Compare HomeVestors.com and ToriiHomes.com

For Buyers

Answer: HomeVestors.com is a direct home cash buyer that buys select homes off-market with cash offers and resells them at a profit to homebuyers while ToriiHomes.com is a buyer’s real estate agent and a referral fee network

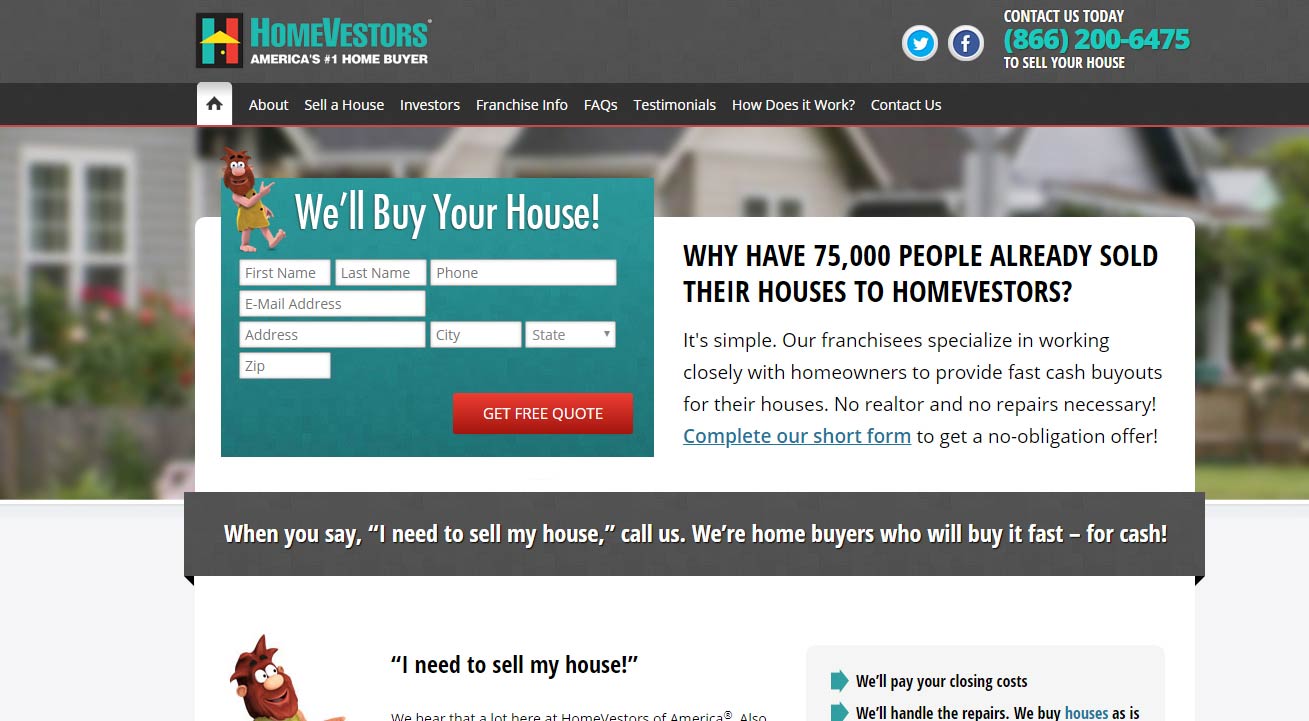

Buying and Selling with HomeVestors

HomeVestors (also known as We Buy Ugly Houses) is a franchise network where each individual local franchisee considers the condition of a home and makes an offer to pay cash for the property. In determining the offer, each franchisee discounts from the estimated retail value after it’s fully renovated.

HomeVestors Pricing

HomeVestors franchisees make money with a difference between buying and selling each home. Typically an offer equal to 70% of home value is expected from this type of sale after any cost of the repairs and resale.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeVestors.com Editor's Review:

HomeVestors franchisee will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. After the franchisee buys the home, it renovates and resells it for a profit or rents it out to qualified tenants.

With the low offer price, comes a convenience of an all-cash closing when selling a home. HomeVestors franchisee typically closes a home in 30 days of receiving cash offer.

Typically each franchisee uses the following factors when determining the offer: existing condition of the home including repairs needed, time it will take to finish needed repairs, value of a home compared to other comparable homes in the area, real estate commission required to resell, costs associated with maintaining a home during repairs, including taxes, payments, insurance, utilities and homeowner dues.

The main disadvantage of using HomeVestors is high losses in homeowners' equity. HomeVestors is a "heavy" model, ready to buy homes in all-cash transactions.

As any real estate investor, HomeVestors franchisee is susceptible to losing money in any given transaction. This model is prone to a number of risk factors, high operational costs and a continued need for higher-than-average Return on Investment (ROI) with each flip.

