Compare Unlocked.com and HomeVestors.com

For Buyers

Answer: Unlocked.com is a buyer's real estate agent that offers savings to homebuyers while HomeVestors.com is a direct home cash buyer that buys select homes off-market with cash offers and resells them at a profit to homebuyers

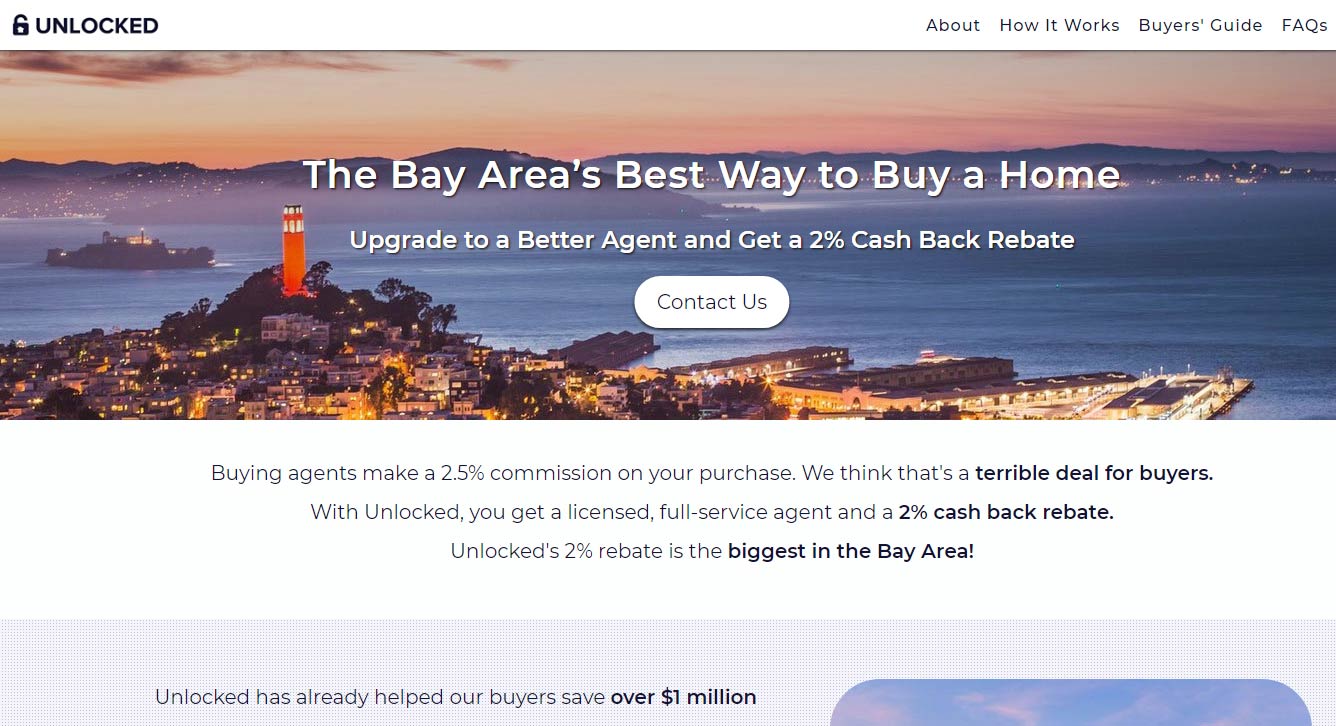

Buying with Unlocked Real Estate

Unlocked Real Estate is a local San Francisco Bay Area agent, offers consumers buyer’s refunds in select areas.

Unlocked Real Estate Pricing

Unlocked Real Estate offers buyers approximately 67% of the Buyer’s Agent Commission.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- Find the Property

- Accept and Deliver All Offers and Counteroffers

- Recommend Other Professionals

- Attend Inspection Services

- Schedule Private Showings

- Negotiate Needed Repairs

- Closing Duties

Unlocked.com Editor's Review:

Unlocked Real Estate is a consumer-focused real estate broker that focuses on helping buyers. As a buyer’s agent, Unlocked Real Estate works with buyers to find a home, schedule inspections, negotiate repairs and finalize the purchase.

Unlocked Real Estate offers overall great value to consumers looking to buy a home, but it does not offer services to sellers.

Where does Unlocked.com operate?

Buying and Selling with HomeVestors

HomeVestors (also known as We Buy Ugly Houses) is a franchise network where each individual local franchisee considers the condition of a home and makes an offer to pay cash for the property. In determining the offer, each franchisee discounts from the estimated retail value after it’s fully renovated.

HomeVestors Pricing

HomeVestors franchisees make money with a difference between buying and selling each home. Typically an offer equal to 70% of home value is expected from this type of sale after any cost of the repairs and resale.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeVestors.com Editor's Review:

HomeVestors franchisee will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. After the franchisee buys the home, it renovates and resells it for a profit or rents it out to qualified tenants.

With the low offer price, comes a convenience of an all-cash closing when selling a home. HomeVestors franchisee typically closes a home in 30 days of receiving cash offer.

Typically each franchisee uses the following factors when determining the offer: existing condition of the home including repairs needed, time it will take to finish needed repairs, value of a home compared to other comparable homes in the area, real estate commission required to resell, costs associated with maintaining a home during repairs, including taxes, payments, insurance, utilities and homeowner dues.

The main disadvantage of using HomeVestors is high losses in homeowners' equity. HomeVestors is a "heavy" model, ready to buy homes in all-cash transactions.

As any real estate investor, HomeVestors franchisee is susceptible to losing money in any given transaction. This model is prone to a number of risk factors, high operational costs and a continued need for higher-than-average Return on Investment (ROI) with each flip.

HomeVestors franchisee is not legally bound to represent consumers, its main legal obligation is to its stakeholders. Moreover, because most homes in the United States are financed, homeowners own only partial net equity in their home.

Banks receive the same amount of the remaining mortgage sum regardless of how any given home is sold, or how much of homeowners' net equity is lost in the transaction with HomeVestors.

Today, there are a number of highly qualified real estate agents who offer competitive listing rates and flat fee listings across the United States. Unless a situation absolutely requires a quick sale, Geodoma recommends that consumers first consider using a licensed real estate agent working on competitive terms to properly list their homes on the open market before turning to HomeVestors option.