Compare Tomo.com (Tomo Real Estate) and Zillow Flex

For Sellers

For Buyers

For Buyers

Answer: Both Tomo.com (Tomo Real Estate) and Zillow Flex function as a referral fee network that enables broker-to-broker collusion with use of blanket referral agreements.

Buying with Tomo Brokerage

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

Tomo.com (Tomo Real Estate)) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

Tomo Brokerage is a paper brokerage that operates a consumer allocation and a price fixing scheme designed to collect hidden referral fees by matching consumers with local real estate agents willing to pay it. Tomo Brokerage operates under a Texas TREC License #9010749 issued to Tomo Brokerage, Inc., but it does not produce any services that are typically offered by real estate agents and does not represent consumers when buying or selling real estate in any State.

In exchange for matching consumers with an Tomo Brokerage Partner Agent, Tomo Brokerage is compensated by the Partner Agent with a hidden kickback, likely 25%-35% cut of their commission. The company partnered with real estate coach Tom Ferry to build out their collusion scheme with a network of independent agents across multiple states.

Tomo Brokerage Pricing

Tomo Brokerage revenue comes from the use of blanket referral agreements with random real estate brokers. Tomo Brokerage is a broker-to-broker collusion scheme that scrubs consumers' information from their mortgage operations and passes it along to a colluding broker who is willing to pay for it with a cut of their commission. Tomo Brokerage’s blanket referral agreements effectively operate on a longstanding myth that buyer agents work for free. In reality, a homebuyer can negotiate a sizable commission refund with a competitive buyer agent in 40 US states from the Buyer’s Agent Commission (typically offered at 2.5%-3% BAC) received.

Tomo Brokerage, in effect, operates as a price-fixing scheme that converts a small portion of the kickback they receive into "perks." Tomo dangles these "perks" as carrots in front of consumers, currently fixed at an interest rate set discount at 0.125% if customers use a Tomo Brokerage Partner Agent. These “perks” savings, in reality, are dismal, compared to thousands in kickbacks received by Tomo for the act of pay-to-play steering. In this scheme, consumers end up giving up an opportunity to receive massive amounts of cash rebates (thousands or tens of thousands depending on the overall home price) available to them in the open market from highly competitive agents who offer in legitimate tax-free buyer’s cash refunds to compete for homebuyers’ business.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Tomo.com (Tomo Real Estate) Editor's Review:

Tomo claims to be a different consumer-focused company, but in reality, it is in of the worst VC-backed real estate pay-to-play consumer steering schemes. For consumers, Tomo Brokerage promises a real estate agent “concierge” platform for top local real estate agents. By gathering consumers’ home preferences and budgets while shopping for a mortgage with Tomo Mortgage, Tomo Brokerage scrubs users’ information and feeds it into their limited pay-to-play network of real estate brokers. According to Tomo's website Privacy Policy, they sell consumers’ information to any number of other services. This pay-to-play dynamic is unlikely to represent the consumer’s best options. Whoever pays Tomo some form of kickbacks, in effect, is who they pass consumers’ information to:

“In some circumstances, we share your information with third parties not owned by or co-branded with Tomo Mortgage that benefit directly from our sharing your information with them.”

Tomo Mortgage may even sell consumers’ information to competing lenders:

“Third-party lenders. If Tomo Mortgage cannot finance your home, we may share your personal information with one of our partner lenders.”

Tomo further may attempt to sell consumers’ information to random home insurance companies:

“Home insurance agencies. If your real estate transaction is such that you may need homeowners insurance, we may share your information with homeowners insurance agencies and those agencies may reach out to you directly to offer you a quote.”

For real estate professionals, Tomo Brokerage promises a “no upfront costs” lead generation by scrubbing consumers’ information when they shop for their mortgage. Once a potential homebuyer is identified, a Tomo Brokerage initiates a transfer to the Partner Agent. Tomo Brokerage representatives give Partner Agents all the background information on the homebuyer to make the transition.

In other words, Tomo Brokerage is a consumer allocation scheme between licensed real estate brokers that scrubs consumer’s information and passes it along to a broker who is willing to pay for it with a cut of their commission. If a broker is unwilling to give a portion of their commission to Tomo Brokerage, the company has no interest in recommending them. Tomo Brokerage further takes no responsibility for any of the actions of the brokers that they allocate to consumers.

