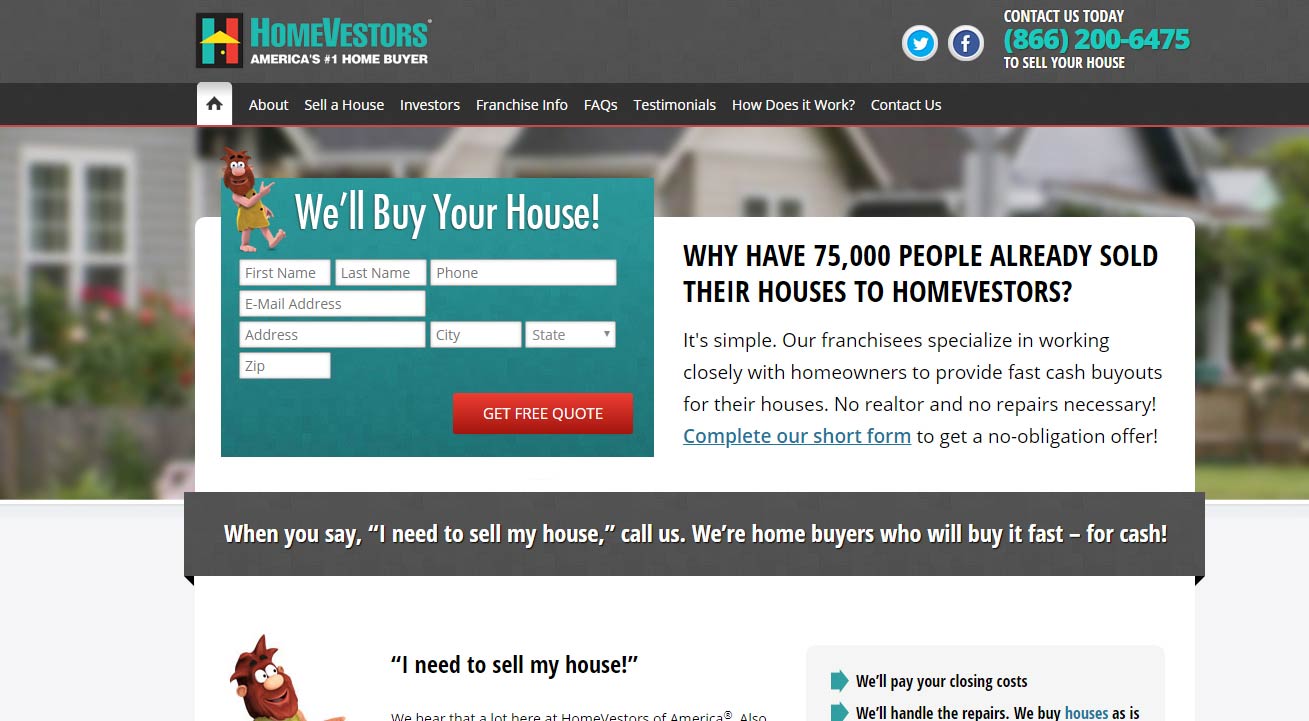

HomeVestors.com Reviews

Buying and Selling with HomeVestors

HomeVestors (also known as We Buy Ugly Houses) is a franchise network where each individual local franchisee considers the condition of a home and makes an offer to pay cash for the property. In determining the offer, each franchisee discounts from the estimated retail value after it’s fully renovated.

HomeVestors Pricing

HomeVestors franchisees make money with a difference between buying and selling each home. Typically an offer equal to 70% of home value is expected from this type of sale after any cost of the repairs and resale.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeVestors.com Editor's Review:

HomeVestors franchisee will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. After the franchisee buys the home, it renovates and resells it for a profit or rents it out to qualified tenants.

With the low offer price, comes a convenience of an all-cash closing when selling a home. HomeVestors franchisee typically closes a home in 30 days of receiving cash offer.

Typically each franchisee uses the following factors when determining the offer: existing condition of the home including repairs needed, time it will take to finish needed repairs, value of a home compared to other comparable homes in the area, real estate commission required to resell, costs associated with maintaining a home during repairs, including taxes, payments, insurance, utilities and homeowner dues.

The main disadvantage of using HomeVestors is high losses in homeowners' equity. HomeVestors is a "heavy" model, ready to buy homes in all-cash transactions.

As any real estate investor, HomeVestors franchisee is susceptible to losing money in any given transaction. This model is prone to a number of risk factors, high operational costs and a continued need for higher-than-average Return on Investment (ROI) with each flip.

HomeVestors franchisee is not legally bound to represent consumers, its main legal obligation is to its stakeholders. Moreover, because most homes in the United States are financed, homeowners own only partial net equity in their home.

Banks receive the same amount of the remaining mortgage sum regardless of how any given home is sold, or how much of homeowners' net equity is lost in the transaction with HomeVestors.

Today, there are a number of highly qualified real estate agents who offer competitive listing rates and flat fee listings across the United States. Unless a situation absolutely requires a quick sale, Geodoma recommends that consumers first consider using a licensed real estate agent working on competitive terms to properly list their homes on the open market before turning to HomeVestors option.

FAQ for HomeVestors.com

What are the alternatives to HomeVestors?

HomeVestors directly competes with iBuyers that include Offerpad, Orchard, Opendoor, and others.

However, genuinely legitimate alternatives to using any iBuyer are real estate agents who offer savings and help consumers efficiently list homes on the open market.

What are the pros and cons of HomeVestors?

Pros: quick cash sale. Unfortunately, this benefit is highly questionable and it is highly unlikely that HomeVestors franchisee will make a fair offer on the seller's home. Consumers systematically decline the vast majority of all instant cash offers from iBuyers.

