Compare HomeGenius.com and Lower.com (OJO Movoto)

For Sellers

For Buyers

For Buyers

Answer: Both HomeGenius.com and Lower.com (OJO Movoto) function as a referral fee network that enables broker-to-broker collusion with use of blanket referral agreements.

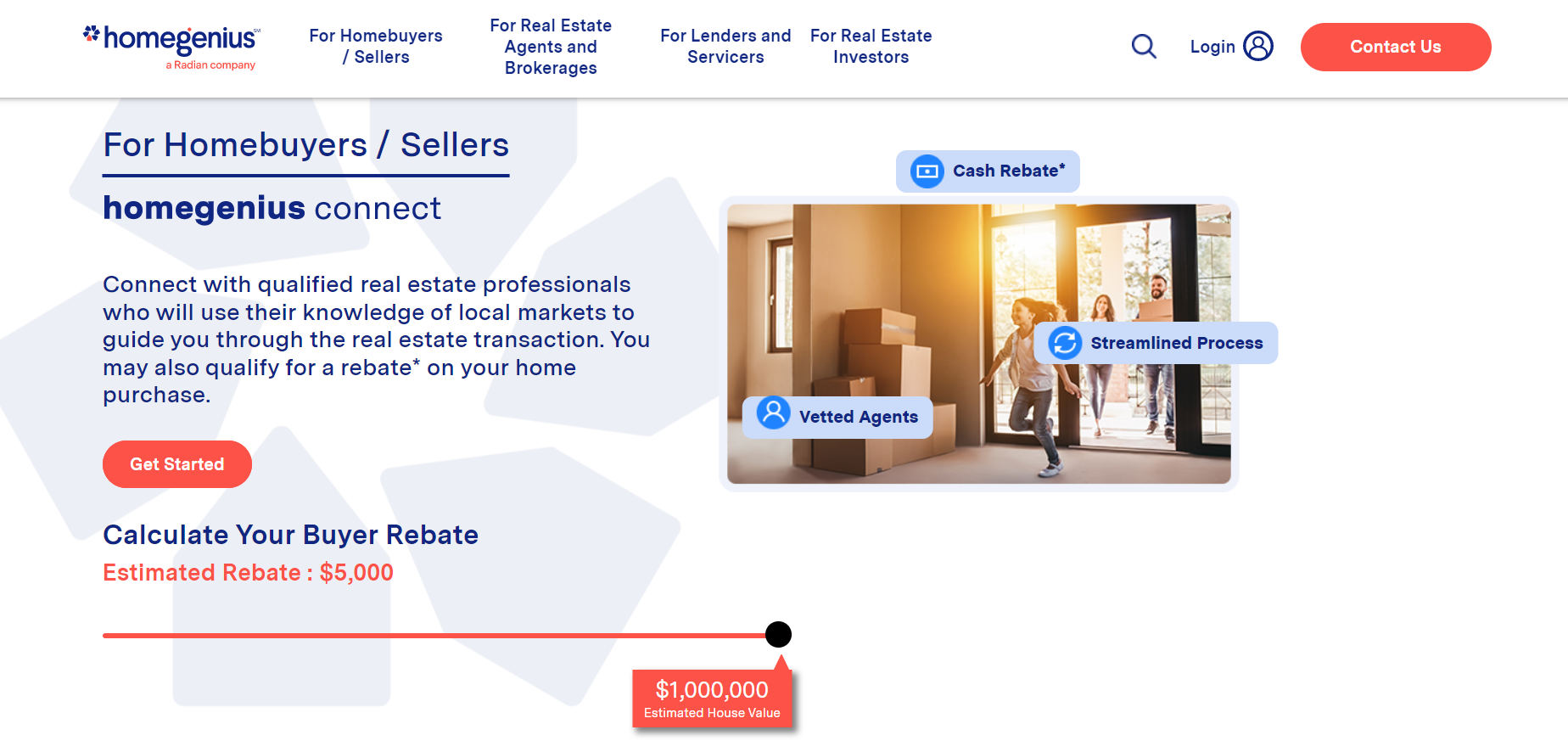

Buying with homegenius

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

HomeGenius.com) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

homegenius is a referral fee network and a price-fixing scheme that allocates home buyers to real estate agents by means of a shell entity homegenius Real Estate of Florida LLC. homegenius is a subsidiary of Radian Group Inc. (NYSE: RDN) where the parent company attempts to use the shell broker as a channel to earn kickbacks from mortgage, mortgage insurance, title, and settlement services. homegenius, effectively, sells Radian's "high intent customers" to random colluding brokers to earn additional kickbacks from these services.

