Is NAEBA a scam?

In the United States, RESPA Section 8 and CFPB Regulation X maintain firm prohibitions against kickbacks and unearned fees, with particular statutory exemptions, with regards to settlement services involving most federally related mortgage loans. This includes services provided by all real estate brokers, real estate agents, and Realtors to homebuyers and home sellers.

'No person shall give, and no person shall accept any fee, kickback, or thing of value pursuant to any agreement or understanding, oral or otherwise, that business incident to or a part of a real estate settlement service involving a federally related mortgage loan shall be referred to any person.' 12 U.S.C. 2607(a). 'Any person or persons who violate the provisions of this section shall be fined not more than $10,000 or imprisoned for not more than one year, or both.' 12 U.S.C. 2607(d)(1).

There is a narrow exemption to this law, for any: 'payments pursuant to cooperative brokerage and referral arrangements or agreements between real estate agents and brokers.' 12 U.S.C. 2607(c)(3). Service provided by a 'real estate broker' is codified under RESPA as a 'settlement service' that is 'provided in connection with a prospective or actual settlement.' 24 C.F.R 3500.2. A mere possession of a 'shell' real estate license does not meet this designation. NAEBA is not genuine brokerage acting in a brokerage capacity, but it attempts to meet this exemption as a 'shell' real estate entity.

When NAEBA acts as an 'agent-matching service' or a 'referral platform' it may, of course, easily sell customer leads and advertising to real estate brokers. However, under RESPA such sales must never be tied to the outcome of the successful transaction or based on a percentage of brokerages' commissions. The US-CFPB Advisory Opinion issued on February 7, 2023, further confirms that any operator of a 'settlement services' digital comparison-shopping platform receives a prohibited referral fee in violation of RESPA Section 8 when the operator receives a 'thing of value' for referral activity.

Because NAEBA does not provide 'service provided in connection with a prospective or actual settlement' when making a referral, the referral is not a bona fide 'settlement service,' and it does not act as a bona fide 'real estate broker,' and it does not meet an exemption for 'payments pursuant to cooperative brokerage and referral arrangements or agreements between real estate agents and brokers.' The scheme cardinally, collects RESPA-prohibited 'fee, kickback, or thing of value' codified under 12 U.S.C. 2607(a), subject to $10,000 fine and a year in federal prison - for each violation. There is no such thing as a 'partner agent' under law, anywhere in the United Satates, and 'shell' brokerages making referrals covered by RESPA do not meet 12 U.S.C. 2607(c)(3) exemption. Both, consumers and honest real estate professionals, should avoid NAEBA because it is an illegal scam, that integrally degrades value of real estate services and inflates real estate commissions with exigent kickbacks.

FAQ for NAEBA

What are the alternatives to NAEBA?

NAEBA directly competes with several broker-to-broker blanket referral fee schemes, including OJO Labs, mellohome, Sold.com, HomeLight, LemonBrew, Radius Agent, ReferralExchange, UpNest, Nobul, agentpronto, effectiveagents, topagentsranked, myagentfinder, Clever Real Estate, and others.

Genuine alternatives to NAEBA are unbiased real estate platforms, open marketplaces, and consumer review portals that offer reliable information without any pay-to-play bias.

What are the pros and cons of NAEBA?

Pros: there are none with NAEBA. NAEBA is a 'paper' broker that operates a consumer steering scheme with a network of independent brokers. Consumer allocation between brokers holds no tangible value to any consumer, either when buying or selling a home.

Cons: there are several main disadvantages to NAEBA. First, consumers are hiring two brokers for the work of one. Second, NAEBA takes a hidden referral fee, so the referred agent is unable to offer their full value to consumers. Third, NAEBA only recommends paying agents to consumers, leaving out the vast majority of honest agents out of the scheme.

Summary: NAEBA steers consumers toward their network of brokers and away from others. NAEBA cannot legally organize brokers into a network because blanket referral agreements, price fixing, and consumer allocation between licensed real estate brokers in the USA are prohibited.

What is NAEBA?

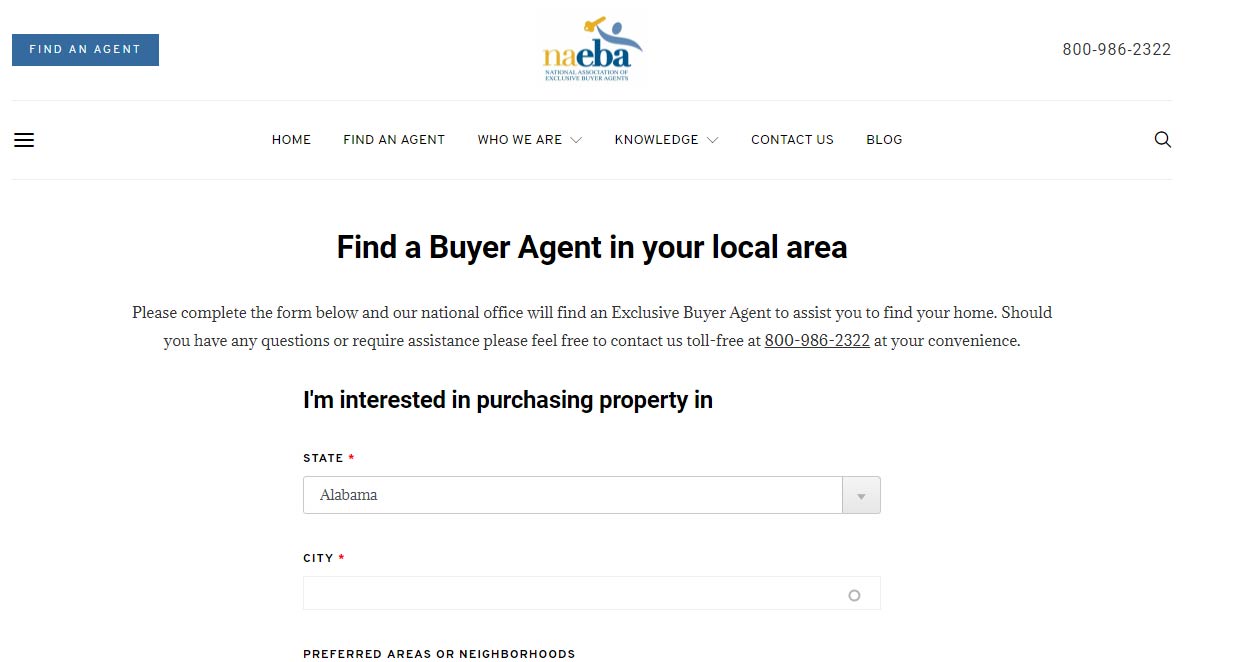

NAEBA is a referral fee network designed to collect fees by matching consumers with local real estate agents willing to pay it. When consumers submit information to NAEBA, this information is simply shared in exchange for an undisclosed fee with real estate agents in a process known as a blind match.

Is NAEBA legitimate?

No. NAEBA is a consumer allocation scheme between licensed real estate brokers that increases broker commissions and limits consumer choices. NAEBA's revenue comes from undisclosed referral fees. Blanket referral fees set by such networks range anywhere between 30%-40% of the entire broker's commission. NAEBA is a pay-to-play scheme that offers biased matches for financial gain. The main qualification for real estate brokers who participate with NAEBA brokerage is their willingness to pay a referral fee. Consumer allocation between licenses real estate brokers is a felony in the United States prohibited by federal antitrust regulations.