HomeVestors franchisee is not legally bound to represent consumers, its main legal obligation is to its stakeholders. Moreover, because most homes in the United States are financed, homeowners own only partial net equity in their home.

Banks receive the same amount of the remaining mortgage sum regardless of how any given home is sold, or how much of homeowners' net equity is lost in the transaction with HomeVestors.

Today, there are a number of highly qualified real estate agents who offer competitive listing rates and flat fee listings across the United States. Unless a situation absolutely requires a quick sale, Geodoma recommends that consumers first consider using a licensed real estate agent working on competitive terms to properly list their homes on the open market before turning to HomeVestors option.

Where does HomeVestors.com operate?

Buying with Torii Homes

Torii Homes is a buyer's agent and a referral fee network that offers homebuyer’s refunds in select service areas. Torii Homes typically credits the buyer's refund savings against the miscellaneous transaction costs such as loan origination fees, appraisal fees, title search, title insurance, surveys, deed-recording fees, and credit report charges.

Torii Homes does not credit the buyer's refund savings against property taxes, homeowner's insurance, transfer taxes, interest, mortgage points (optional fees paid directly to a lender in exchange for a reduced interest rate.) orii Homes does not credit the buyer's refund savings against any recurring costs.

After the miscellaneous transaction costs are paid for, Torii Homes keeps the rest of the Buyer’s Agent Commission as a fee for representing buyers in the home purchase.

Torii Homes Pricing

Torii Homes offers homebuyers approximately 20%-30% of the Buyer’s Agent Commission as savings.

Listing Services

- This Service Does Not Openly Advertise to Home Sellers

Buyer's Agent Services

- Find the Property

- Accept and Deliver All Offers and Counteroffers

- Recommend Other Professionals

- Attend Inspection Services

- Schedule Private Showings

- Negotiate Needed Repairs

- Closing Duties

ToriiHomes.com Editor's Review:

Torii Homes is a tech-enabled real estate brokerage. Torii Homes claims that it costs nothing to use the service: “The seller of a home pays the real estate commission, which we then put toward your closing costs. You don't pay Torii anything for our help.” This is false and misleading advertising because buyer’s agents never work for free. A recent settlement between NAR and US-DOJ prohibits licensed real estate brokers from making a claim that their services are offered for free.

The cost of hiring a buyer’s agent is always incorporated into the homebuyer’s final mortgage sum. As a buyer’s agent, Torii Homes is paid with a percentage of the home sale, Buyer's Agent Commission (typically offered at 2.5%-3% by the seller) and it contributes 20%-30% of this total amount to the buyer as a way to financially compete for buyer’s business.

Torii Homes provides homebuyers with a licensed expert real estate agent who helps with the home search, scheduling/attending showings, preparing a home purchase offer, and price negotiations.

Torii Partner Agents

Torii Partner Agents Referral Network (Torii Partner Agents) is a referral process that connects buyers with third-party real estate agents in exchange for an undisclosed blanket referral fee. Torii Partner Agents are not employed by Torii Homes, however, Torii Homes maintains a set of pre-arranged price-fixing agreements with random Partner Agents, claiming to offer consumers savings.

The price-fixing agreements between Torii Homes and Torii Partner Agents are presented to homebuyers as blanket incentives of $1,000 in buyer commission rebates.

Torii Partner Agents are employed by, or work with their independent brokerages, are referred by Torii Homes at their own discretion, as a blind match. Torii Homes keeps the referral fee amount it receives from these brokers hidden. This practice is highly deceptive and is designed to deceive consumers to utilize Torii Homes as a price-fixing scheme to receive savings from competing brokers.

A blanket incentive of $1,000 is presented before consumers as savings, but the cost of the referral fee always works against homebuyers. The blanket referral fee between Torii Homes and Torii Partner Agents is hidden in the final cost of commissions. This practice results in an inefficiency known as reverse competition between brokers and price-fixing. Ultimately, price fixing and kickbacks result in a lower quality of service or higher commissions paid by the homebuyers.

By engaging with Torii Homes, homebuyers authorize them to share personal information and home search history with any Partner Agent, regardless if a consumer wants to work with a Torii Homes agent directly.

Torii Homes dictates that Partner Agent rebates $1,000 of their commission as means to allocate homebuyers to other brokers. In the United States, all independent brokerage fees are always negotiable and each real estate agent establishes its own policy for a fee structure, amount of commissions, and issuing rebates to consumers.

Price fixing is firmly prohibited by federal antitrust legislation. To fix, control, recommend, suggest or maintain commission rates, rebates, and fees for other agents' services is an improper practice.

In summary, Torii Homes offers a legitimate buyer's refund to consumers spent against miscellaneous closing costs. However, Torii Homes cannot legally organize competing brokers into a referral fee network because blanket referral agreements, price-fixing, consumer allocation, and market allocation between licensed real estate brokers in the United States are prohibited.