homegenius Pricing

homegenius takes a hidden kickback set at 30% of the gross commission income received by colluding Realtor via MLS from the Buyer Agent Commission (BAC) amount typically offered at 2.5% to 3% of the home purchase via local MLS. The kickback is paid after the price-fixed 0.50% buyer rebate is paid out to the homer buyer by a colluding Realtor.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeGenius.com Editor's Review:

homegenius Real Estate of Florida LLC is a licensed real estate entity in the State of Florida License No. CQ1057661 operates as a "shell" broker to collect an undisclosed referral fee, set at 30% from the gross commissions paid by all colluding Realtors in the network. This fee is inevitably passed down to consumers in a form of inflated real estate commissions when either buying or selling a home.

More importantly, homegenius is a licensed real estate entity that does not engage in actual real estate broker services. homegenius systematically applies pay-to-play bias towards all Realtor matching results, meaning, only Realtors that have agreed to collude and pay a referral fee are matched with consumers.

Realtors only sign-up with homegenius because the price of the referral fee can be easily incorporated into their client's agreement with excessive commissions.

homegenius receives a low Editor's rating because this service is a biased hub-and-spoke broker-to-broker collusion scam, that falsely claims to provide an independent and unbiased service of matching consumers with agents.

homegenius operates on a pay-to-play methodology to collect junk fees that needlessly make home buying and selling more expensive. In this scheme, consumers are no longer in the driver's seat, but instead, are traded as a commodity between brokers.

homegenius plays junk fees down, claiming there are "no upfront costs" to Realtors and the service is "free" to consumers, but it rigidly locks every participating Realtor into a kickback attached to the back-end of every agreement that restrains free trade. As a licensed real estate entity that doesn’t perform any real estate services or take any responsibility for the transaction, this scheme operates to unlawfully allocate consumers and bypass RESPA anti-kickback regulations through a "shell" entity.

Consumer brokering is an act of selling information of potential home buyers and home sellers (paid referrals) between real estate brokers, in exchange for a cut of a broker’s commission. Brokers on each side of the adopted scheme, cause direct damage to the real estate representation market with reverse competition, anticompetitive market allocation, price-fixing, lack of competition, limited choices to consumers, unnecessary high commissions, and improperly negotiated fees. A referring broker in this scheme does not compete with referred brokers, instead, homegenius administers a series of agreements that restrain free trade, disguised as Realtor matching services.

12 C.F.R. § 1024.14(g)(1)(v) (Regulation X) and RESPA 12 U.S.C. § 2607(c)(3) narrowly allow payments pursuant to cooperative brokerage and referral arrangements between real estate agents and real estate brokers. This limited exemption on kickbacks only applies to fee divisions within real estate brokerage arrangements when all parties are acting in a real estate brokerage capacity. homegenius does not act in a brokerage capacity, in fact, this entity willfully chooses to disengage from offering real estate representation services to consumers, as the core premise to create successful collusion through interstate wire communication to further the scheme. Wire fraud is financial fraud involving the use of any telecommunications or information technology.

Real estate transaction is a rare, high-value, and high-risk-aversion experience that is easily subjected to unlawful kickbacks, especially with the use of the Internet. Consumers are often subjected to high commissions and hidden referral fees without a full understanding that these fees increase their commissions and result in a lower quality of service. Whenever any double-dealing Realtor agrees to pay these massive kickbacks, he or she is unable to offer full and competitive representation services to anyone. homegenius does not cater to honest Realtors, it only caters to Realtors willing to cheat their clients out of full services, and willing to share private information about their clients' transactions with the scheme.

homegenius antitrust and consumer protection violations are not harmless. Realtors who attempt to compete for consumers on fair terms and competitive pricing are at a massive disadvantage in this environment. As a result of broker-to-broker collusion, consumers end up getting steered toward a limited pool of agents and overpay for commissions. Consumers’ private transaction information is always shared with a referring broker that requires it to be disclosed to calculate the referral fees to be paid at the close of each transaction.

Consumers, of course, pay for this abuse with higher costs of commissions that, eventually, make it directly into their new mortgages and cause significant losses of net equity from a home sale.

homegenius is a subsidiary of Radian Group Inc. (NYSE: RDN) where the parent company attempts to use the shell broker as a channel to earn kickbacks from mortgage, mortgage insurance, title, and settlement services. homegenius, effectively, sells Radian's "high intent customers" to random colluding brokers to earn additional kickbacks from these services.

