Compare EnkasaHomes.com and HomeStoryRewards.com

For Sellers

For Buyers

For Buyers

Answer: EnkasaHomes.com is a buyer's real estate agent that offers savings to homebuyers while HomeStoryRewards.com is a referral fee network that enables broker-to-broker collusion with use of blanket referral agreements

Buying with Enkasa

Enkasa is a tech-enabled real estate broker and a residential remodeling construction management company. Enkasa’s services are paid through a Buyer Agent Commission (BAC) concession, typically offered by the seller’s agent to the buyer’s agent when a property is advertised on the MLS.

If a home buyer is already working with another agent, Enkasa’s Construction Managers can conduct a property consultation, review disclosures, and assess feasibility of your ideas for repairs or improvements.

Enkasa Pricing

Enkasa brokerage revenue comes from Buyer Agent Commissions (BAC) amounts offered by the sellers' agents. Enkasa’s Contractor Consultation costs between $299 and $1,299. For comparison, a Buyer Agent Commission (BAC) offered at 3% for a $4 million home (not uncommon in California) is about $120,000 without a negotiated buyer rebate. Enkasa rebates consultation service fees to any client who uses Enkasa to represent them as their agent in purchasing a home.

Listing Services

- MLS Listing

- Zillow, Trulia, etc. Listing

- Accept and Deliver All Offers and Counteroffers

- Hold Open Houses

- Professional Photography

- Professional Floor Plans

- Yard Signage Installation

- Spare Key Lock-box Installation

- Schedule Inspection Services

- Schedule Private Showings

- Closing Duties

Buyer's Agent Services

- Find the Property

- Accept and Deliver All Offers and Counteroffers

- Recommend Other Professionals

- Attend Inspection Services

- Schedule Private Showings

- Negotiate Needed Repairs

- Closing Duties

EnkasaHomes.com Editor's Review:

Enkasa is a California brokerage that operates under a DRE license #02155340. Enkasa claims that: "Buyers don’t pay Enkasa anything. We charge sellers industry-standard brokerage commissions." First of all, buyer agents never work for free. Second of all, there are no industry-standard brokerage commissions in real estate. All commissions are eventually paid by the buyer when s/he writes a check (or takes out the new mortgage) on a newly-purchased property. Sellers lose equity due to costs of listing commissions, but buyers pay all closing costs including the costs of buy-side commissions built into the final accepted offer on a home.

Buyers in reality pay for Enkasa’s services through a Buyer Agent Commission (BAC) concession, typically offered by the seller’s agent to the buyer’s agent when a property is advertised on the MLS. In California, where Enkasa is licensed, a buyer can negotiate a rebate from this "blanket" BAC amount to reduce the cost of commissions financially. This rebate is a tax-free, fully negotiable amount is that converts an "industry-standard" BAC commission into a competitive rate.

Enkasa further claims that "because we help you buy sooner, we’re more efficient than other brokers, so we don’t charge you any extra fees for helping you plan your home improvements." Sooner than what? This is an empty statement with an unfounded claim that choosing Enkasa somehow will allow a buyer to purchase a home faster. The costs associated with "helping buyers plan for home improvements" are simply bundled by Enkasa into the Buyer Agent Commission revenue it will receive at the closing.

In the real world, the home buyer can openly negotiate tens of thousands in tax-free rebates with highly competitive agents and often use that money to not just "help plan home improvements," but to renovate a home.

According to their website, Enkasa’s Contractor Consultation costs between $299 and $1,299. For comparison, a Buyer Agent Commission (BAC) offered at 3% for a $4 million home (not uncommon in California) is about $120,000. If a buyer is able to negotiate a buyer refund at 50% of BAC from a competitive and a highly-qualified agent, that refund amount adds up to $60,000 in tax-free cash due to the buyer from their agent after the closing of the transaction.

The United States Department of Justice has made it clear in the 2020 settlement agreement with the NAR that buyer agents do not work for free and to advertise services as such is a deceptive practice. Provided that Enkasa’s services can be unbundled, the best way I can describe the financial incentive offered by Enkasa is a credit of $1,299 for the "consultation service fee waived for any client who uses Enkasa to represent them as their agent in purchasing a home." In another word, if you are a home buyer looking for a $4 home in California with Enkasa as your buyer agent, their brokerage may receive about $120,000 in Buyer Agent Commission as a fee before they credit you $1,299 as a cash incentive, an equivalent of a 1% cash rebate where the 99% of the BAC is kept by the brokerage.

