Compare Offerpad.com and Trulia.com

For Sellers

Answer: Offerpad.com is a direct home cash buyer that buys select homes off-market with cash offers and resells them at a profit to homebuyers while Trulia.com is a Multiple Listing Services (MLS) aggregator

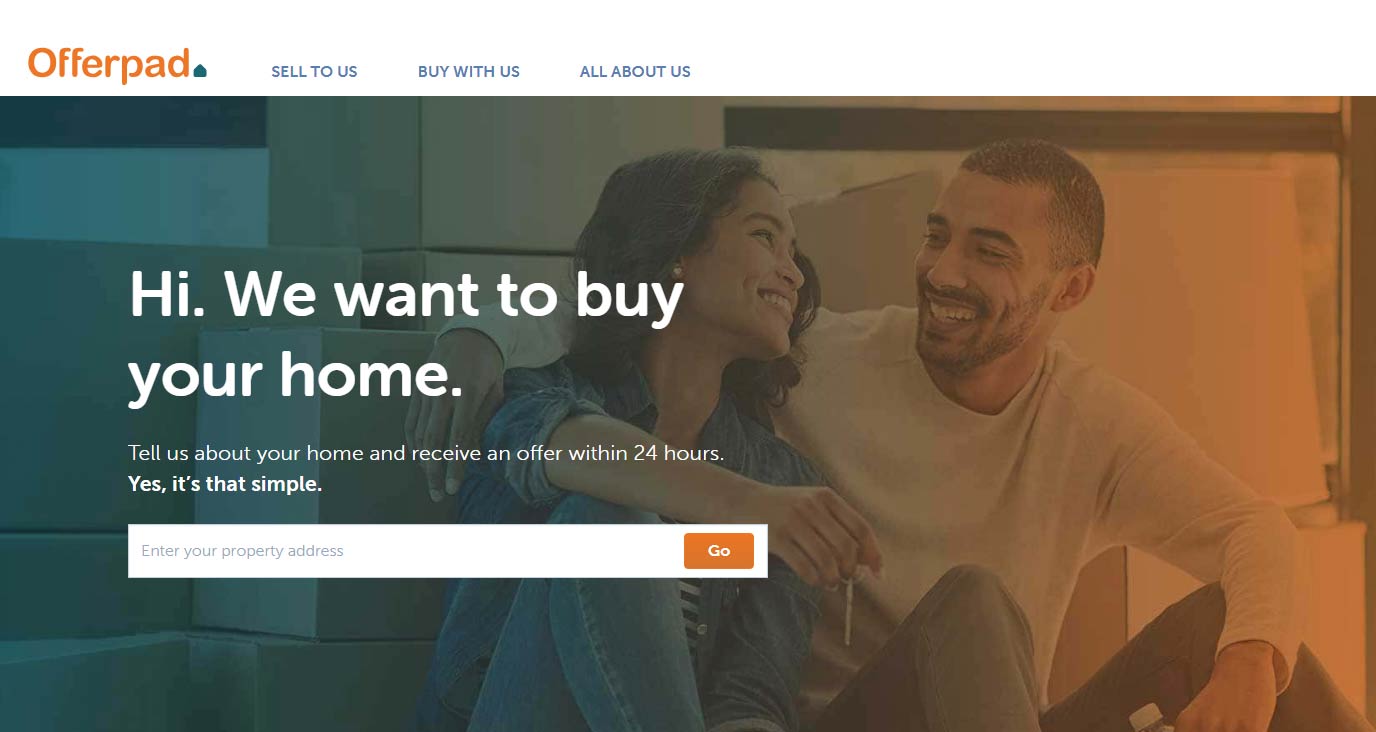

Buying and Selling with Offerpad

Offerpad is a direct home buyer that makes cash offers to sellers as it considers the condition of a home, improvements, home's upgrades, and required repairs.

In determining the offer, Offerpad discounts the offer amount from the estimated retail value after it’s fully renovated.