A typical broker-to-broker collusion scheme often attempts to fool consumers with heavily advertised campaigns on Google, Nextdoor, Facebook, or local radio and TV. Such a false ad might read: "Unbiased. Get Data-Driven Results. Our Agents Can Get You the Best Deals. Sign Up Now! Save Time & Hassle and Get Matched to the Perfect Agent for Your Needs. Find Quality Realtors. Top Agent Rankings. Personalized & Fast. 100% Free. Top 1% of Real Estate Agents Compete to Sell Your Home. No Obligation. Save Thousands."

In reality, all such "matches" are 100% biased, pay-to-play collusion steering mechanisms between licensed brokers, and they all cost consumers tens of thousands compared to open market savings. These "paper" brokers do not connect consumers with anyone outside the network, in fact, they specifically steer consumers into the network in exchange for massive kickbacks pre-negotiated in advance.

There are numerous reasons why consumers are wise to avoid the homegenius scheme, but probably the most important reason is that the lack of transparency and honesty is contagious. homegenius scheme only attracts double-dealing Realtors who are willing to break a host of federal laws, and unwilling to compete for consumers with transparency. An unethical Realtor will always find a way to turn the most important transaction into a self-dealing proposition - to collect a bigger commission check faster without any regard for what is truly a good deal for their clients.

Why Does homegenius Engage in Price-Fixing?

homegenius engages in price-fixing because it needs a "dangling carrot in front of consumers" to "reasonably" justify the kickbacks it takes from the Realtors who patriciate in the scheme. This dynamic is better known as a hub-and-spoke conspiracy. In a hub-and-spoke conspiracy, all rebates are set at the same amount for all Realtors, where none of the "partner agents" compete with one another on pricing at all. homegenius scheme produces absolutely no tangible service as a licensed broker to anyone and instead delivers inflated prices and lower quality of service. The scheme originates as a conspiracy to restrain trade and to funnel consumers toward the scheme and away from the open market. There are hundreds of thousands of highly competitive Realtors who offer great savings and great service, and they refuse to pay kickbacks or to comply with the price fixed rates set by homegenius.

The kickback is the reason why homegenius sets listing commission rates and buyer rebates for Realtors outside their firm. ALL consumers and ALL legitimate Realtors are scammed by homegenius, even if the experience and savings may seem "good enough" because price-fixing is a faulty shortcut to genuine open competition between Realtors. By law, all Realtors must compete for consumers and set prices individually. Open competition is at the core of our free and independent society everywhere in America.

The Realtor commissions in the United States have long suffered from the "standard" 6% myth and the false notion that "buyer agents work for free." However, these myths cannot be resolved with price-fixing of commissions to some other level, in exchange for kickbacks. ALL Realtors who participate in the homegenius scheme are engaged in price-fixing. The Sherman Act imposes criminal penalties of up to $100 million for a corporation and $1 million for an individual, along with up to 10 years in prison. No legitimate Realtor will ever willingly allow themselves to be exposed to such massive liability.

The best, highly-experienced, well-educated, law-abiding, honest, and ethical Realtors will never participate in price-fixing because it is a felony that carries massive penalties. The best Realtors can recognize price-fixing as wrong because they respect the true value of honest negotiations.

The prices set by homegenius are not for the services that they offer, but for services offered by their direct competitors – other brokers. When homegenius refuses to compete with these brokers and instead organizes "partner agents" into a network, it breaks an entire host of basic principles that guide our open and fair markets. Moreover, homegenius extends this conspiracy all across the United States, making the scheme highly damaging due to the scaled use of the Internet to transmit collusion. The Internet, like any other scaled information medium, can be used to transmit competition just as easily as fraud and collusion.

The short answer is: homegenius's intent to fix prices is directly tied into the kickbacks it receives from the "partner agents." This dynamic is a product of the restraint of genuine competition. The "standard commissions" problem in the residential real estate sector can only be fixed legally by encouraging Realtors to set and advertise competitive prices to consumers at scale without paying any kickbacks.

Where does HomeGenius.com operate?