Consumers should further carefully read Enkasa Terms of Service, where, for example:

…You will only be permitted to pursue claims and seek relief against Enkasa on an individual basis, not as a plaintiff or class member in any class or representative action or proceeding; and …

…You are waiving your right to pursue disputes or claims and seek relief in a court of law and to have a jury trial on your claims…

… Enkasa provides services, including the transaction assistance, on an "as is" and "as available" basis. To the fullest extent permitted by applicable law, Enkasa does not provide any express or implied warranties, conditions, or representations regarding the services, including transaction assistance, or any information provided in connection with the services and Enkasa, its parents, subsidiaries, affiliates, officers, employees, contractors, agents, partners, suppliers, and licensors (collectively, the "Enkasa parties") disclaim any and all warranties, representations, and conditions of any kind, whether express, implied, or statutory, including all warranties or conditions of merchantability, fitness for a particular purpose, title, quiet enjoyment, accuracy, or non-infringement. Enkasa makes no guarantee that the services will function without interruption or errors…

…You acknowledge and agree that the Enkasa parties are not liable, and you will not seek to hold the Enkasa parties liable, for the conduct of third parties, including operators of external sites, and that the risk of injury from such third parties rests entirely with you. Enkasa makes no warranty that the goods or services provided by third parties will meet your requirements or be available on an uninterrupted, secure, or error-free basis. Enkasa makes no warranty regarding the quality of any such goods or services, or the accuracy, timeliness, truthfulness, completeness or reliability thereof…

In conclusion, the advertised premise where "Enkasa charges industry-standard agent commissions, so buyers and sellers don’t pay anything more than they would with other agents" is plain false. There are highly competitive agents who will compete for buyers’ with buyer agents rebates; there are no industry-standard agent commissions in California. In some states, such as Oregon, buyers cannot receive rebates due to anticompetitive state-specific rebate bans, but Enkasa is not a licensed broker in any of these ten states.

Because of such blatantly false advertising methods for services offered by Enkasa brokerage, this editor cannot possibly recommend them to any home buyer. The truth has a habit of revealing itself, and the deceptive advertising notions employed by Enkasa, as described in this review, should be enough to raise a common sense alarm for a savvy consumer.

The real estate industry likes to operate on false notions that "buyer agents work for free" and that "commissions are standard" because real estate brokers do not like to compete with each other on pricing. Yet the commission buyer rebate is the single largest line item for savings when buying a home. When shopping for a buyer agent, or a contractor, there are no gimmicks and there are no substitutes for open negotiations and multiple bids with clearly defined pricing schedules. There are no standard rates in the housing industry: everything is negotiable.

As always, we encourage consumers to post unbiased feedback about this business with any sentiment. If hiring this brokerage worked for you, or if it didn’t, other California consumers need to know.

Where does EnkasaHomes.com operate?

Buying and Selling with HomeStory

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

HomeStoryRewards.com) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

HomeStory is a price-fixing scheme that allocates home buyers to colluding Realtors through a "shell" real estate entity. When consumers submit information on the HomeStory website, this information is simply shared in exchange for an undisclosed fee with real estate agents in a process known as a pay-to-play steering and a "blind match." HomeStory Real Estate Services, Inc. "shell" entity colludes and price-fixes commissions with various Realtors affiliated with Keller Williams, Weichert, Christie's, RE/MAX, ERA, Compass, Coldwell Banker, Better Homes & Gardens, Berkshire Hathaway, eXp Realty, Exit, Fathom, Sotheby's, Century 21, HomeSmart, and others.

HomeStory Pricing

HomeStory fees come from hidden kickbacks, set at 25% to 40% of the gross commission received by a network of colluding Realtors.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeStoryRewards.com Editor's Review:

HomeStory Real Estate Services, Inc. (dba HomeStory, HomeStory.com, HomeStoryRewards, HomeStoryRewards.com) is a licensed real estate entity in the State of Texas License No. 605602 operates as a "shell" broker to collect an undisclosed referral fee, set at 25% to 40% from the gross commissions paid by all colluding Realtors in the network. This fee is inevitably passed down to consumers in a form of inflated real estate commissions when selling a home.

More importantly, HomeStory is a licensed real estate entity that does not engage in actual real estate broker services. HomeStory systematically applies pay-to-play bias towards all Realtor matching results, meaning, only Realtors that have agreed to collude and pay a referral fee are matched with consumers.

Realtors only sign-up with HomeStory because the price of the referral fee can be easily incorporated into their client's agreement with excessive commissions.

