Compare Offerpad.com and Zillow Flex

For Sellers

For Sellers

For Buyers

Answer: Offerpad.com is a direct home cash buyer that buys select homes off-market with cash offers and resells them at a profit to homebuyers while Zillow Flex is a referral fee network that enables broker-to-broker collusion with use of blanket referral agreements

Buying and Selling with Offerpad

Offerpad is a direct home buyer that makes cash offers to sellers as it considers the condition of a home, improvements, home's upgrades, and required repairs.

In determining the offer, Offerpad discounts the offer amount from the estimated retail value after it’s fully renovated.

Offerpad Pricing

Offerpad makes money with fees and a difference between buying and selling each home. Offerpad claims service fees vary between 6% to 10%, plus an additional 1% to 3% of the purchase price in closing costs.

Sellers can also expect to receive an offer that has a built-in margin of 5% to 10% between the market price today and what Offerpad plans to flip the home in the open market.

In summation of all these fees, an offer equal to 80% of home value is reasonably expected from this type of sale after fees and cost of the repairs and resale.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Offerpad.com Editor's Review:

Offerpad will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. After it buys the home, it renovates and resells it for a profit to another buyer or another company that rents it out to qualified tenants. With low offer price, comes a convenience of an all-cash closing when selling a home. Offerpad typically provides a conditional offer within 24 hours.

Offerpad will perform a free, on-site inspection of your home within 15 days of the signed conditional agreement. If Offerpad finds something it doesn't like and the sellers decline to make any requested repairs or issue a Offerpad credit it demands, Offerpad can then choose to cancel the contract or may determine that it still wants to move forward with the purchase of the home. If Offerpad elects to cancel the contract, there is no penalty to either party.

Offerpad does not make offers for most homes, it will only make offers for single-family residential homes in areas where it operates, including condos and townhomes, built after 1960, with a value of no more than $500,000-$600,000 as well as fair conditions without any major repairs required. Offerpad will not consider homes with significant foundation, structural or other condition issues.

Typically, Offerpad uses the following factors when determining the offer: existing condition of the home including repairs needed, time it will take to finish needed repairs, value of a home compared to other comparable homes in the area, real estate commission required to resell, costs associated with maintaining a home during repairs, including taxes, payments, insurance, utilities and homeowner dues.

The main disadvantage of using Offerpad is high loss in homeowners' equity. Offerpad is a "heavy" model, ready to buy homes in all-cash transactions. As any real estate investor, Offerpad is susceptible to losing money in any given transaction. Offerpad model further suffers from a "double expense" such as paying all the normal transaction costs that come with selling a home—including a commission to a buyer's agent (3%), concessions to buyer, holding costs, maintenance fees, taxes and other costs to list and market the home.

This model is prone to a number of risk factors, high operational costs and a continued need for higher-than-average Return on Investment (ROI) with each flip.

Offerpad is not legally bound to represent consumers, its main legal obligation is to its stakeholders. Moreover, because most homes in the United States are financed, homeowners own only partial net equity in their home.

Banks receive the same amount of the remaining mortgage sum regardless of how any given home is sold, or how much of homeowners' net equity is lost in the transaction with Offerpad.

Today, there are a number of highly qualified real estate agents who offer competitive listing rates and flat fee listings across the United States. Unless a situation absolutely requires a quick sale, Geodoma recommends that consumers first consider using a licensed real estate agent working on competitive terms to properly list their homes on the open market before turning to Offerpad option.

Where does Offerpad.com operate?

