Compare FastExpert.com and HomeLight.com

For Sellers

For Sellers

For Buyers

For Buyers

Answer: Both FastExpert.com and HomeLight.com function as a referral fee network that enables broker-to-broker collusion with use of blanket referral agreements.

Buying and Selling with Fast Expert

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

FastExpert.com) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

Fast Expert is a broker-to-broker collusion scheme that allocates home buyers and sellers to a network of colluding Realtors through a "shell" real estate entity. When consumers submit information on the Fast Expert website, this information is sold in exchange for an undisclosed fee with real estate agents in a process known as a pay-to-play steering and a "blind match." Fast Expert, a California state brokerage, unlawfully allocates consumers with various Realtors as a hub-and-spoke conspiracy that inflates real estate commissions.

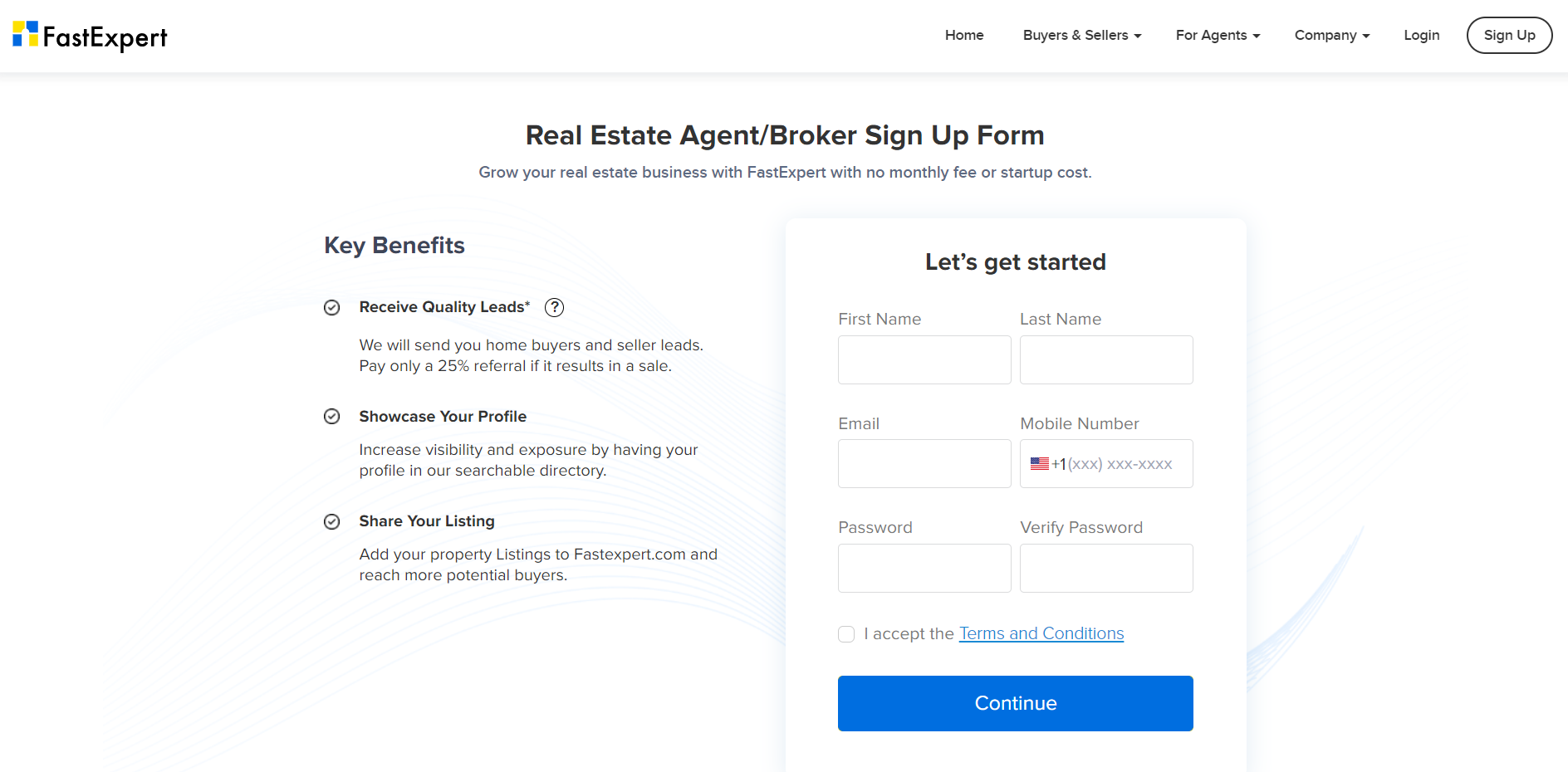

Fast Expert Pricing

Fast Expert fees come from Realtor commission kickbacks, set at 25% of the gross commissions received by colluding Realtors.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

FastExpert.com Editor's Review:

FastExpert, Inc (dba Fast Expert, FastExpert.com) is a licensed real estate firm in the State of California License No. 01950016 operates as a "shell" broker to collect an undisclosed referral fee, set at 25% from the gross commissions, paid by all colluding Realtors in the network, aka FastExpert Partner Agents. This fee is inevitably passed down to consumers in a form of inflated real estate commissions when selling or buying any home.

More importantly, Fast Expert is an active licensed real estate entity that does not engage in actual real estate broker services. Fast Expert systematically applies pay-to-play bias towards all Realtor matching results, meaning, only Realtors that have agreed to collude and pay a referral fee are matched with consumers.

Realtors only sign-up with Fast Expert because the price of the referral fee can be easily incorporated into their client's agreement with excessive commissions.

Fast Expert receives a low Editor's rating because this service is a biased hub-and-spoke broker-to-broker collusion scam, that falsely claims to provide an independent and unbiased service of matching consumers with agents.