Buying and Selling with OJO Home

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

Lower.com (OJO Movoto)) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

OJO Home is a referral fee network designed to collect referral fees by matching consumers with local real estate agents willing to pay it. OJO Home operates under a variety of broker licenses, mainly two issued by the Texas Real Estate Commission as OJO Home Inc. 9007689 and OJO Home LLC 9008342, but it does not produce any services that are typically offered by real estate agents and does not represent consumers when buying or selling real estate in any State. In exchange for matching consumers with an OJO Home Partner Agent, OJO Home is compensated by the Partner Agent with an undisclosed percentage of their commission. As of June 2020, OJO Home further operates a real estate online brokerage Movoto. When users are ready to talk to an in-person agent, OJO refers clients to a Movoto agent, or Partner brokerage.

OJO Home Pricing

OJO Home revenue comes from undisclosed referral fees. Referral fees set by such networks range anywhere between 25%-40% of the entire agent’s commission.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

Lower.com (OJO Movoto) Editor's Review:

For consumers, OJO Home promises real estate assistance as a lead nurturing platform and a transaction manager. The platform is supposedly able to learn a buyer's preferences via machine learning and match them with homes that fit their needs. By gathering consumers' home preferences and budgets, OJO communicates conversationally through mobile text as a personal advisor throughout the home-buying process.

For real estate professionals, OJO Home promises a scalable, high-touch experience that reflects well on a brokerage and helps increase closings by scrubbing leads as they come in and nurturing buyers with unique insights powered by machine learning. Once a homebuyer is prepared, a home concierge initiates a live transfer to the Partner Agent. OJO representatives give Partner Agents all the background information on the homebuyer to make the transition as warm as possible. This handoff helps ensure both consumers and agents alike receive the most seamless, hassle-free experience. OJO claims to help real estate professionals to create stronger, better-informed connections with buyers and sellers and keeps them engaged until they're ready to get down to business.

For Partner Agents, there is no upfront cost to join OJO to receive leads and referrals. The referral fee is paid on each lead that results in a close.

In other words, OJO Home is a middle-man that scrubs consumer's information and passes it along to a broker who is willing to pay for it with a cut of their commission. All options offered to consumers by OJO Home suffer from pay-to-play bias. If a broker is unwilling to give a portion of their commission to OJO Home, the company has no interest in recommending them. The following is a set of statements taken from OJO's Terms of Service that all, effectively, show that OJO takes no responsibility for their recommendations.

"OJO will process lead inquiries from a variety of sources including but not limited to: your brokerage's website, your brand's website, and leads you have acquired from the major national search portals (e.g. Zillow, Homes.com, Realtor.com, Trulia, etc.)."

"We ingest your leads from your various sources (website, Realtor.com, etc.) in real time and will call leads in as quickly as 10 seconds. We do the legwork to get a customer on the phone and facilitate the live transfer to the first-available agent once a buyer is ready to be connected."

"By using the OJO services, you agree to receive phone calls and text messages from us and our partners. By using the OJO services, you expressly authorize OJO, its affiliated companies and its partners (described below) and each such entity's employees, contractors and software (collectively, "Service Provider") to communicate with you by phone and text at the wireless phone number provided or any other number that you may provide in the future. You understand that message and data rates may apply based upon the terms of your wireless service provider contract. You also agree that methods of contact may include use of auto-generated text messages or an automated telephone dialing system, even if you've registered that number on a Do-Not-Call registry, and that my consent to text messages and phone calls is not a condition to using any Service Provider's services. If you do not consent to receive these texts or calls, do not use the OJO service or provide your information to us."

"We do not endorse or recommend the products or services of any service provider and are not an agent or advisor to you or any service provider. We do not validate or investigate the licensing, certification or other requirements and qualifications of service providers. It is your responsibility to investigate any service providers before you engage them. You acknowledge and agree that these service providers are solely responsible for any services that they may provide to you and that we are not liable for any losses, costs, damages or claims in connection with, arising from, or related to, your use of a service provider's products or services."

"OJO is not a real estate agent or lending institution or other service provider. Instead, we, through the OJO services, may help to connect you with service providers that might meet your needs based on information provided by you. OJO does not, and will not, make any credit decision with any service provider referred to you. OJO does not issue mortgages or any other financial products."

"By accepting a referral to one of our Referral Partners, you grant us permission to share your User Data with the Referral Partner so that they may offer their products or services to you."

"When you accept a referral to one of our Referral Partners, you acknowledge that you are purchasing any products or services offered by the Referral Partner directly from them and that OJO is not a party to any agreement between you and the Referral Partner with respect to those products and services; and OJO is not responsible for that Referral Partner's products or services, the content therein, or any claims that you or any other party may have relating to that Referral Partner's products and services."

