Compare Landis.com and EnkasaHomes.com

For Buyers

For Buyers

Answer: Landis.com is a rent-to-own program that does not provide real estate services while EnkasaHomes.com is a buyer's real estate agent that offers savings to homebuyers

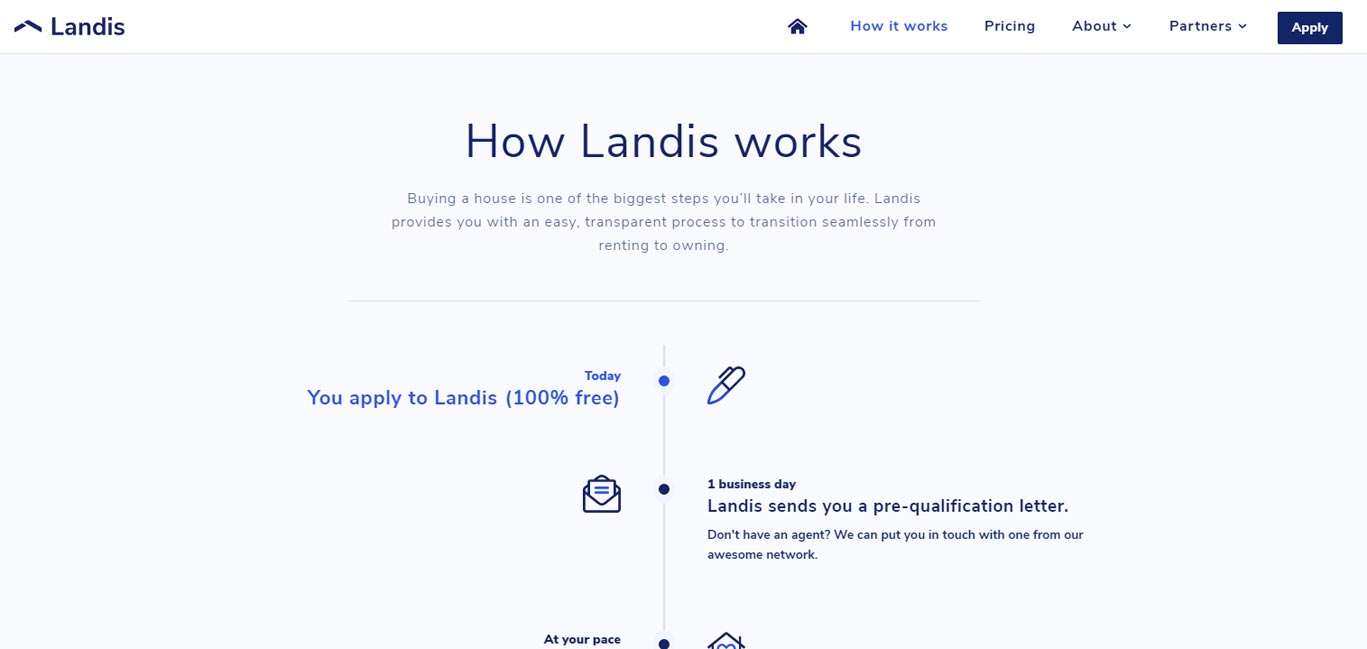

Buying with Landis

Landis is a rent-to-own program that purchases the home and then rents it out to you as a tenant. Landis claims to operate a one-year program for the tenants to buy the property once they can afford a down payment. A common complaint with all rent-to-own programs is an inability of the tenant to secure a loan in time to purchase the property, at which point the tenant is either forced to walk away with a loss or continues to rent.

Landis may sometimes suggest that a customer reach out to someone (e.g. a lender) who can help them, but the company doesn’t make money from it, and only gives the info to the customer, not the customer's info to anyone else. Landis does not receive any referral fees from third parties (such as lenders, real estate brokers, etc.) and keenly guards customers' information. This is a refreshing approach that adds value to consumers. Landis states that: "companies at our stage don't have any incentive to charge hidden fees: growth and customer experience simply matter much more than revenue."

Landis Pricing

Landis revenue comes from the price of rent and a 3% increase between the price of the home when Landis buys it and the price it sells it to the tenant after a year.

Landis is silent on what happens in a situation when the price of the home drops before the tenant can buy it, or if the mortgage rates increase during the tenancy period. When consumers use Landis, they are unable to take advantage of a buyer’s commission rebate from a real estate agent because the company is the one actually buying the home.

Landis states that it receives "no rebates or commissions from agents, we pay agents their full commission, as though they were working with the customer."

When it comes to the cost of rent Landis says that "we're very upfront with our users that during the 12 months of the program, we are more expensive than owning, or even renting. That's because we need our customers to put money to the side for their down payment … our only revenue is market rent and 3% appreciation at the end of the year. The economics work out because we're in areas where average rents are high."