Fast Expert operates on a pay-to-play methodology to collect junk fees that needlessly make home buying and selling more expensive. In this scheme, consumers are no longer in the driver's seat, but instead, are traded as a commodity between licensed brokers.

Fast Expert plays junk fees down claiming that the service is "free" "unbiased" and "no obligation" to consumers, but it rigidly locks every participating Realtor into a kickback attached to the back-end of every agreement that restrains free trade. As a licensed real estate entity that doesn’t perform any real estate services or take any responsibility for the transaction, this scheme operates to unlawfully allocate consumers and bypass RESPA anti-kickback regulations through a "shell" entity. Fast Expert scheme operates on a false notion that all buyer agent and listing agents commissions are the same, where no Realtor in the Fast Expert scheme competes for consumers on pricing.

Consumer brokering is an act of selling information of potential home buyers and home sellers (paid referrals) between real estate brokers, in exchange for a cut of a broker’s commission. Brokers on each side of the adopted scheme, cause direct damage to the real estate representation market with reverse competition, anticompetitive market allocation, price-fixing, lack of competition, limited choices to consumers, unnecessary high commissions, and improperly negotiated fees. A referring broker in this scheme does not compete with referred brokers, instead, Fast Expert administers a series of agreements that restrain free trade, disguised as Realtor matching services.

12 C.F.R. § 1024.14(g)(1)(v) (Regulation X) and RESPA 12 U.S.C. § 2607(c)(3) narrowly allow payments pursuant to cooperative brokerage and referral arrangements between real estate agents and real estate brokers. This limited exemption on kickbacks only applies to fee divisions within real estate brokerage arrangements when all parties are acting in a real estate brokerage capacity. Fast Expert shell entity does not act in a brokerage capacity, in fact, this entity willfully chooses to disengage from offering real estate representation services to consumers, as the core premise to create successful collusion through interstate wire communication to further the scheme. Wire fraud is financial fraud involving the use of any telecommunications or information technology.