Buying and Selling with Zillow Flex

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

Zillow Flex) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

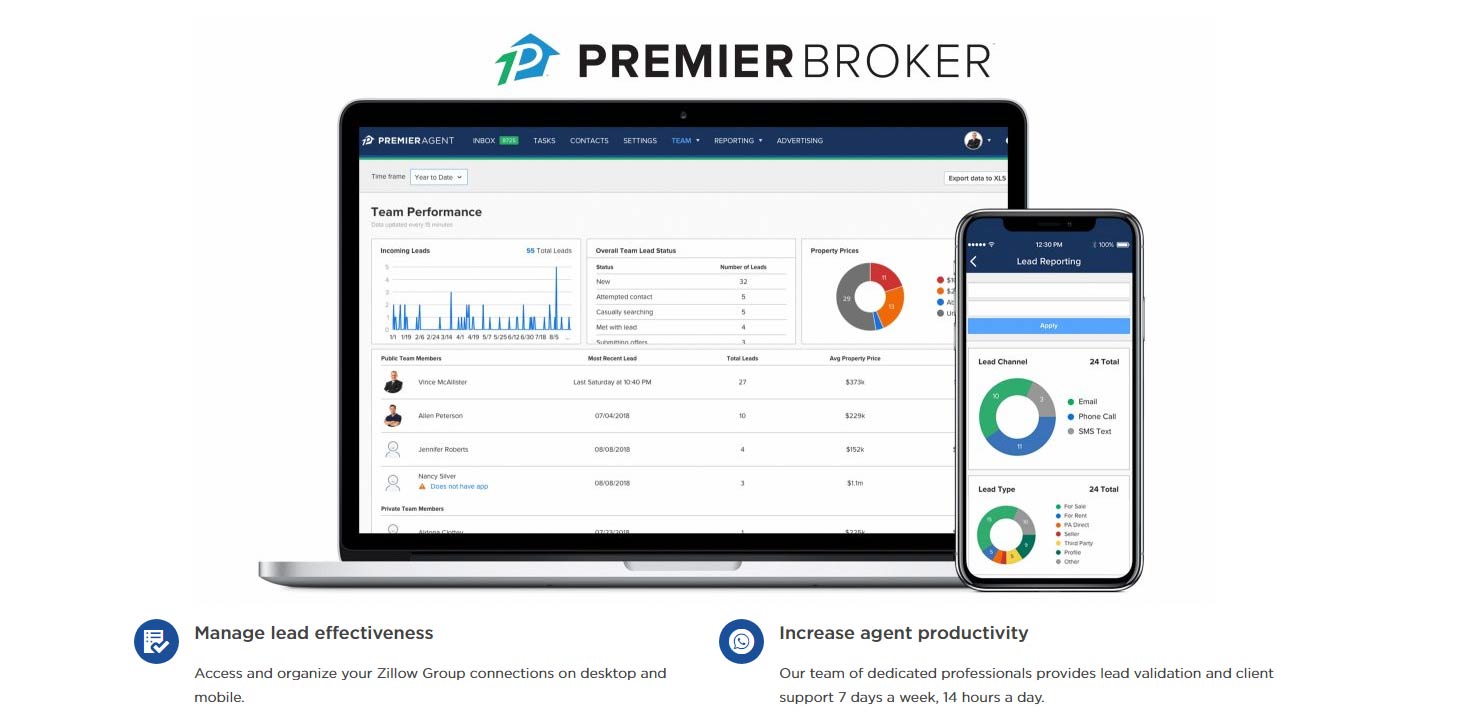

Zillow Flex is a real estate referral fee network that is designed to collect undisclosed referral fees from real estate agents. Within this network, Zillow Group screens and refers consumers to real estate agents with a pre-existing "blanket" referral agreements. Zillow Group refers to this referral service as a Zillow Flex because it allows brokers to participate without paying any upfront costs to Zillow Group.

As a consumer filling out a contact form on the Zillow-owned (Zillow, Trulia, etc.) web site, "you authorize Zillow to make Real Estate Referral and acknowledge Zillow may be paid valuable consideration for facilitating such referral." Zillow Group does not disclose to consumers how much "valuable consideration" it receives from participating brokers. "The established referral fees are specific to each market in order to account for local pricing trends," according to Zillow.

Zillow Flex is a form of pay-to-play consumer brokering product that relies on the use of blanket referral agreements to pay for each referral. Blanket referral agreements between brokers are a per se violation of the Sherman Act. With Zillow Flex consumers are effectively pre-screened by Zillow and “sold as leads” to whoever is willing to pay for this information with a share of their commission.

Zillow Flex Pricing

Zillow Premier Broker does not offer paid services to consumers directly, instead, the portal generates revenue with estimated 25%-40% referral fees from real estate brokers. Zillow Group declines to disclose the exact fee amount.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Zillow Flex Editor's Review:

This review is focused on the Zillow Flex program only. Two separate reviews are assigned to Zillow Instant Offers and Zillow MLS aggregator programs. Since Zillow was first founded, it has idolized itself as a real estate Internet company. However, with an introduction of Zillow Flex in 2018, this is no longer the case.