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Landis.com Editor's Review:

Landis program purchases the home and rents it to the tenant with an option to buy. Landis reviews full financial, credit, and work history of each potential tenant. Those few applicants who pass the screening may select a home within the allowed amount Landis sets. A tenant pays rent, a portion of which becomes a down payment to eventually buy the home. After a year, if the tenant decides to move out, Landis deducts half of the down payment amount saved, as an added fee. When purchasing a house from Landis, a tenant must and pay closing costs of the sale.

Landis has only enough cash on hand (structured as debt) to place offers against a handful of properties. This is why the company likely rejects the majority of applications as a way to reduce risk. It is safe to assume that only a very small number of applications with Landis are approved.

According to the company, "lenders send us customers that want to buy a home but can't close on a loan. It could be due to a low credit score, insufficient down payment, a recent bankruptcy, self-employment, or some other reason."

To secure a mortgage on competitive terms is a primary and the best option to buy a home. Yes, the down payment is difficult, but adding Landis to the mix doesn't solve the overall affordability. Landis claims that owning a home is always cheaper than renting it, but Landis is a landlord.

There is nothing to substantiate that renting a home from Landis is less expensive to own it during that same time frame. There is also nothing to suggest that Landis is offering reduced rent to the tenant at any given time. Buying a property is a risk, and Landis must account for this risk with added fees. The true costs of this rent-to-buy program are incredibly difficult to estimate by anyone other than Landis, and these costs are absolutely real.

Buyers are unlikely to receive a buyer's rebate from a real estate agent when buying with Landis program.

Buying a home is one of the most important transactions in people's lives, especially the first home. By adding Landis rent-to-own proposition, buyers are subjecting their transaction to the additional 3% appreciation fees, paying rent, and a possible loss of half of the down payment amount if moving out.

Landis receives a neutral editor's score because of several factors. When asked, the company declined to disclose its application volume and applicant success rates. Lack of this information makes it difficult to estimate the “weight” of overall operations and the returns the company is required to make against the total number of participants.

An undisputed positive is that the company doesn’t make money from referrals, making their claims to hold consumers’ best interest viable.

Landis claims that owning in the long term is cheaper than renting, especially in the markets where it operates. However, there is no clear evidence money is saved and there is no evidence that consumers who choose the Landis model end up with a higher chance of purchasing the home.

Landis states: “We completely agree that a mortgage is better. That's why we coach all our customers to do what they need to get a mortgage. It's the whole point of the company. We work with those who simply can't get a mortgage (because of credit score, down payment, etc.) and we coach them to fix what prevents them from getting one. As soon as they can get one, they graduate from the program.”

We find no solid evidence that Landis offers home buyers tangible savings as part of their rent-to-own program, but at the same time, some home buyers may decide for themselves that the program is worth the added fees.

Geodoma editorial staff remains overall neutral on the subject: we can neither recommend Landis nor suggest that buyers refrain from using the program.

Where does Landis.com operate?

Buying with Enkasa

Enkasa is a tech-enabled real estate broker and a residential remodeling construction management company. Enkasa’s services are paid through a Buyer Agent Commission (BAC) concession, typically offered by the seller’s agent to the buyer’s agent when a property is advertised on the MLS.

If a home buyer is already working with another agent, Enkasa’s Construction Managers can conduct a property consultation, review disclosures, and assess feasibility of your ideas for repairs or improvements.

Enkasa Pricing

Enkasa brokerage revenue comes from Buyer Agent Commissions (BAC) amounts offered by the sellers' agents. Enkasa’s Contractor Consultation costs between $299 and $1,299. For comparison, a Buyer Agent Commission (BAC) offered at 3% for a $4 million home (not uncommon in California) is about $120,000 without a negotiated buyer rebate. Enkasa rebates consultation service fees to any client who uses Enkasa to represent them as their agent in purchasing a home.

Listing Services

- MLS Listing

- Zillow, Trulia, etc. Listing

- Accept and Deliver All Offers and Counteroffers

- Hold Open Houses

- Professional Photography

- Professional Floor Plans

- Yard Signage Installation

- Spare Key Lock-box Installation

- Schedule Inspection Services

- Schedule Private Showings

- Closing Duties

Buyer's Agent Services

- Find the Property

- Accept and Deliver All Offers and Counteroffers

- Recommend Other Professionals

- Attend Inspection Services

- Schedule Private Showings

- Negotiate Needed Repairs

- Closing Duties

EnkasaHomes.com Editor's Review:

Enkasa is a California brokerage that operates under a DRE license #02155340. Enkasa claims that: "Buyers don’t pay Enkasa anything. We charge sellers industry-standard brokerage commissions." First of all, buyer agents never work for free. Second of all, there are no industry-standard brokerage commissions in real estate. All commissions are eventually paid by the buyer when s/he writes a check (or takes out the new mortgage) on a newly-purchased property. Sellers lose equity due to costs of listing commissions, but buyers pay all closing costs including the costs of buy-side commissions built into the final accepted offer on a home.