Real estate transaction is a rare, high-value, and high-risk-aversion experience that is easily subjected to unlawful kickbacks, especially with the use of the Internet. Consumers are often subjected to high commissions and hidden referral fees without a full understanding that these fees increase their commissions and result in a lower quality of service. Whenever any double-dealing Realtor agrees to pay these massive kickbacks, he or she is unable to offer full and competitive representation services to anyone. Fast Expert does not cater to honest Realtors, it only caters to Realtors willing to cheat their clients out of full services, and willing to share private information about their clients' transactions with the scheme.

Fast Expert antitrust and consumer protection violations are not harmless. Realtors who attempt to compete for consumers on fair terms and competitive pricing are at a massive disadvantage in this environment. As a result of broker-to-broker collusion, consumers end up getting steered toward a limited pool of dishonest Realtors and overpay for commissions. Consumers’ private transaction information is always shared with a referring broker that requires it to be disclosed to calculate the referral fees to be paid at the close of each transaction.

Consumers, of course, pay for this abuse with higher costs of commissions that, eventually, make it directly into their new mortgages and cause significant losses of net equity from a home sale.

In reality, Fast Expert is a 100% biased, pay-to-play collusion steering mechanism between licensed brokers, that costs consumers tens of thousands compared in inflated commissions compared to open market savings. Fast Expert specifically steers consumers into the network in exchange for massive kickbacks pre-negotiated in advance. Fast Expert operates on false notions that "buyer agents work for free" and that all commissions are" standard" to justify a "standard" referral fee.

There are numerous reasons why consumers are wise to avoid the Fast Expert scheme, but probably the most important reason is that the lack of transparency and honesty is contagious. Fast Expert scheme attracts ONLY double-dealing Realtors who are willing to break a host of federal antitrust laws, and unwilling to compete for consumers with transparency. An unethical Realtor will always find a way to turn the most important transaction into a self-dealing proposition - to collect a bigger commission check faster without any regard for what is truly a good deal for their clients.

Why Does Fast Expert Engage in Collusion?

Fast Expert engages in consumer allocation because it is an active real estate entity that refuses to compete with other real estate agents who patriciate in the scheme. This dynamic is better known as a hub-and-spoke conspiracy. In a hub-and-spoke type conspiracy, all Realtor commissions are set at the same amount for all Realtors, where none of the "partner agents" compete with one another on pricing at all. Fast Expert scheme produces absolutely no tangible service as a licensed broker to anyone and instead delivers inflated prices and lower quality of service. The scheme originates as a conspiracy to restrain trade and to funnel consumers toward the scheme and away from the open market. There are hundreds of thousands of highly competitive Realtors who offer great savings and great service, and they refuse to pay kickbacks or collude with Fast Expert shell brokerage.

The illicit kickback is the reason why Fast Expert colludes with Realtors outside their firm. ALL consumers and ALL legitimate Realtors are scammed by Fast Expert, even if the experience may seem "good enough" because collusion is a faulty shortcut to genuine open competition between Realtors. Federal laws require all Realtors to compete for consumers and to deliver a tangible service, a simple test Fast Expert brokerage entity decisively fails. Open competition is at the core of our free and independent society everywhere in America.

The Realtor commissions in the United States have long suffered from the "standard" 6% myth and the false notion that "buyer agents work for free." Fast Expert is a direct extension of these uncompetitive, unethical, and unlawful notions. ALL Realtors who participate in the Fast Expert scheme are engaged in plain collusion, where each Realtor knows that Fast Expert shell brokerage will not compete at all, in exchange for a blanket kickback from the home sale or a home purchase. The Sherman Act imposes criminal penalties of up to $100 million for a corporation and $1 million for an individual, along with up to 10 years in prison for each count. Persons found guilty of wire fraud under federal law face fines up to $250,000 for individuals and up to $500,000 for organizations, subject to imprisonment of not more than 20 years. There are additional penalties of 30 years imprisonment and a million-dollar fine if the wire fraud involves a financial institution. These penalties are per count, which means that each electronic communication can be considered as a separate count. No legitimate Realtor will ever willingly allow themselves to be exposed to such massive liability.