"By using the OJO services, you hereby release us of any and all losses, costs, damages or claims in connection with, arising from or related to your use of a service provider's products or services, including any fees charged by a service provider."

Clearly, OJO is a biased platform designed to funnel consumers toward brokers who pay them a kickback at the close of consumers' transactions. Consumers using OJO Home have zero control over what agents the company shares their information with. Instead of being "scrubbed" and "sold as leads" consumers looking for a competitive and fair representation can consider negotiating directly with real estate agents, or with help from unbiased consumer-focused online services that do not collect referral fees.

Conflicts of Interest

According to OJO Home, "When a consumer is ready to connect with an agent, up to five qualified agents are contacted via text message. The first agent to respond wins the opportunity. Upon responding to the consumer notification, the agent will receive a phone call for a warm transfer within one minute. This phone call must be answered promptly or the consumer introduction will go to another agent."

OJO Home doesn't care which agent, specifically, picks up the phone first, but it does care that the match is made only to someone in their referral network.

"After the introductory call with the consumer, agents will receive a text message with a link to update their profile in the Agent Dashboard. Agents will then receive bi-weekly reminders to update their buyer and seller profiles as they move further down the path toward closing on a new home."

This process is established to keep OJO Home informed about what stage of the transaction process the consumer is in. OJO Home needs to understand when the broker will close the deal and when it will receive a referral fee from the sale or purchase of the home. This means that OJO Home receives intimate details about consumers' transactions from Partner Agents.

According to one OJO Home Partner Agent, Sharon S. from Atlanta, GA, "Signing up was really easy. I also love that I can choose what kinds of leads I want and they show up on my phone. I'm talking to new clients within a few minutes. It's pretty neat."

Of course, this is a neat consumer brokering scheme, where agents pick "what leads they want" and consumers are steered only toward agents who choose to cut in OJO Home with a major share of their commission. In this scenario, consumers' needs are "ingested" and "warmed-up" for the agent.

Antitrust Implications

In reality, OJO Home is a broker-to-broker collusion scheme that scrubs consumer's information and passes it along to a colluding broker who is willing to pay for it with a cut of their commission. All Partner Agents agree to pay OJO Home a pre-arranged referral fee, on all closed transactions, through their employing broker. A referral agreement between OJO Home and a Partner Agent for a random transaction that may or may not happen sometime in the future is executed in advance.

OJO Home engages in consumer and market allocation schemes with Partner Agents brokerages, because it is a broker itself. Instead of representing consumers to help buy and sell homes, this "paper" brokerage actively disengages from its licensed activities so that every Partner Agent knows that OJO brokerage will not compete with them. OJO Home does not act in a real estate brokerage capacity, instead, their real estate license is used to collect a blanket referral fee from the largest number of brokers possible.

Sherman Act effectively requires all active real estate brokers to proactively compete for consumers. An agreement or an understanding between brokers not to compete for a mutual profit is a "per se" violation of antitrust regulations in the United States.

The amount of a referral fee between brokers must be negotiated with respect to an individual transaction. It is a per se violation of the Sherman Act for real estate brokers to agree on a "standard" referral fee that will be paid for producing a client. Real estate professionals are not allowed to enter into blanket referral agreements between one another because such agreements always restrict free trade.

Brokers are not allowed to organize their operations into any collusion schemes and networks, and instead, all brokers must compete for consumers on a fair playing field. Legitimate agents who choose to not engage in the OJO referral scheme are harmed as well because consumers are steered away in a highly competitive real estate market.

To comply in good faith with RESPA (12 U.S.C. 2607) Section 8 exception for cooperative brokerage and referral arrangements, legitimate real estate agents must render referral agreements in a particular instance for a particular transaction.

Actions of OJO Home "paper" brokerage directly increase the costs of owning homes in the United States due to added blanket referral fees, consumer allocation practices, and reverse completion between brokers. Partner Agents in the scheme have no incentive to compete for consumers with lower fees, instead, they have an incentive to compete for OJO Home' attention. In this scheme, both colluding parties benefit from offering consumers higher commissions. OJO Home promotes Partner Agents as somehow "superior" to those outside of the network, thus limiting free-market competitive forces and steering consumers in self-interest toward a network of very few agents who chose to agree to participate in the scheme.

As a licensed brokerage, OJO Home owes absolutely no duty of care to consumers and takes no responsibility for the transaction, despite receiving a direct financial benefit from the home sale or purchase completed by a third-party referred brokerage.