In effect, Tomo Brokerage is a self-serving scheme designed to funnel consumers toward brokers who pay them a hidden kickback at the close of consumers’ transactions. Consumers using Tomo Brokerage have zero control over what agents the company shares their information with. Instead of being scrubbed and sold as leads, consumers looking for a competitive and fair representation can consider negotiating directly with real estate agents, or with help from unbiased consumer-focused online services that do not collect kickbacks.

Tomo attempts to present this pay-to-play scheme differently:

"Tomo Brokerage only works with Partner Agents that meet its high standards of customer-centric service, and they have to be experts in the areas you want to live in. They help you hone in your search criteria, find great homes, negotiate a great deal, and navigate the entire process. They can also help you identify qualified professionals to put the finishing touches on your new home."

These claims are entirely false. Tomo Brokerage only works with brokers who pay them kickbacks. These agents engage in consumer allocation with Tomo Brokerage. The act of consumer allocation between licensed brokers is a prohibited practice in the United States, by the virtue of the Sherman Antitrust Act. Tomo Brokerage Partner Agents are unlikely to have consumers' best interests, and, because they have to pay a kickback, they do not earn their full commissions. In effect, these agents work for consumers half the time, and for Tomo, the other half.

Even considering the overall dishonesty, kickbacks, and legal implications of the scheme, a consumer can technically still use Tomo Mortgage and freely negotiate a competitive buyer refund elsewhere on the open market with any agent.

There are honest and competitive buyer agents who are willing to share a cut of their commissions with consumers, as a legitimate way to earn business, rather than paying hidden kickbacks to Tomo Brokerage. Tomo Mortgage does not require consumers to use Tomo Brokerage, but it instead dangles an interest rate discount (set at 0.125%) so that homebuyers think that there are savings available to them. Tomo Brokerage's hidden kickbacks cost consumers thousands in properly negotiated fees while funneling hidden fees back into the scheme itself. These hidden kickbacks, eventually, reside in consumers’ mortgages and collect interest.

Price Fixing with Tomo Perks

Broker compensation fees must never be fixed via agreements between two or more brokers anywhere in the United States. All commissions and rebates must be set by each real estate agent individually and may only be negotiable between the consumer and the real estate agent. Buyer agents never work for free.

Genuine quality and honest real estate professionals establish pricing for their services independently, and without any kickbacks. The truth is, every single agent is different, and every single agent has an individual commission structure. If an agent is unwilling to negotiate competitive buyer rebate terms in compliance with the law, there is no reason for homebuyers to assume that they will be willing to negotiate competitively when it comes to their home purchase.

In combination, Tomo Mortgage and Tomo Brokerage terms equate to price fixing rates of independent real estate professionals who do not work for either one of these entities. Price fixing between independent business entities is a felony everywhere in the United States.

Tomo Perks Terms and ConditionsSubject to the following terms and conditions, customers who buy a home with Tomo Mortgage and a Tomo Brokerage Partner Agent qualify for Tomo Perks, which lowers their mortgage interest rate by 0.125%:

Tomo Brokerage Partner Agent. The customer must be party to a fully executed home purchase contract that identifies a Tomo Brokerage Partner Agent as their real estate agent, and Tomo Brokerage must have a record of referring the customer to the Partner Agent.

Tomo. The customer must purchase the home referenced above using a mortgage loan from Tomo with a loan amount of at least $150,000.

Rate Lock. The Tomo Perks interest rate reduction will be applied when the customer locks in their interest rate.

Modification. Tomo may modify the terms of Tomo Perks, but when it does so they will be modified only for customers who entered into purchase contracts after the date the program terms were modified.

Consumer Allocation

Tomo Brokerage is a broker-to-broker collusion scheme. All Partner Agents agree to pay Tomo Brokerage a pre-arranged referral fee, on all closed transactions, through their employing broker. A referral agreement between Tomo Brokerage and a Partner Agent for a random transaction that may or may not happen sometime in the future is executed in advance.

Tomo Brokerage engages in consumer and market allocation agreements with Partner Agents brokerages, because it is a broker itself. Instead of representing consumers to help buy and sell homes, this “paper” brokerage actively disengages from its licensed activities so that every Partner Agent knows that Tomo Brokerage, Inc. will not compete with them. Tomo Brokerage does not act in a real estate brokerage capacity, instead, their real estate license is used to collect a blanket referral fee from the largest number of brokers possible.