HomeStory receives a low Editor's rating because this service is a biased hub-and-spoke broker-to-broker collusion scam, that falsely claims to provide an independent and unbiased service of matching consumers with agents.

HomeStory operates on a pay-to-play methodology to collect junk fees that needlessly make home buying and selling more expensive. In this scheme, consumers are no longer in the driver's seat, but instead, are traded as a commodity between brokers.

HomeStory plays junk fees down, claiming there are "no upfront costs" to Realtors and the service is "free" and "no obligation" to consumers, but it rigidly locks every participating Realtor into a kickback attached to the back-end of every agreement that restrains free trade. As a licensed real estate entity that doesn’t perform any real estate services or take any responsibility for the transaction, this scheme operates to unlawfully allocate consumers and bypass RESPA anti-kickback regulations through a "shell" entity.

Consumer brokering is an act of selling information of potential home buyers and home sellers (paid referrals) between real estate brokers, in exchange for a cut of a broker’s commission. Brokers on each side of the adopted scheme, cause direct damage to the real estate representation market with reverse competition, anticompetitive market allocation, price-fixing, lack of competition, limited choices to consumers, unnecessary high commissions, and improperly negotiated fees. A referring broker in this scheme does not compete with referred brokers, instead, HomeStory administers a series of agreements that restrain free trade, disguised as Realtor matching services.

12 C.F.R. § 1024.14(g)(1)(v) (Regulation X) and RESPA 12 U.S.C. § 2607(c)(3) narrowly allow payments pursuant to cooperative brokerage and referral arrangements between real estate agents and real estate brokers. This limited exemption on kickbacks only applies to fee divisions within real estate brokerage arrangements when all parties are acting in a real estate brokerage capacity. HomeStory does not act in a brokerage capacity, in fact, this entity willfully chooses to disengage from offering real estate representation services to consumers, as the core premise to create successful collusion through interstate wire communication to further the scheme. Wire fraud is financial fraud involving the use of any telecommunications or information technology.

Real estate transaction is a rare, high-value, and high-risk-aversion experience that is easily subjected to unlawful kickbacks, especially with the use of the Internet. Consumers are often subjected to high commissions and hidden referral fees without a full understanding that these fees increase their commissions and result in a lower quality of service. Whenever any double-dealing Realtor agrees to pay these massive kickbacks, he or she is unable to offer full and competitive representation services to anyone. HomeStory does not cater to honest Realtors, it only caters to Realtors willing to cheat their clients out of full services, and willing to share private information about their clients' transactions with the scheme.

HomeStory antitrust and consumer protection violations are not harmless. Realtors who attempt to compete for consumers on fair terms and competitive pricing are at a massive disadvantage in this environment. As a result of broker-to-broker collusion, consumers end up getting steered toward a limited pool of agents and overpay for commissions. Consumers’ private transaction information is always shared with a referring broker that requires it to be disclosed to calculate the referral fees to be paid at the close of each transaction.

Consumers, of course, pay for this abuse with higher costs of commissions that, eventually, make it directly into their new mortgages and cause significant losses of net equity from a home sale.