Offerpad Pricing

Offerpad makes money with fees and a difference between buying and selling each home. Offerpad claims service fees vary between 6% to 10%, plus an additional 1% to 3% of the purchase price in closing costs.

Sellers can also expect to receive an offer that has a built-in margin of 5% to 10% between the market price today and what Offerpad plans to flip the home in the open market.

In summation of all these fees, an offer equal to 80% of home value is reasonably expected from this type of sale after fees and cost of the repairs and resale.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Offerpad.com Editor's Review:

Offerpad will buy a home at a price that is below market value due to necessary repairs, renovation, and other factors. After it buys the home, it renovates and resells it for a profit to another buyer or another company that rents it out to qualified tenants. With low offer price, comes a convenience of an all-cash closing when selling a home. Offerpad typically provides a conditional offer within 24 hours.

Offerpad will perform a free, on-site inspection of your home within 15 days of the signed conditional agreement. If Offerpad finds something it doesn't like and the sellers decline to make any requested repairs or issue a Offerpad credit it demands, Offerpad can then choose to cancel the contract or may determine that it still wants to move forward with the purchase of the home. If Offerpad elects to cancel the contract, there is no penalty to either party.

Offerpad does not make offers for most homes, it will only make offers for single-family residential homes in areas where it operates, including condos and townhomes, built after 1960, with a value of no more than $500,000-$600,000 as well as fair conditions without any major repairs required. Offerpad will not consider homes with significant foundation, structural or other condition issues.

Typically, Offerpad uses the following factors when determining the offer: existing condition of the home including repairs needed, time it will take to finish needed repairs, value of a home compared to other comparable homes in the area, real estate commission required to resell, costs associated with maintaining a home during repairs, including taxes, payments, insurance, utilities and homeowner dues.

The main disadvantage of using Offerpad is high loss in homeowners' equity. Offerpad is a "heavy" model, ready to buy homes in all-cash transactions. As any real estate investor, Offerpad is susceptible to losing money in any given transaction. Offerpad model further suffers from a "double expense" such as paying all the normal transaction costs that come with selling a home—including a commission to a buyer's agent (3%), concessions to buyer, holding costs, maintenance fees, taxes and other costs to list and market the home.

This model is prone to a number of risk factors, high operational costs and a continued need for higher-than-average Return on Investment (ROI) with each flip.

Offerpad is not legally bound to represent consumers, its main legal obligation is to its stakeholders. Moreover, because most homes in the United States are financed, homeowners own only partial net equity in their home.

Banks receive the same amount of the remaining mortgage sum regardless of how any given home is sold, or how much of homeowners' net equity is lost in the transaction with Offerpad.

Today, there are a number of highly qualified real estate agents who offer competitive listing rates and flat fee listings across the United States. Unless a situation absolutely requires a quick sale, Geodoma recommends that consumers first consider using a licensed real estate agent working on competitive terms to properly list their homes on the open market before turning to Offerpad option.

Where does Offerpad.com operate?

