Redfin Partner Agents Open Collusion

A copy of the request filed with the DOJ, CFPB, and the FTC asking to review practices of Redfin Partner Agents.

A copy of the author’s official request that asks the United States Federal Trade Commission, the United States Department of Justice, and the United States Consumer Financial Protection Bureau to investigate Redfin Corporation (dba Redfin Partner Program) and Redfin Partner Agents on the grounds of an alleged violation of the Federal Trade Commission Act of 1914 (15 U.S.C. Section 45) an alleged violation of the Sherman Antitrust Act of 1890 (15 U.S.C. Section 1) an alleged violation of RESPA Section 8 (12 U.S.C. 2607) as well as any other possible violations of antitrust and consumer protection laws currently ratified and enforced in connection with alleged broker-to-broker market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices.

Attn: Citizen Complaint Center, Antitrust Division

Department of Justice

950 Pennsylvania Ave., NW Room 3322

Washington, DC 20530

Attn: Office of Policy and Coordination

Bureau of Competition

Federal Trade Commission

600 Pennsylvania Ave. NW Room CC-5422

Washington, DC 20580

Attn: CFPB Regulatory Implementation

Consumer Financial Protection Bureau

1700 G St., NW

Washington, DC 20552

Please find the information below with regards to possible antitrust violations.

What companies or organizations are engaging in conduct you believe violates the antitrust laws?

Redfin Corporation

1099 Stewart St, Suite 600

Seattle, WA 98101 US

Phone: (877) 973-3346

California DRE #01521930

In an alleged collusion scheme with a vast partner agent network. As a numerical reference, this is a massive wire fraud and broker-to-broker collusion scheme, where about 11,600 Redfin Partner Agents are in an open collusion with Redfin, while Redfin merely employs only 1,500 as legitimate Redfin Agents as a real estate brokerage. Redfin Partner Agents operate for competing brokerages and choose to execute blanket broker-to-broker referral agreements with Redfin Corporation. According to the Redfin website, as of June 2021, 85,000+ customers bought and/or sold homes with Redfin Partner Agents.

Why do you believe this conduct may have harmed competition in violation of the antitrust laws?

Redfin operates under several brokerage licenses, primarily helping consumers buy and sell homes. However, a large number of transactions originated by Redfin are “farmed out” to competing brokerages. The company relies on an illicit referral network of over 11,600 Redfin Partner agents who all work for competing brokerages.

Acting as the "spokes" within the "hub-and-spoke" broker-to-broker collusion scheme, Redfin Partner Agents are independent Realtors firmly affiliated with various brokerages such as Berkshire Hathaway HomeServices, eXp Realty, Windermere Real Estate, Keller Williams Realty, Inc., RE/MAX, Coldwell Banker, NextHome, Inc., HomeSmart, Compass, John L. Scott Real Estate, CENTURY 21, Realty ONE Group, Vylla, ERA Real Estate, Weichert Realtors, Better Homes and Gardens Real Estate, Fathom Realty, Intero Real Estate Services, John R. Wood Properties, Worth Clark Realty, Sotheby's International Realty, etc.

According to an initial public offering of shares of common stock of Redfin Corporation filed with the SEC on July 27, 2017, during 2017 out of 7,733 of Redfin's real estate transactions originated 2,041 were completed by its referral network. Once Redfin refers a customer to a partner agent, that agent, not Redfin, represents the customer from the initial meeting through closing, at which point the agent pays Redfin a portion of her commission as a referral fee.