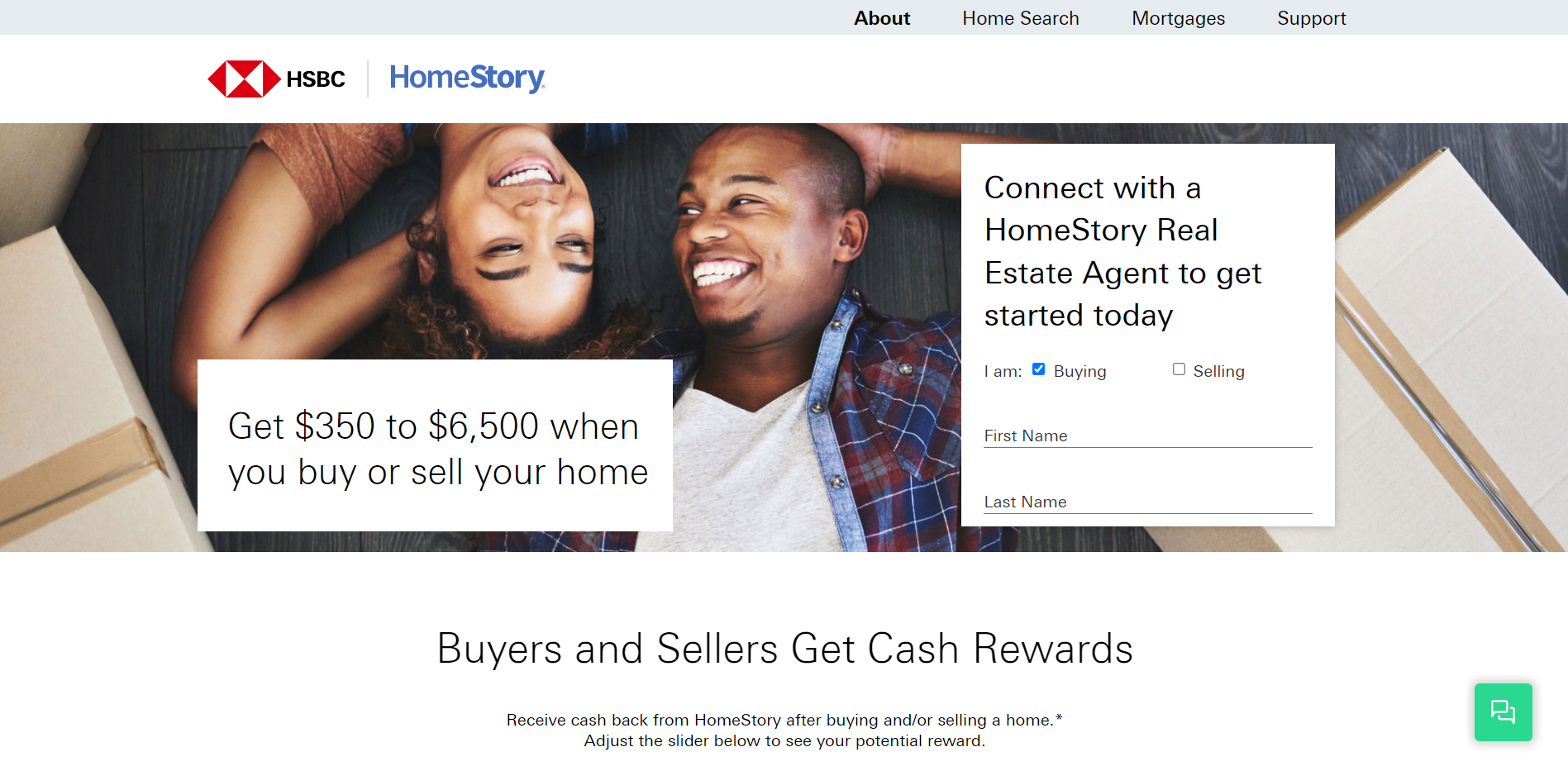

HomeStory utilizes several high-profile financial institutions and lending channels to promote price-fixing and fraud to consumers across state borders, such as HSBC Bank USA, JPMorgan Chase Bank NA, Lakeview Loan Servicing, LLC, The Money Source Inc., Alliant Credit Union, Home Point Financial, etc.

| HOME VALUE | REWARD |

| $0 - $99K | $350 |

| $100K - $149K | $650 |

| $150K - $249K | $900 |

| $250K - $349K | $1,000 |

| $350K - $449K | $1,250 |

| $450K - $499K | $1,750 |

| $500K - $549K | $2,000 |

| $550K - $599K | $2,300 |

| $600K - $699K | $2,400 |

| $700K - $799K | $2,750 |

| $800K - $899K | $3,100 |

| $900K - $999K | $3,500 |

| $1.0M - $1.099M | $4,000 |

| $1.1M - $1.199M | $4,350 |

| $1.2M - $1.299M | $4,750 |

| $1.3M - $1.399M | $5,500 |

| $1.4M - $1.499M | $6,000 |

| $1.5M+ | $6,500 |

Obviously, these are plain price fixed amounts imposed by HomeStory on random brokerages. All of this is done to profit from the largest number of transactions, without actually performing the service of a real estate broker. The scheme is disguised as if consumers are saving money, but in reality, consumers lose money in hidden kickbacks.

For example, on a home purchase of $1 million, Home Story price-fixes the rebate for ALL "partner agents" at $4,000. What the scheme fails to mention is that the kickback HomeStory secretly takes (assuming a 30% kickback) from that same transaction is $9,000 - more than double the amount the consumer receives. On the open market, consumers can easily receive a buyer rebate valued at $15,000 or more, instead of a price-fixed $4,000 amount. This $9,000 loss is, obviously, the price difference between wire fraud, false advertising, collusion, price-fixing, as opposed to open competition. Moreover, honest agents able to offer even better terms to consumers on the open market are bypassed by this scheme entirely. Price fixing does not only harm consumers, but it harms all honest participants outside of the scheme, as well as the open nature of the real estate market itself.

