Redfin Partner Program and Antitrust

The antitrust laws prohibit for two or more real estate firms to agree on the commission rate that each will charge.

US Federal and State antitrust laws are designed to protect competition and provide an opportunity for competitors to engage in business free of artificial agreements. Such restrictions include price-fixing agreements and market allocation arrangements. Antitrust laws are enforced by the US-DOJ, the US-FTC, and State agencies, such as Attorneys General. Geodoma cannot enforce these laws, but successful implementation of our online service requires for antitrust laws to become fully enforced.

Price fixing is an agreement among competitors to raise, fix, or otherwise maintain the price at which their goods or services are sold. These antitrust regulations exist because the competitive process only works when competitors set prices honestly and independently. Price fixing is prohibited in real estates, like any other industry, which means that competing brokers cannot agree to set fees, rebates, or commission rates.

The antitrust laws are designed to protect competition and consumers alike. Temporarily, consumers may see the benefits of price fixing, especially when prices are set to lower rates, however, these benefits are short-lived and will eventually result in lower quality of service and limited competition. Real estate process is highly susceptible to price fixing due to high risk-aversion, high-value of a typical transaction, and a high level of collaboration between real estate professionals.

A common subject of price-fixing agreements in real estate is the commission rates each competitor charges. The antitrust laws prohibit for two or more real estate firms to agree on the commission rate that each will charge. Brokers must not agree with others on commission rates and should always avoid discussing or colluding on any agreements on fees.

Real estate brokers should establish their fees unilaterally, where no two brokers should discuss rates with one another as a business proposition, especially with an exchange of referral fees.

In April 2019, I had asked the United States Federal Trade Commission to review the practice of Redfin Corporation for engaging in conduct that I believe violates the US antitrust laws.

Why do I believe that Redfin harms competition?

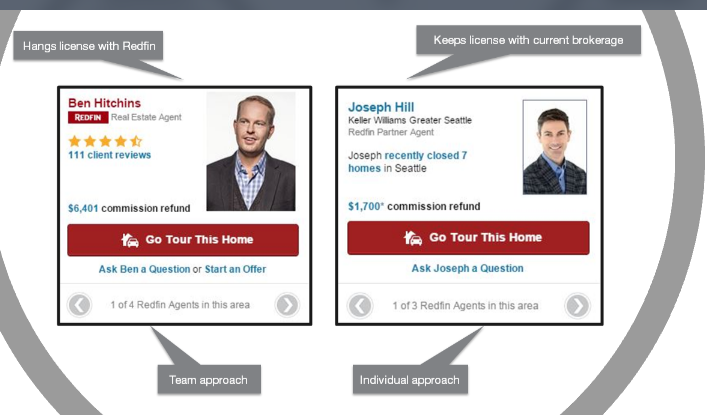

Redfin is a multi-state broker, a full-service company rebates buyer part of the commission it receives, where allowed, and provides listing savings to sellers. In some cases, this company acts as an Internet referral fee network where it is unable to provide real estate services. Redfin works with about 3,100 Partner Agents in regions where it has no direct representation in exchange for a 30% referral fees. Approximately 40% of all real estate transactions originated by Redfin are executed by this referral network. Referral agents pay 30% of their commission back to Redfin when they close transactions. Once Redfin refers a customer to a Partner Agent, that agent, not Redfin, represents the customer from the initial meeting through closing. In the recent past, Redfin has openly dictated how Partner Agent should set commission rebates and listing rates as a way to participate in the Partner Program.

Redfin stated:

"In early 2016, we changed the pricing and structure of the Redfin Partner Program. Instead of paying 15% of the commissions' partner agents earned through the program to us, partner agents began paying us 30%. At the same time, we began directly issuing a $500 check to certain partner program customers, partially offsetting the increase in referral fees paid by partner agents. These changes to our partner program positively affected our real estate revenue per partner transaction in the latter part of the three months ended March 31, 2016, and were fully reflected in the three months ended March 31, 2017. We do not expect a large year-over-year increase in real estate revenue per partner transaction for the three months ended June 30, 2017."

Image via Redfin.com

Redfin FAQ further stated in the recent past that:

"When you work with a Redfin partner agent to buy your home, you’ll receive up to 15% savings on their commission, subject to a minimum commission of $2,500 and approval by the lender. The refund is based on the net sales price of the home, which is your agreed sales price with the seller minus any credits the seller pays for closing costs, repairs, or other contributions. For example, on a $500,000 home with a 3% commission for the buyer’s agent, your refund would be $2,250; for a $250,000 home, your refund would be $1,125. If you purchase a home for less than $120,000, your refund won’t quite be 15% of the partner agent’s commission. After they receive their minimum commission of $2,500 for helping you buy your home, you’ll split the difference. On a $115,000 home, you’d receive a $475 refund. Your agent will confirm your refund amount once the inspection period is complete and any seller contributions have been accounted for."