Sherman Antitrust Act effectively requires all active real estate brokers to proactively compete for consumers. An agreement or an understanding between brokers not to compete for a mutual benefit is a "per se" violation of antitrust regulations in the United States.

The amount of a referral fee between brokers must be negotiated with respect to an individual transaction. It is a per se violation of the Sherman Antitrust Act for real estate brokers to agree on a “standard” referral fee that will be paid for producing a client. Real estate professionals are not allowed to enter into blanket referral agreements between one another because such agreements always restrict free trade.

Brokers are not allowed to organize their operations into any collusion schemes and networks, and instead, all brokers must compete for consumers on a fair playing field. Legitimate agents who choose NOT to engage in the Tomo Brokerage “no upfront costs” scheme are harmed as well because consumers are steered away from them in a highly competitive real estate market.

Kickbacks and Unearned Fees

RESPA, among other things, is designed to prohibit abusive practices such as kickbacks and referral fees between mortgage companies and real estate brokers.

The statutory exemption for a payment to a cooperative brokerage and referral arrangements between real estate agents and real estate brokers requires all agents to compete against one another. To comply in good faith with RESPA (12 U.S.C. 2607) Section 8 exception for cooperative brokerage and referral arrangements, legitimate real estate agents must render referral agreements in a particular instance for a particular transaction.

Actions of Tomo Brokerage “paper” brokerage directly increase the costs of owning homes in the United States due to added blanket referral fees, consumer allocation practices, price fixing, and reverse completion between brokers. Partner Agents in the scheme have no incentive to compete for consumers individually with lower fees, instead, they have an incentive to compete for Tomo Brokerage’ attention. In this scheme, both colluding parties benefit from offering consumers higher commissions. Tomo Brokerage promotes Partner Agents as somehow “superior” to those outside of the network, thus limiting free-market competitive forces and steering consumers in self-interest toward a network of very few agents who chose to agree to participate in the scheme.

Similar attempts to by-pass RESPA prohibition against kickbacks by means operating a paper brokerage in a combination with services of a mortgage broker are not new. Similar schemes include:

Blend and Blend Brokerage

Better.com and Better Real Estate

HomeStory and a number of third-party lenders

Rocket Mortgage and Rocket Homes

loanDepot and mellohome

Nationstar Mortgage (dba Mr. Cooper) and Xome

and possibly some others. CFPB is currently investigating at least one of these schemes, Rocket Homes, and consumers must exercise great care to protect themselves in the meantime. A real estate home purchase is one of the most important transactions and it must be free from hidden kickbacks and self-steering.

In the real world, Tomo Mortgage and Tomo Brokerage are a single company, both designed and built with massive VC capital to rake hidden fees, by-pass RESPA, collude with independent brokers for a cut of their commissions, and openly price-fix services of others.

The entire RESPA prohibition against kickbacks was enacted specifically to stop mortgage companies from entering into “symbiotic relationships” with real estate brokers. Tomo Brokerage may seem like a clever by-pass of RESPA’s prohibition against kickbacks, but this loophole is built entirely on the use of blanket referral agreements between brokers designed to restrain free trade.

As an active licensed brokerage, Tomo Brokerage owes absolutely no duty of care to consumers, takes no responsibility for the transaction, and does not help consumers to buy homes - all despite receiving a direct financial benefit from the home purchase completed by the homebuyer.

Where does Tomo.com (Tomo Real Estate) operate?