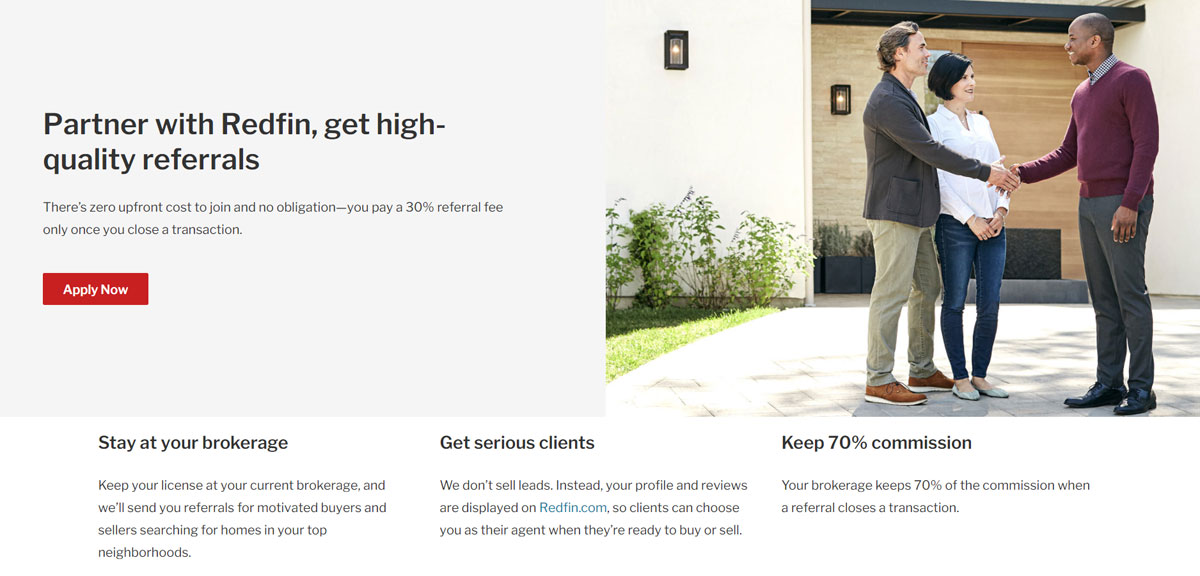

Redfin currently mandates a 30% blanket referral fee from agents that participate in this program. This open arrangement between competitors leads to an inefficiency known as "reverse competition" where referring brokers end up competing not for the consumer attention but for the attention of the middle-man who steers the consumer toward its network of brokers and away from competitors. Such pay-to-play steering results in lower quality of service and/or higher commissions, fees, and price levels. In effect, Redfin turns consumers into a commodity for sale to a competing brokerage. According to Redfin, “Redfin Partner Agent keeps 70% of the commission when a referral closes a transaction.”

For real estate professionals, Redfin states: “Keep your license at your current brokerage, and we’ll send you referrals for motivated buyers and sellers searching for homes in your top neighborhoods.”

Both, Redfin and competing Redfin Partner Agents benefit from the consumer allocation scheme where, for example, one Redfin Partner Agent named Nayda Reyes operating in Miami, FL, claims the following: “Becoming a partner with Redfin has been extremely life-changing to my business and professional growth. I've doubled my closed transactions, continue to receive repeated business from my sphere of influence and past referrals, and evolved from a salesperson to a trusted Real Estate Advisor. I'm living the life I’ve always dreamed of with ease and confidence.”

Another Redfin Partner Agent, Tabitha and Adam Murphy Chicago, Illinois licensed with a competing brokerage called Berkshire Hathaway HomeServices Chicago, claims that: “Since becoming Redfin Partner Agents, our business has increased tremendously. The quality of our referrals has been great—they’re educated about the process and ready to go.”

