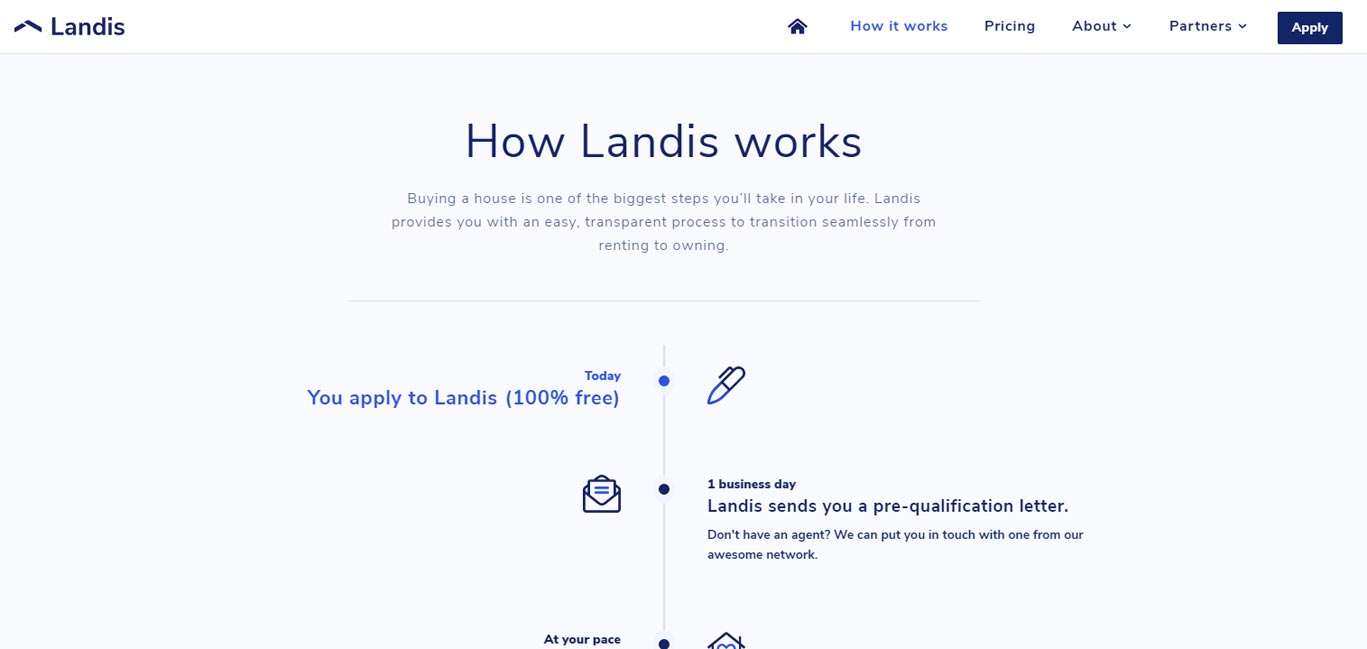

Landis is a rent-to-own program that purchases the home and then rents it out to you as a tenant. Landis claims to operate a one-year program for the tenants to buy the property once they can afford a down payment. A common complaint with all rent-to-own programs is an inability of the tenant to secure a loan in time to purchase the property, at which point the tenant is either forced to walk away with a loss or continues to rent.

Landis may sometimes suggest that a customer reach out to someone (e.g. a lender) who can help them, but the company doesn’t make money from it, and only gives the info to the customer, not the customer's info to anyone else. Landis does not receive any referral fees from third parties (such as lenders, real estate brokers, etc.) and keenly guards customers' information. This is a refreshing approach that adds value to consumers. Landis states that: "companies at our stage don't have any incentive to charge hidden fees: growth and customer experience simply matter much more than revenue."

Landis Pricing

Landis revenue comes from the price of rent and a 3% increase between the price of the home when Landis buys it and the price it sells it to the tenant after a year.

Landis is silent on what happens in a situation when the price of the home drops before the tenant can buy it, or if the mortgage rates increase during the tenancy period. When consumers use Landis, they are unable to take advantage of a buyer’s commission rebate from a real estate agent because the company is the one actually buying the home.

Landis states that it receives "no rebates or commissions from agents, we pay agents their full commission, as though they were working with the customer."

When it comes to the cost of rent Landis says that "we're very upfront with our users that during the 12 months of the program, we are more expensive than owning, or even renting. That's because we need our customers to put money to the side for their down payment … our only revenue is market rent and 3% appreciation at the end of the year. The economics work out because we're in areas where average rents are high."

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Landis.com Editor's Review:

Landis program purchases the home and rents it to the tenant with an option to buy. Landis reviews full financial, credit, and work history of each potential tenant. Those few applicants who pass the screening may select a home within the allowed amount Landis sets. A tenant pays rent, a portion of which becomes a down payment to eventually buy the home. After a year, if the tenant decides to move out, Landis deducts half of the down payment amount saved, as an added fee. When purchasing a house from Landis, a tenant must and pay closing costs of the sale.

Landis has only enough cash on hand (structured as debt) to place offers against a handful of properties. This is why the company likely rejects the majority of applications as a way to reduce risk. It is safe to assume that only a very small number of applications with Landis are approved.

According to the company, "lenders send us customers that want to buy a home but can't close on a loan. It could be due to a low credit score, insufficient down payment, a recent bankruptcy, self-employment, or some other reason."