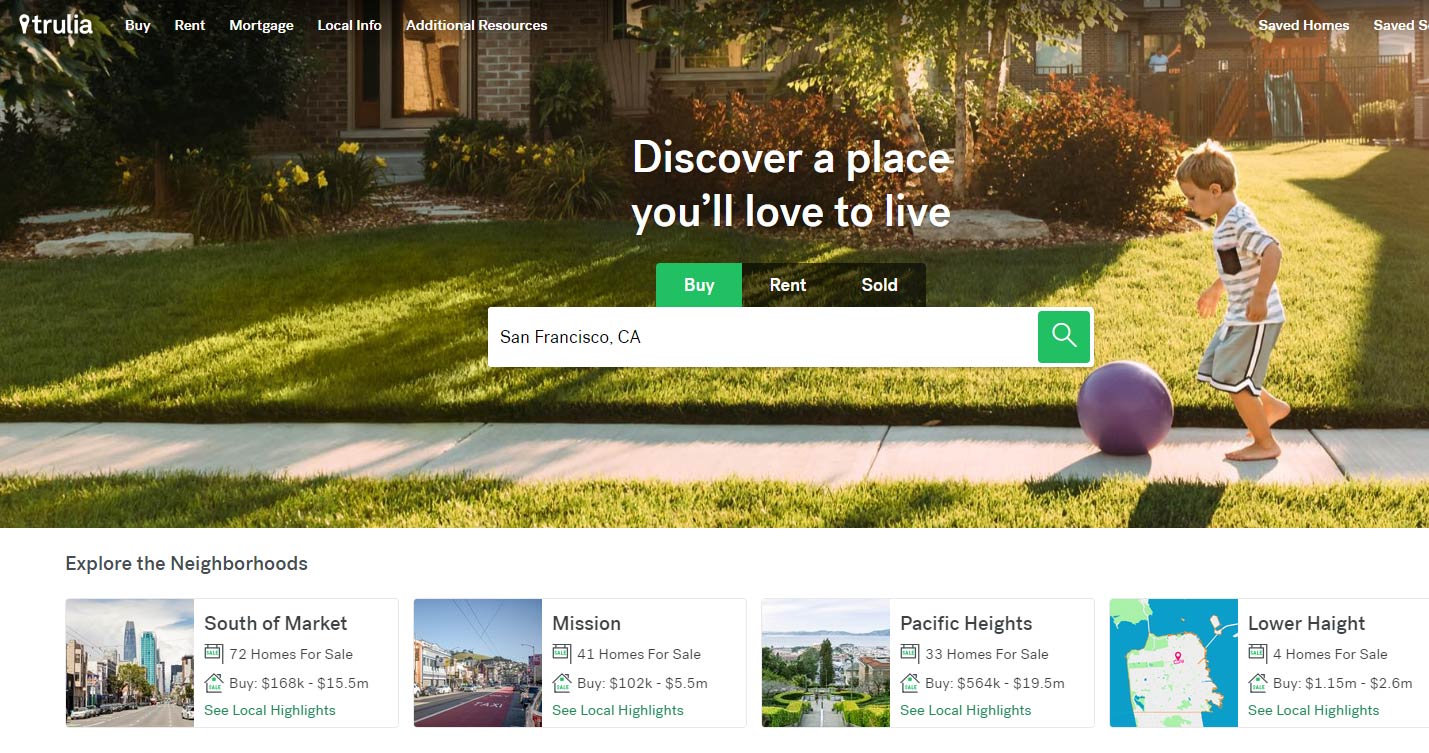

Buying and Selling with Trulia

Trulia is an MLS Aggregator that allows buyers and sellers to list homes and find out what local homes are available for sale. Trulia aggregates home listing data from thousands of private MLS databases across the United States.

By making this otherwise unavailable information to consumers, the company creates a positive value-added experience with local results for a vast majority of available listings.

Trulia generates revenue with ads using Zillow Group's Premier Agent and Premier Broker programs.

Trulia Pricing

Trulia does not offer paid services to consumers directly, instead, portal generates revenue with ads and referral fees from real estate brokers as part of the Zillow Group.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Trulia.com Editor's Review:

Trulia is a Zillow Group subsidiary with similar search results, data, and options available to consumers. Trulia is an Internet MLS aggregator, where brokers and consumers may post listings independently. Until recently Trulia was an Internet company, not a real estate broker.

In 2018 Trulia’s parent company Zillow Group began to operate a pilot program called Zillow Premier Broker.

This program operates as an actual real estate broker in order to collect hidden referral fees from any leads originated via Trulia. Anytime consumers use Trulia and provide this portal with private information, this information is then sold for referral fees to a select group of brokers willing to pay for it. This fee is backloaded and paid only if the consumer is persuaded by the real estate agent to enter into a representation agreement.

Trulia’s original revenue generator is called Premier Agent, this is an ads-based process where agents advertise their services and consumers contact an agent themselves.

Unlike Premier Broker leads pipeline, Premier Agent process is not “blind.” When consumers use Trulia, it is impossible to tell if private information is sold to Premier Brokers and what brokers get to see it. When using Trulia, consumers should be careful not to leave any private information such as email, name or a phone number.