Buying and Selling with Zillow Flex

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

Zillow Flex) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

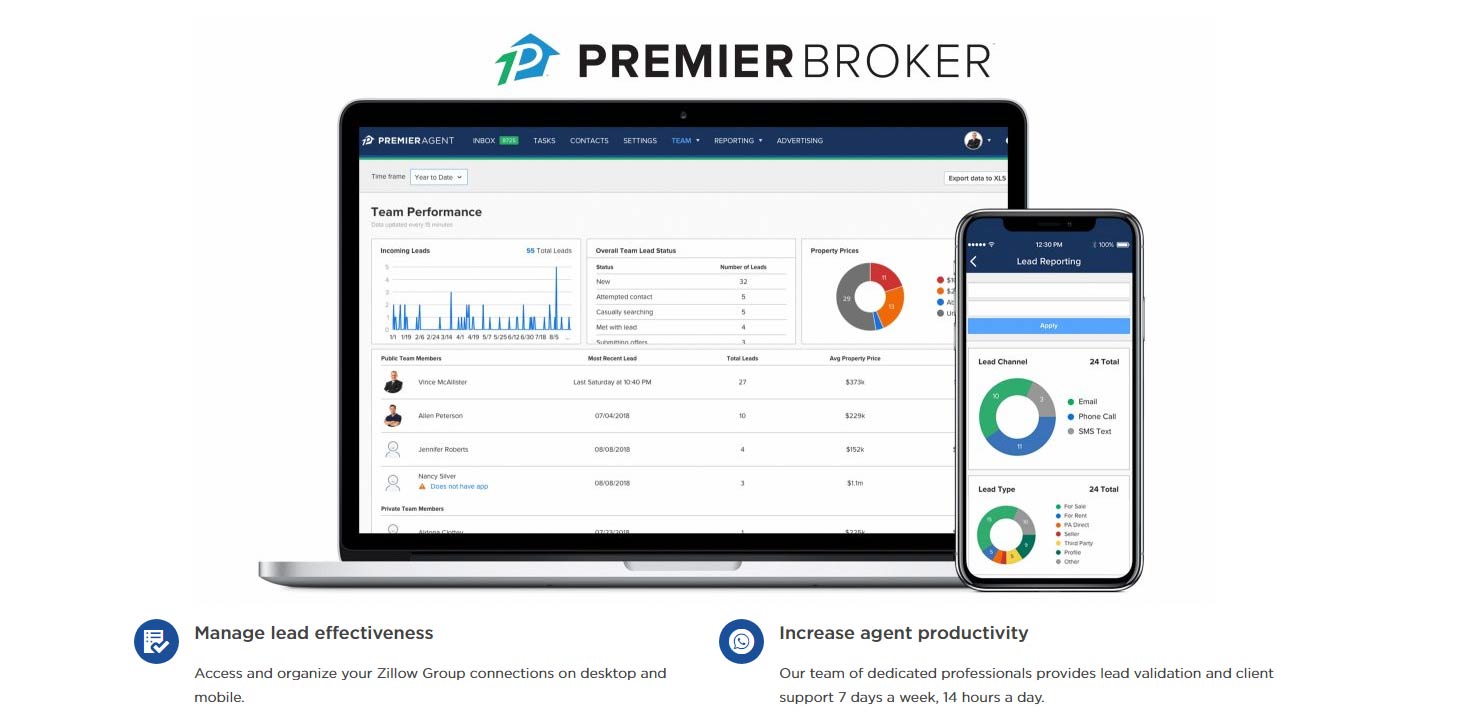

Zillow Flex is a real estate referral fee network that is designed to collect undisclosed referral fees from real estate agents. Within this network, Zillow Group screens and refers consumers to real estate agents with a pre-existing "blanket" referral agreements. Zillow Group refers to this referral service as a Zillow Flex because it allows brokers to participate without paying any upfront costs to Zillow Group.

As a consumer filling out a contact form on the Zillow-owned (Zillow, Trulia, etc.) web site, "you authorize Zillow to make Real Estate Referral and acknowledge Zillow may be paid valuable consideration for facilitating such referral." Zillow Group does not disclose to consumers how much "valuable consideration" it receives from participating brokers. "The established referral fees are specific to each market in order to account for local pricing trends," according to Zillow.

Zillow Flex is a form of pay-to-play consumer brokering product that relies on the use of blanket referral agreements to pay for each referral. Blanket referral agreements between brokers are a per se violation of the Sherman Act. With Zillow Flex consumers are effectively pre-screened by Zillow and “sold as leads” to whoever is willing to pay for this information with a share of their commission.

Zillow Flex Pricing

Zillow Premier Broker does not offer paid services to consumers directly, instead, the portal generates revenue with estimated 25%-40% referral fees from real estate brokers. Zillow Group declines to disclose the exact fee amount.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Zillow Flex Editor's Review:

This review is focused on the Zillow Flex program only. Two separate reviews are assigned to Zillow Instant Offers and Zillow MLS aggregator programs. Since Zillow was first founded, it has idolized itself as a real estate Internet company. However, with an introduction of Zillow Flex in 2018, this is no longer the case.