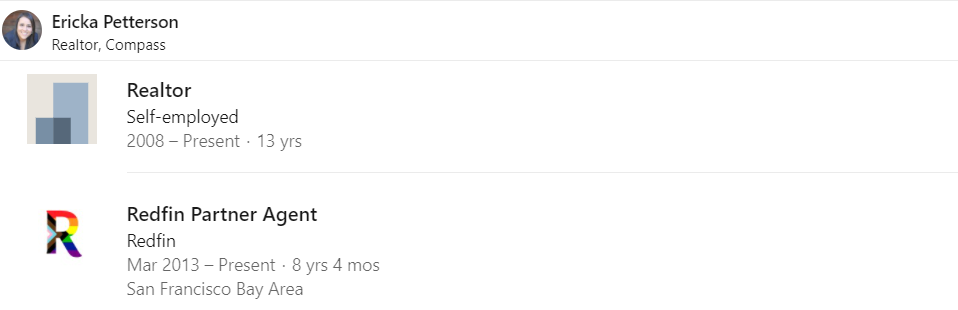

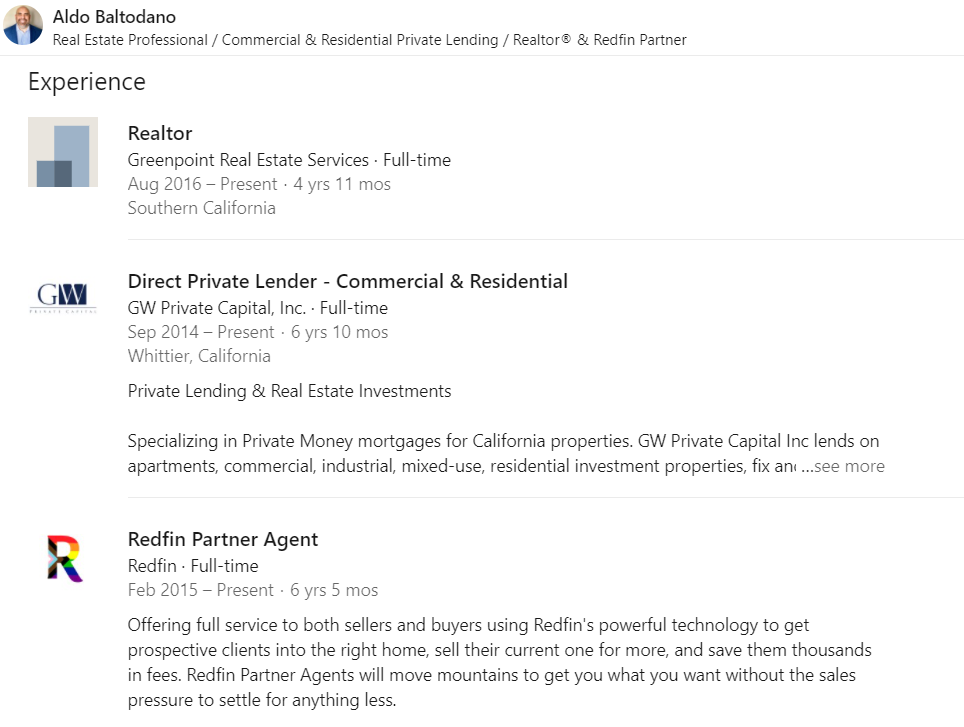

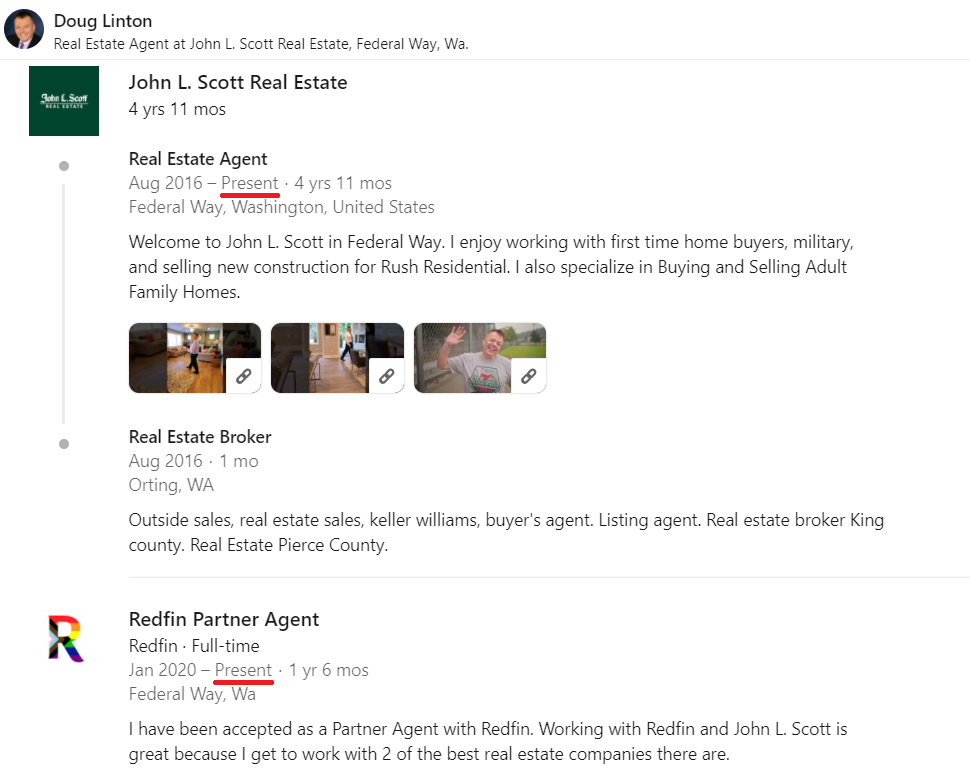

Redfin Partner Agents often advertise their collusion scheme with Redfin as a positive experience. Many Redfin Partner Agents even include Redfin Partner Program into their LinkedIn professional profiles alongside their actual broker of record affiliation.

Ericka Petterson advertises as a Compass agent and a Redfin Partner Agent

Aldo Baltodano advertises as a Greenpoint Real Estate agent and a Redfin Partner Agent

Doug Linton advertises as a John L. Scott agent and a Redfin Partner Agent

A referral agreement between Redfin and a Partner Agent for a random transaction that may or may not happen sometime in the future is executed in advance.

Redfin engages in consumer allocation, price-fixing, and market allocation schemes with Partner Agents’ brokerages because it is a broker itself. Instead of representing consumers to help buy and sell homes, the company actively disengages from its licensed activities so that every Redfin Partner Agent knows that Redfin brokerage will not actively compete with them on a certain set of transactions. According to the company message to brokers, “There’s zero upfront cost to join and no obligation—you pay a 30% referral fee only once you close a transaction.”