Buyers in reality pay for Enkasa’s services through a Buyer Agent Commission (BAC) concession, typically offered by the seller’s agent to the buyer’s agent when a property is advertised on the MLS. In California, where Enkasa is licensed, a buyer can negotiate a rebate from this "blanket" BAC amount to reduce the cost of commissions financially. This rebate is a tax-free, fully negotiable amount is that converts an "industry-standard" BAC commission into a competitive rate.

Enkasa further claims that "because we help you buy sooner, we’re more efficient than other brokers, so we don’t charge you any extra fees for helping you plan your home improvements." Sooner than what? This is an empty statement with an unfounded claim that choosing Enkasa somehow will allow a buyer to purchase a home faster. The costs associated with "helping buyers plan for home improvements" are simply bundled by Enkasa into the Buyer Agent Commission revenue it will receive at the closing.

In the real world, the home buyer can openly negotiate tens of thousands in tax-free rebates with highly competitive agents and often use that money to not just "help plan home improvements," but to renovate a home.

According to their website, Enkasa’s Contractor Consultation costs between $299 and $1,299. For comparison, a Buyer Agent Commission (BAC) offered at 3% for a $4 million home (not uncommon in California) is about $120,000. If a buyer is able to negotiate a buyer refund at 50% of BAC from a competitive and a highly-qualified agent, that refund amount adds up to $60,000 in tax-free cash due to the buyer from their agent after the closing of the transaction.

The United States Department of Justice has made it clear in the 2020 settlement agreement with the NAR that buyer agents do not work for free and to advertise services as such is a deceptive practice. Provided that Enkasa’s services can be unbundled, the best way I can describe the financial incentive offered by Enkasa is a credit of $1,299 for the "consultation service fee waived for any client who uses Enkasa to represent them as their agent in purchasing a home." In another word, if you are a home buyer looking for a $4 home in California with Enkasa as your buyer agent, their brokerage may receive about $120,000 in Buyer Agent Commission as a fee before they credit you $1,299 as a cash incentive, an equivalent of a 1% cash rebate where the 99% of the BAC is kept by the brokerage.

Consumers should further carefully read Enkasa Terms of Service, where, for example:

…You will only be permitted to pursue claims and seek relief against Enkasa on an individual basis, not as a plaintiff or class member in any class or representative action or proceeding; and …

…You are waiving your right to pursue disputes or claims and seek relief in a court of law and to have a jury trial on your claims…

… Enkasa provides services, including the transaction assistance, on an "as is" and "as available" basis. To the fullest extent permitted by applicable law, Enkasa does not provide any express or implied warranties, conditions, or representations regarding the services, including transaction assistance, or any information provided in connection with the services and Enkasa, its parents, subsidiaries, affiliates, officers, employees, contractors, agents, partners, suppliers, and licensors (collectively, the "Enkasa parties") disclaim any and all warranties, representations, and conditions of any kind, whether express, implied, or statutory, including all warranties or conditions of merchantability, fitness for a particular purpose, title, quiet enjoyment, accuracy, or non-infringement. Enkasa makes no guarantee that the services will function without interruption or errors…

…You acknowledge and agree that the Enkasa parties are not liable, and you will not seek to hold the Enkasa parties liable, for the conduct of third parties, including operators of external sites, and that the risk of injury from such third parties rests entirely with you. Enkasa makes no warranty that the goods or services provided by third parties will meet your requirements or be available on an uninterrupted, secure, or error-free basis. Enkasa makes no warranty regarding the quality of any such goods or services, or the accuracy, timeliness, truthfulness, completeness or reliability thereof…

In conclusion, the advertised premise where "Enkasa charges industry-standard agent commissions, so buyers and sellers don’t pay anything more than they would with other agents" is plain false. There are highly competitive agents who will compete for buyers’ with buyer agents rebates; there are no industry-standard agent commissions in California. In some states, such as Oregon, buyers cannot receive rebates due to anticompetitive state-specific rebate bans, but Enkasa is not a licensed broker in any of these ten states.

Because of such blatantly false advertising methods for services offered by Enkasa brokerage, this editor cannot possibly recommend them to any home buyer. The truth has a habit of revealing itself, and the deceptive advertising notions employed by Enkasa, as described in this review, should be enough to raise a common sense alarm for a savvy consumer.

The real estate industry likes to operate on false notions that "buyer agents work for free" and that "commissions are standard" because real estate brokers do not like to compete with each other on pricing. Yet the commission buyer rebate is the single largest line item for savings when buying a home. When shopping for a buyer agent, or a contractor, there are no gimmicks and there are no substitutes for open negotiations and multiple bids with clearly defined pricing schedules. There are no standard rates in the housing industry: everything is negotiable.

As always, we encourage consumers to post unbiased feedback about this business with any sentiment. If hiring this brokerage worked for you, or if it didn’t, other California consumers need to know.