Today, Zillow acts as a "paper" real estate broker. This fact allows Zillow to receive referral fees from real estate agents across the United States.

Zillow operates under the following real estate brokerage license in the following States:

Arizona CO580407000

California 01522444

California 01980367

Colorado 100080923

Florida CQ1058944

Georgia 76885

Minnesota 40638657

Nevada B.1002277.CORP

North Carolina C30388

Texas 549646

Washington 21212

Wisconsin 835987-91

Real estate agents are allowed to pay one another referral fees with a narrow RESPA provision that is needed to allow individual agents to refer business to other individual agents outside their service area. Despite being registered as a broker, Zillow does not perform real estate services, it simply sends leads to specific agents within its network and uses a real estate license to collect a back-loaded referral fee in the process.

Referral fee revenue is 32x that of a regular advertisement revenue because it results in an economic process called reverse competition, where consumers suffer from elevated costs and lower service as a result. A referral network is anything but free.

The following are some telling quotes from Zillow itself and a Premier Broker program participants. These words speak for themselves.

- "We receive listing and buyer referrals directly from Zillow's Premier Broker concierge services. These leads have been scrubbed and vetted before they are directly handed off to you." Source: Sonoma County RE/MAX Marketplace, Zillow Flex participant.

- "We will validate all leads first, then send agent-ready buyers to you." Source: Zillow website.

- "What happens if you miss a call? Don't worry. You won't lose your place in the queue and we will call you with the next connection we validate." Source: Zillow website.

Zillow Group does not disclose the exact amount in referral fees it collects from Premier Brokers, aside from stating that it is an "industry standard." Similar referral fee networks typically receive 25%-40% of the agent's total commission. This is a good reference for the amount in commissions consumers can expect to overpay for their real estate services with a Premier Broker. Zillow Flex is a pay-to-play process that harms the industry as a whole and makes buying and selling homes more expensive.

Why does the Zillow allow for such poor UX? There are thousands and sometimes tens of thousands in fees collected from each transaction effectively hidden in consumer’s commission.

Consumers in the United States have been systematically conditioned to a 6% "standard" commission structure, a non-negotiable fact that needs no justification. Unfortunately, this inefficiency alone breeds uncompetitive behavior where real estate agents can easily pay tens of thousands in fees because they are recoverable with a high commission.

Consumers are truly forgotten in this model as an afterthought. When these exigent commissions are amortized over the first five years of homeownership, these fees are the highest single expense line-item - more than the insurance, more than the interest, more than utilities. Clearly, real estate agents only sign-up with Premier Broker because the price of the referral fee can be easily incorporated into their client's agreement with excessive commissions.

RESPA allows for an exception for real estate agents if and only if “all parties are acting in a real estate brokerage capacity" so that individual agents can refer each other when they are out of the local area. This exception has now been turned up-side-down where a referral network does not act in the capacity of a real estate broker. Zillow Group simply uses a license to collect fees without any tangible services done as defined by said license.

Consumers looking to work with a legitimate real estate agent on fair terms should absolutely avoid Zillow Flex and never release their full name, email and a phone number to Zillow Group.

The issue of having all US residential real estate markets heavily subjected to these schemes results in noncompetitive behavior, higher costs to consumers and lower quality of service. Having agents "commonly" pay networks 25%-45% of their commission is the true reason why real estate is broken.

Zillow Group matches consumers with "great, amazing, top-producing, perfect agents" based on who first picks up the phone and who is willing to kick in a chunk of their commission, this is the main basis for this process.

What happens when this flawed revenue model is no longer sustainable due to competitive commissions entering the market? The next stage of real estate innovation will have to account for this reality. In play are now competitive open rates, flat fees and buyer’s refunds from highly qualified real estate agents.

Transparent commission rates will eventually bring and end to a pay-to-play phenomenon in the real estate process where programs like Premier Broker simply cannot exist.

Today, consumers should be careful and only negotiate with agents that have no referral fee agreements signed, this is the only way to negotiate for full service at a market rate.