RESPA (12 U.S.C. 2607) Section 8 narrowly allows payments under cooperative brokerage and referral arrangements between real estate agents and real estate brokers. This limited exemption on kickbacks only applies to fee divisions within real estate brokerage arrangements when all parties are acting in a real estate brokerage capacity. To comply in good faith with RESPA (12 U.S.C. 2607) Section 8 exception for cooperative brokerage and referral arrangements, real estate agents must render referral agreements on an individual basis, in a particular instance for a particular transaction.

Sherman Antitrust Act (15 U.S.C. Chapter 1, 2), effectively, requires all active real estate brokers to proactively compete for consumers without entering into blanket anticompetitive agreements that restrain free trade. An agreement or an understanding between brokers not to compete (or, in this case, to actively promote competing brokers) for a mutual profit is a "per se" violation of antitrust regulations in the United States.

It is a per se violation of the Sherman Act for real estate brokers to agree on a “standard” referral fee that will be paid for producing a client. Real estate professionals are not allowed to enter into “standard” referral agreements with competitors because such agreements always restrict free trade.

Once the consumer is “farmed out” to a random Redfin Partner Agent, Redfin owes absolutely no duty of care to consumers and takes no responsibility for the transaction, despite receiving a direct financial benefit from the home sale or purchase completed by a referred brokerage.

Actions of Redfin and Redfin Partner Agents directly increase the costs of owning homes in the United States due to added referral fees, consumer allocation practices, and reverse completion between brokers. In this scheme, both colluding parties benefit from offering consumers higher commissions. Redfin promotes Partner Agents as a way to limit competition with those agents outside of the network, and to encourage competing brokers to collude with them, thus limiting free-market competitive forces and steering consumers in self-interest.

Honest agents who choose to advertise competitive rates fairly to consumers also end up receiving less business while operating outside the dominant scheme. Redfin, on the other hand, rakes in hidden kickbacks while consumers are fighting their way through a housing affordability crisis.

As long as consumer allocation schemes, such as Redfin Partner Program, are allowed to operate, brokers looking to represent consumers are naturally encouraged to participate in the scheme. “There are no upfront costs, only pay us once the transaction closes,” is an attractive proposition to a broker who acts on this proposition by simply increasing a quoted commission to any consumer who comes as a referral. Any broker who chooses not to participate in such schemes risks losing “free business.” Such an environment is highly poisonous to a healthy real estate representation market.

Redfin Partner Program collusion scheme secretly harms real estate consumers and diminishes the efforts of competitive independent agents to provide a tangible service at an independently set competitive price.

The government must treat Redfin Partner Agents and Redfin as competing brokers because they are equally licensed as brokers and they currently choose "at will" to either compete or to collude with one another. Licensed brokers are not allowed to promote the services of competitors, they are required to compete with competitors. A broker must promote their services directly to consumers and exist to solely help consumers buy, rent, and sell real estate.

RESPA further requires brokers to act in a brokerage capacity to pay and/or accept kickbacks. Redfin Partner Program operates by removing itself from having to offer a tangible service as a licensed broker, but instead, it acts as a “blanket” referral fee intermediary between a large number of random real estate agents, itself, and its mortgage operations.

Due to its popularity, Redfin Partner Program remains a “gateway drug” and an acceptable open collusion practice for several similar broker collusion schemes between licensed brokers and paper brokerages across the United States. For example, the following is a list of ten similar schemes, all operated under a similar premise:

(1) Realtor.com ReadyConnect Concierge (Opcity) consumer allocation and price-fixing agreements

(2) Zillow Flex Program consumer allocation agreements

(3) Xome Concierge consumer allocation and price-fixing agreements

(4) Blend Realty consumer allocation and price-fixing agreements

(5) Opendoor Brokerage (and Open Listings affiliate) consumer allocation and price-fixing agreements

(6) Rocket Homes (Rocket Companies) consumer allocation agreements

(7) mellohome (loanDepot) consumer allocation agreements

(8) HomeLight consumer allocation agreements

(9) Better.com Real Estate consumer allocation and price-fixing agreements

This is list is alarming by itself because it includes some of the most well-known, well-funded, and openly advertised paper brokers in the online real estate sector. All of these online propositions, without exception, operate by the exact principle as Redfin and Redfin Partner Agents without any regard for consumer welfare in the housing sector.

As long as brokers can trade consumers as “leads” between competitors in exchange for blanket referral fees, Open Marketplace™ continues to operate at a competitive disadvantage.

If you have a question or comment about an antitrust issue, you may submit it to the Bureau of Competition at the United States Federal Trade Commission and/or to the Antitrust Division of the United States Department of Justice

If you have a question or comment about federal consumer protection financial laws, including RESPA, you may submit it to the Office of Enforcement of the United States Consumer Financial Protection Bureau