Cons: there are several main disadvantages to HomeVestors. First, HomeVestors franchisee has no legal obligation to offer consumers full value on their home. Second, HomeVestors franchisees operate in highly limited markets and is highly selective when buying homes. Third, consumers may lose as much as 20%-30% of their home's equity when selling a home to an iBuyer.

What is HomeVestors?

HomeVestors (also known as We Buy Ugly Houses) is a franchise network where each individual local franchisee considers the condition of a seller's home and makes an offer to pay cash for the property.

Is HomeVestors legitimate?

Yes and No. HomeVestors franchisees make money with a difference between buying and selling each home. HomeVestors franchisee will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. Typically, an offer equal to 70% of home value can be expected from this type of sale after any cost of the repairs and resale.

Where does HomeVestors.com operate?

HomeVestors.com User Reviews

As I knew a house up the street had sold for $425K+, I knew my house was worth well in excess of what the buyer said. My house is one of a few brick homes in an older neighborhood within 3 miles of downtown and a 8 minute walk to a light rail system. I have personally had the following done in over 2 decades: wood floors refinished; slate floors in 3 rooms; granite countertops in kitchen and adjacent room; ceiling fans in kitchen & adjacent room; canned lights in kitchen, dining, & butler pantry; new hinges throughout house; new front & back mahogany doors; triple paned windows, solar shades on all windows, & velvet drapes in bedrooms, den, dining, & living room; crown molding throughout; oversized 14 SEER HVAC, insulation in attic, insulated ducts; irrigation system; extensive landscaping around skirt of house; working gas log fireplace & decorative chimney caps; etc. Their buyer said - with a straight face - all these touches were nice, but were not THAT important to an eventual buyer. After being blissfully ignorant of a provision used by close in neighborhoods to keep townhouse development out, she said that the market value of my house would be $350K.

The difference between their inaccurate estimation of MV and their offering price would be their holding costs (homes in my specific subdivision sell within 1 month, sometimes within a week) and their profit.

These people called me 4 times to follow up. When I told them I had never received an actual offer, they had the buyer contact me to tell me the offer was $233K. The buyer offered to list the house for sale for me at my estimation of $400K. After not knowing of a significant land use provision and not being aware of the market, I told her no.

I listed my house with a knowledgeable local broker. My house needed no repairs, but did need to be cleaned and decluttered. I received 2 offers for my house within a week. One was for $6K over list and the other was $60.5K over list.

If you live in a close in neighborhood and do not need repairs on your home, use a local agent. I would have missed out on $219K in equity if I would have given their crazy offer any consideration. Being ignorant of significant land use issues (can townhomes be developed next to you) showed their lack of professionalism. My house was market ready, but people who use hammers all day see every situation as a nail.

They will rip you off!

They ask if they can send contractors in to get an estimate for repairs, then they drop the price even more.

TERRIBLE company to deal with!!!

WARNING! DO NOT USE THEM!!

Kathy Morgan was very professional, friendly and helpful in my Property Analysis. I highly recommend Kathy for her expertise. She fully understood when I did not accept her offer. Told me if I need any help, she will be more than willing. Thanks again Kathy.

They offered me 440k for my home.

I got a moving company and moved my stuff and guess what? The 440k is off the table. New offer is 360k. To me, a big drop. To these scammers of a company, it’s small change and it’s what they do all the time. Avoid at all costs!!!

I give a 5 star on this.

How they dare?

If I sell my house I’ll call you but sending me mails with offers isn’t professional! .

Please stop doing this to peaceful people !

Thank you

Had a walkthrough with them today and at the end of the visit the gentleman didn't even offer what I paid for my house and he could have cared less about the improvements that I have made to it over the years nor the fact that I'm willing to leave brand new appliances (oldest appliance is just over a year old). His final offer was about 40% of what the house is appraised for. A hard "no" from me. I understand that they need to make money from the house, but I'm not just going to throw my investment away for pennies on the dollar.

1 star only because, like others have said before, I had to give them something.

My house is worth more. He low balled me so bad it was sinful. I have been trying to get a form signed since 12-19-19 to release earnest money.

He ignored me and needless to say it was never signed. So I am being held up with any in future escrows.

I regret I ever had any dealings with Mr. Siebeneicher or Homevestors in Houston TX.

my experience: Shady contracts. Only protect them, with ZERO risk on their part, they can not follow through on anything they say they will do and they try to get selller to take less right before closing... a LOT less. Not worth the risk. There are other reputable investors AND even better off just listing retail and have an agent look out for YOUR best interest.. not theirs.

I called HomeVesters to buy my house. An agent came, by the name of Romel Patterson, from PHor the PHamily Properties, LLC, showed us a nice folder on their business, looked around and gave an estimated selling price.

Two days later, contacted me with a negotiated price to which we agreed upon, in "as is condition". Our attorney drew up contracts, sent them to their attorney for signature, which was signed and approved.

The agent brought two of their contractors to our house for a walk through.

The next day, minutes before I was going to sign the contracts, my attorney received notice that HomeVestors were withdrawing their offer and deposit check based on the "COVID-19 and the economy" and at this time can no longer meet our negotiated price, leaving us with no buyer and acquired legal fees. During this time, I rejected other offers based upon their commitment.

Honest, trusting sellers, beware of these types of business dealings that mislead potential sellers. We used HomeVestors/PHor the PHamily Properties, LLC, (Romel Patterson).

Thank you!

Your review has been successfully received. Please allow 24 hours for your review to become available.

Feel free to contact us if you need further assistance. At Geodoma we aim to make the opportunity of homeownership transparent, affordable and an open experience.