Today, Zillow acts as a "paper" real estate broker. This fact allows Zillow to receive referral fees from real estate agents across the United States.

Zillow operates under the following real estate brokerage license in the following States:

Arizona CO580407000

California 01522444

California 01980367

Colorado 100080923

Florida CQ1058944

Georgia 76885

Minnesota 40638657

Nevada B.1002277.CORP

North Carolina C30388

Texas 549646

Washington 21212

Wisconsin 835987-91

Real estate agents are allowed to pay one another referral fees with a narrow RESPA provision that is needed to allow individual agents to refer business to other individual agents outside their service area. Despite being registered as a broker, Zillow does not perform real estate services, it simply sends leads to specific agents within its network and uses a real estate license to collect a back-loaded referral fee in the process.

Referral fee revenue is 32x that of a regular advertisement revenue because it results in an economic process called reverse competition, where consumers suffer from elevated costs and lower service as a result. A referral network is anything but free.

The following are some telling quotes from Zillow itself and a Premier Broker program participants. These words speak for themselves.

- "We receive listing and buyer referrals directly from Zillow's Premier Broker concierge services. These leads have been scrubbed and vetted before they are directly handed off to you." Source: Sonoma County RE/MAX Marketplace, Zillow Flex participant.

- "We will validate all leads first, then send agent-ready buyers to you." Source: Zillow website.

- "What happens if you miss a call? Don't worry. You won't lose your place in the queue and we will call you with the next connection we validate." Source: Zillow website.

Zillow Group does not disclose the exact amount in referral fees it collects from Premier Brokers, aside from stating that it is an "industry standard." Similar referral fee networks typically receive 25%-40% of the agent's total commission. This is a good reference for the amount in commissions consumers can expect to overpay for their real estate services with a Premier Broker. Zillow Flex is a pay-to-play process that harms the industry as a whole and makes buying and selling homes more expensive.

Why does the Zillow allow for such poor UX? There are thousands and sometimes tens of thousands in fees collected from each transaction effectively hidden in consumer’s commission.

Consumers in the United States have been systematically conditioned to a 6% "standard" commission structure, a non-negotiable fact that needs no justification. Unfortunately, this inefficiency alone breeds uncompetitive behavior where real estate agents can easily pay tens of thousands in fees because they are recoverable with a high commission.

Consumers are truly forgotten in this model as an afterthought. When these exigent commissions are amortized over the first five years of homeownership, these fees are the highest single expense line-item - more than the insurance, more than the interest, more than utilities. Clearly, real estate agents only sign-up with Premier Broker because the price of the referral fee can be easily incorporated into their client's agreement with excessive commissions.

RESPA allows for an exception for real estate agents if and only if “all parties are acting in a real estate brokerage capacity" so that individual agents can refer each other when they are out of the local area. This exception has now been turned up-side-down where a referral network does not act in the capacity of a real estate broker. Zillow Group simply uses a license to collect fees without any tangible services done as defined by said license.

Consumers looking to work with a legitimate real estate agent on fair terms should absolutely avoid Zillow Flex and never release their full name, email and a phone number to Zillow Group.

The issue of having all US residential real estate markets heavily subjected to these schemes results in noncompetitive behavior, higher costs to consumers and lower quality of service. Having agents "commonly" pay networks 25%-45% of their commission is the true reason why real estate is broken.

Zillow Group matches consumers with "great, amazing, top-producing, perfect agents" based on who first picks up the phone and who is willing to kick in a chunk of their commission, this is the main basis for this process.

What happens when this flawed revenue model is no longer sustainable due to competitive commissions entering the market? The next stage of real estate innovation will have to account for this reality. In play are now competitive open rates, flat fees and buyer’s refunds from highly qualified real estate agents.

Transparent commission rates will eventually bring and end to a pay-to-play phenomenon in the real estate process where programs like Premier Broker simply cannot exist.

Today, consumers should be careful and only negotiate with agents that have no referral fee agreements signed, this is the only way to negotiate for full service at a market rate.