HomeStory shell broker does not connect consumers with anyone outside the network, in fact, they specifically steer consumers into the network in exchange for massive kickbacks pre-negotiated in advance.

There are numerous reasons why consumers are wise to avoid the HomeStory scheme, but probably the most important reason is that the lack of transparency and honesty is contagious. HomeStory scheme attracts ONLY double-dealing Realtors who are willing to break a host of federal antitrust laws, and unwilling to compete for consumers with transparency. An unethical Realtor will always find a way to turn the most important transaction into a self-dealing proposition - to collect a bigger commission check faster without any regard for what is truly a good deal for their clients.

Why Does HomeStory Engage in Price-Fixing?

HomeStory engages in price-fixing because it needs a "dangling carrot in front of consumers" to "reasonably" justify the kickbacks it takes from the Realtors who patriciate in the scheme. This dynamic is better known as a hub-and-spoke conspiracy. In a hub-and-spoke type conspiracy, all listing rates are set at the same amount for all Realtors, where none of the "partner agents" compete with one another on pricing at all. HomeStory scheme produces absolutely no tangible service as a licensed broker to anyone and instead delivers inflated prices and lower quality of service. The scheme originates as a conspiracy to restrain trade and to funnel consumers toward the scheme and away from the open market. There are hundreds of thousands of highly competitive Realtors who offer great savings and great service, and they refuse to pay kickbacks or to comply with the price fixed rates set by HomeStory.

The illicit 25% kickback is the reason why HomeStory setsHSBC HomeStory listing commission rates for Realtors outside their firm. ALL consumers and ALL legitimate Realtors are scammed by HomeStory, even if the experience and savings may seem "good enough" because price-fixing is a faulty shortcut to genuine open competition between Realtors. By law, all Realtors must compete for consumers and set prices individually. Open competition is at the core of our free and independent society everywhere in America.

The Realtor commissions in the United States have long suffered from the "standard" 6% myth and the false notion that "buyer agents work for free." However, these myths cannot be resolved with price-fixing of commissions to some other level, in exchange for kickbacks. ALL Realtors who participate in the HomeStory scheme are engaged in price-fixing. The Sherman Act imposes criminal penalties of up to $100 million for a corporation and $1 million for an individual, along with up to 10 years in prison for each count. Persons found guilty of wire fraud under federal law face fines up to $250,000 for individuals and up to $500,000 for organizations, subject to imprisonment of not more than 20 years. There are additional penalties of 30 years imprisonment and a million-dollar fine if the wire fraud involves a financial institution. These penalties are per count, which means that each electronic communication can be considered as a separate count. No legitimate Realtor will ever willingly allow themselves to be exposed to such massive liability.

The best, highly-experienced, well-educated, law-abiding, honest, and ethical Realtors will never participate in price-fixing because it is a felony that carries massive penalties. The best Realtors can recognize price-fixing as wrong because they respect the true value of honest negotiations.

The prices set by HomeStory are not for the services that they offer, but for services offered by their direct competitors – other brokers. When HomeStory refuses to compete with these brokers and instead organizes "partner agents" into a network, it breaks an entire host of basic principles that guide our open and fair markets. Moreover, HomeStory extends this conspiracy all across the United States, making the scheme highly damaging due to the scaled use of the Internet to transmit collusion. The Internet, like any other scaled information medium, can be used to transmit open competition just as easily as pay-to-play fraud and collusion.

HomeStory wire fraud scheme is particularly alarming because it is scaled across state borders by financial institutions such as HSBC Bank USA, JPMorgan Chase Bank NA, Lakeview Loan Servicing, LLC, The Money Source Inc., Alliant Credit Union, Home Point Financial, etc. in an open violation of RESPA and Sherman Antitrust Act by means of wire communications interstate channels such as the following:

HSBC HomeStory wire fraud channel

Fidelity HomeStory wire fraud channel

Chase Homestory wire fraud channel

The short answer is: HomeStory's intent to fix prices is directly tied into the kickbacks it receives from the "partner agents." This dynamic is a product of the restraint of genuine competition. The "standard commissions" problem in the residential real estate sector can only be fixed legally by encouraging Realtors to set and advertise competitive prices to consumers at scale without paying any kickbacks.