The best, highly-experienced, well-educated, law-abiding, honest, and ethical Realtors will never participate in collusion because it is a felony that carries massive penalties. The best Realtors can recognize collusion as wrong because they respect the true value of honest negotiations.

When Fast Expert refuses to compete with these brokers and instead organizes "partner agents" into a network, it breaks an entire host of basic open commerce principles that guide our open and fair markets. Moreover, Fast Expert extends this conspiracy all across the United States via its website, making the scheme highly damaging due to the scaled use of the Internet to transmit collusion. The Internet, like any other scaled telecommunications medium, can be used to transmit open competition just as easily as pay-to-play fraud.

Most consumers do not know that Fast Expert is a licensed real estate brokerage because the nature of the scam requires this information to be deliberately hidden. Fast Expert scam is built entirely on false advertising to deliberately deceive consumers. This shell broker presents itself as an unbiased marketplace, but it is a real estate broker that engages in unlawful activities under federal laws. The short answer is: Fast Expert's intent to allocate consumers as a secret real estate shell entity is directly tied into the kickbacks it receives from the "partner agents." This dynamic is a product of the restraint of genuine competition. The "standard commissions" problem in the residential real estate sector can only be fixed legally by encouraging Realtors to set and advertise competitive prices to consumers at scale without paying any kickbacks.

Where does FastExpert.com operate?

Buying and Selling with HomeLight

WARNING: Unlawful Kickbacks, Broker-to-Broker Collusion, False Marketing, Wire Fraud, Price Fixing.

HomeLight.com) is a broker-to-broker collusion scheme, where "partner agents" unlawfully agree to pay massive kickbacks to receive your information and engage in market allocation, consumer allocation, false advertising, unlawful kickbacks, wire fraud, and price-fixing practices in violation of, inter alia, 18 U.S.C. § 1346, 18 U.S.C. § 1343, 15 U.S.C. § 1, 15 U.S.C. § 45, 12 U.S.C. § 2607, 12 C.F.R. § 1024.14. As a consumer, you will always significantly overpay for Realtor commissions subject to hidden kickbacks and pay-to-play steering promoted in this scheme.

United States federal antitrust laws prohibit consumer allocation and blanket referral agreements between real estate companies.

Be smart; do not allow your information to be "sold as a lead" to a double-dealing Realtor in exchange for massive commission kickbacks paid from your future home sale, or your future home purchase.

HomeLight is a referral fee network designed to collect fees by matching consumers with local real estate agents willing to participate. HomeLight operates as a licensed real estate brokerage in California under BRE License #01900940, but it does not produce any services that are typically offered by real estate agents and does not represent consumers when buying or selling real estate in any State.

When consumers submit information to HomeLight, this information is simply sold to real estate agents who are willing to pay for it with a 25% share of their commission.

HomeLight Pricing

HomeLight revenue comes from referral fees and sale of user data.

Listing Services

- This Service Does Not Represent Sellers

Buyer's Agent Services

- This Service Does Not Represent Buyers

HomeLight.com Editor's Review:

On paper, HomeLight seems to have a great idea – to provide its users with a list of the "most effective" real estate agents that are scrutinized across the board to systematically facilitate better offers for sellers and better terms for buyers.

HomeLight states that "our service is 100% free, with no catch. Agents don't pay us to be listed, so you get the best match." Digging deeper into Terms of Service the actual model turns out to be much less effective - HomeLight is a California licensed real estate broker that collects a 33% referral fee from all real estate agents that participate.

This fee makes it hardly a free service for anyone since referral fees are inevitably passed down to consumers.

More importantly, HomeLight applies this pay-to-play bias towards all matching results, meaning, only real estate agents that have agreed to pay a referral fee are displayed in match results for consumers.

HomeLight audits all transactions because it needs to find out how much money real estate agents receive in commissions, inevitably collecting private details of consumer's agreement for home purchase or sale.