In the United States, all independent brokerage fees are always negotiable and each real estate agent establishes its own policy for a fee structure, amount of commissions, and the sharing of any listing commissions. Price fixing is prohibited by antitrust legislation. To fix, control, recommend, suggest or maintain commission rates or fees for independent agents’ services, not directly associated with the company, is an improper practice. Redfin Corporation is always able to set rates for its own brokerage services, but not for services of others. By setting listing rates and rebates for independent agents, Redfin utilizes price-fixing as means to deliver lower prices for consumers, but the real aim for this scheme is to collect 30% referral fee in the process. This, in turn, means that a Partner Agent effectively works for a set rate payment minus 30% referral fee.

By setting rates and rebates for other agents in the past, Redfin has gained exposure with consumers that were seeking savings, but it did so at the expense of a fair and open market process. Such practice cannot be tolerated in the real estate industry. As long as Redfin Corporation was able to engage in this behavior, others will too. Recently, a number of real estates brokers have begun using this method to collect referral fees. This trend will continue to grow unless prompt action is taken to stop price-fixing agreements in the industry between licensed real estate brokers.

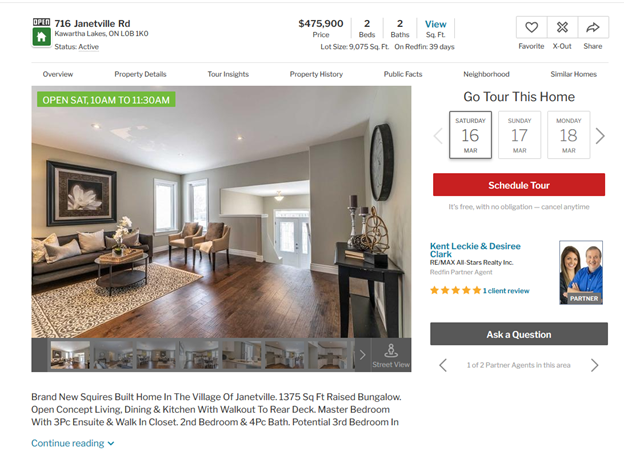

Redfin Corporation has further secured a referral fee partnership with RE/MAX Corporation as well. While rates and rebates for this competitor are not directly advertised, this type of partnership is a form of market allocation.

Image via Redfin.com

The full expanse of this problem goes beyond Redfin Corporation. For example, another licensed broker Open Listings has recently started a Partner Program where Partner Agents can “stay at current brokerage while building additional client and industry relationships through the OL network.” Open Listings requires that these agents provide a 50% refund to consumers, despite being employed elsewhere. By setting rebates at 50% for other agents, I believe Open Listings also engages in price fixing when setting rates for brokers that do not work for the company.

Another licensed broker from Missouri, Clever Real Estate, does not produce any real estate representation services, but instead sets a flat listing fee of $3,000 for homes sold under $350,000 and 1% listing fee for homes sold over that amount; for home Buyers Clever Real Estate sets a 1% rebate. For purposes of the present discussion, brokerage fees are always negotiable and no broker should set rates and rebates for other brokers.

Redfin Corporation has recently stopped its price fixing strategy, where a statement on the company’s website now reads:

"Since Partner Agents aren't employed by Redfin, we can't guarantee our 1%–1.5% listing fee or offer a Redfin Refund for customers who work with a Partner Agent,"however, the company still heavily engages in consumer market allocation practices in their efforts to earn referral fees, instead of actually providing representation services. I believe that in the recent past Redfin Corporation has been setting rates and rebates for Partner Agents, and this practice has effectively paved the way for what is now a massive collusion scheme with RE/MAX brokerage.

What is Geodoma role in the situation?

Our neutrality is secured by the fact that Geodoma is not a real estate broker, and we never intend to become one. Geodoma is always a technology company.

Geodoma is seeking a fair and open competitive environment to develop our service. Successful implementation of our platform requires FTC to enforce existing antitrust laws that were implemented to protect US consumers.

Geodoma helps our users to make the opportunity of home-ownership transparent, affordable and open experience.