To secure a mortgage on competitive terms is a primary and the best option to buy a home. Yes, the down payment is difficult, but adding Landis to the mix doesn't solve the overall affordability. Landis claims that owning a home is always cheaper than renting it, but Landis is a landlord.

There is nothing to substantiate that renting a home from Landis is less expensive to own it during that same time frame. There is also nothing to suggest that Landis is offering reduced rent to the tenant at any given time. Buying a property is a risk, and Landis must account for this risk with added fees. The true costs of this rent-to-buy program are incredibly difficult to estimate by anyone other than Landis, and these costs are absolutely real.

Buyers are unlikely to receive a buyer's rebate from a real estate agent when buying with Landis program.

Buying a home is one of the most important transactions in people's lives, especially the first home. By adding Landis rent-to-own proposition, buyers are subjecting their transaction to the additional 3% appreciation fees, paying rent, and a possible loss of half of the down payment amount if moving out.

Landis receives a neutral editor's score because of several factors. When asked, the company declined to disclose its application volume and applicant success rates. Lack of this information makes it difficult to estimate the “weight” of overall operations and the returns the company is required to make against the total number of participants.

An undisputed positive is that the company doesn’t make money from referrals, making their claims to hold consumers’ best interest viable.

Landis claims that owning in the long term is cheaper than renting, especially in the markets where it operates. However, there is no clear evidence money is saved and there is no evidence that consumers who choose the Landis model end up with a higher chance of purchasing the home.

Landis states: “We completely agree that a mortgage is better. That's why we coach all our customers to do what they need to get a mortgage. It's the whole point of the company. We work with those who simply can't get a mortgage (because of credit score, down payment, etc.) and we coach them to fix what prevents them from getting one. As soon as they can get one, they graduate from the program.”

We find no solid evidence that Landis offers home buyers tangible savings as part of their rent-to-own program, but at the same time, some home buyers may decide for themselves that the program is worth the added fees.

Geodoma editorial staff remains overall neutral on the subject: we can neither recommend Landis nor suggest that buyers refrain from using the program.

FAQ for Landis.com

What is Landis?

Landis is a rent-to-own program that purchases the home and rents it to the tenant with an option to buy in one year. There is no solid evidence that Landis offers home buyers tangible savings as part of their rent-to-own program, but at the same time, some home buyers may decide for themselves that the program is worth the added fees.

Is Landis legitimate?

Like most rent-to-own programs, Landis is a highly questionable proposition. Geodoma can neither recommend Landis nor suggest that buyers refrain from using the program.

Where does Landis.com operate?

Landis.com User Reviews

Please don't use them

They put in an offer fast no time wasted Nick and Jesse worked hard.It is a pleasure to work with Landis!!!!

Thanks guys!

I was assigned a personal expert, Bre who made things go along smoothly. She was so knowledgeable that I felt safe about the process. I will gladly share my experience with friends and family regarding this unique program. Thank you, Landis for this special homebuying opportunity.

This program is NOT for low income. You must have 2,500/mo. Then, you must pay thousands for rent, plus a very high down payment. Ours was asked to be around 10k, even though we stated we did not want to give up more than 5 at the present time. So after you give up almost all your money to rent, and your life savings up front, you then need to get a mortgage after 12 months. So here you are, paying more than your old rent was in the first place, and in 12 months you need to have a down payment for the mortgage, plus closing costs, for a home that they're going to sell to you for 3% OVER what they bought it for in the first place. How exactly does that happen when you're getting taken to the cleaners?

They also have a ridiculous policy that the home must be 30 years old or less, or undergo FULL renovation. In my area, it's almost impossible to find a home like that, and if you do, it is way out of a middle-class price range. They claim they are in areas where "rent is high" to "help" people. Rent in my area is anywhere from 800-1,200/mo. That's not high at all. And I fail to see how Landis helps anyone, given the insane amount of money required to actually purchase the home.

My advice: take a few months to get yourself together. Spruce up your credit, stop over-spending, and you can have a mortgage in no time for way less than what Landis is asking.

I tried to find reviews online regarding this company before submitting anything and couldn't find anything.

I kept asking questions to find out more and the information they gave me was limited.

I spoke with Lindsay, (when she would pick up the phone) and told her the day before, my spouse took lunch at a certain time and could only speak than.

She callled over a hour late.

Began to tell me we would only qualify for a $110,000 house and they would require $5000 up front!

(She had our documents in front of her and knew that was more then we had saved and this money is only going towards the down payment, not the mortgage of the home.)

When I told her, what she already knew, that on a $110,000 house, FHA only requires $3850 and $5000 would cover that plus most of the closing cost, she tells me about the 3 percent they charge.

Not to mention, the $1200 a month in rent they would charge and only $128 of it going towards the down payment! The $1072 dollars is going to them!

And there is no guarantee you will get the house at the end of 12 months. It's a win win situation...for Landis only! Hopefully, someone else, that is curious like me and wondering should they try this, will read this review.

Landis provides knowledge, coaching, assistance, and builds a relationship with a caring and professional manner.

I am grateful for finding Landis and becoming their client.

Compare Landis.com to:

Thank you!

Your review has been successfully received. Please allow 24 hours for your review to become available.

Feel free to contact us if you need further assistance. At Geodoma we aim to make the opportunity of homeownership transparent, affordable and an open experience.