HomeLight further claims to produce higher returns to consumers when selling, but there is absolutely no third-party evidence for this. HomeLight algorithm is self-proclaimed and is based on the data derived from MLS past transactions. There are any number of factors that affect the actual home value with no proven correlation to agent representation. In order to select a proper real estate agent, consumers need an open and a transparent information process that HomeLight is unable to provide.

HomeLight plays fees down to consumers - it states directly that the service is 100% free, but at the same time, it rigidly locks every participating real estate agent into 33% referral fee attached to the back-end of every contract. As a licensed real estate agent that doesn't perform any real estate services or takes any responsibility for the transaction, it is not entirely clear how this process works under the Business and Professions Code and RESPA.

Clearly, real estate agents only sign-up with HomeLight because the price of the referral fee can be easily incorporated into their client's agreement with excessive commissions.

HomeLight receives the second lowest score because this service is clearly biased and it claims to provide the complete opposite of what it actually does. HomeLight has presented the following facts prior to the review getting published, but did not respond with any comments. HomeLight must be well aware of this issue but continues to operate on pay-to-play methodology in order to collect fees that needlessly make home buying and selling more expensive.

HomeLight Simple Sale™ Product

HomeLight further offers consumers a connection to local real estate developers that buy and flip homes for profit. According to the company, the majority of Simple Sale developers are only interested in purchasing off-market homes. HomeLight itself admits that 91 percent of sellers choose a real estate agent to list their home on the open market, but that does not stop it from an attempt to offer your information to developers as well.

HomeLight states it will show the seller their best iBuyer offer against an estimation for what they can sell a home in an open market with the help of an agent. The reality is HomeLight doesn't care how your home is sold, as long as it receives a fee for directing you one way or another. It costs absolutely nothing to HomeLight to offer you a bad deal on selling your home to a real estate developer because this company is a referral fee network that is primarily interested in connecting consumers to anything that pays them a fee.

HomeLight does not state how much developers and iBuyers pay them for each successful lead, but according to third-party sources, HomeLight receives a 4% commission from the total value of your home. Remember, this fee comes from the real estate developer, so HomeLight for all practical reasons, works for that developer, not you. A developer will know that your home is off-market and it costs them absolutely nothing to give you a severely underpriced offer.

Typically, iBuyers cost consumers about 15%-20% of net equity from the home sale, when accounting for all fees and reduced cash offer against your home's true value. Most developers will not take anything less of a 30% margin below market. The reason is developers experience high risks and double transaction costs when making an offer on your home, and HomeLight's 4% commission on the sale is a very real closing fee to account for. The bank, on the other hand, does not care how you sell your home or for how much. Your mortgage company receives the same amount from the sale of your home, so these all excessive costs work directly against your net equity as a seller. If you are seriously considering Simple Sale offer made to you using HomeLight, the best way to approach it is with your own real estate agent who does not pay any referral fees to HomeLight.

Of course, matching you with a competitive agent to list your home on the open market is something HomeLight is not built for. Remember, HomeLight is a broker that is interested in receiving a referral fee for any match. If HomeLight does not receive payment of some sort from a broker, you will never see them on their platform. When you use a broker sent to you by HomeLight, you are paying for two brokers.

Consumer Steering

Some consumers who receive a recommendation for the three local HomeLight partner agents will often proclaim that the process of selecting a Realtor is very simple and that they have experienced excellent results.

The question stands, why doesn't the editor's review for HomeLight extend a similar recommendation? The difference is that the editor's review focuses directly on the quality of HomeLight brokerage as an information channel, while most consumers tend to combine HomeLight brokerage with an experience provided by HomeLight partner brokers into a single experience. From an editor's perspective, these are not the same.

The way consumers find a real estate professional must be unbiased and free from pay-to-play incentives in order to be considered as a quality channel.

HomeLight brokerage offers an excellent channel that proactively steers consumers toward a highly selected pool of partner brokers who have a blanket referral agreement with them, in an exchange for a significant share of their commission.

This is a very different experience than having to genuinely rate local agents and offer an unbiased recommendation. HomeLight has a direct financial incentive to steer consumers toward brokers who charge higher commissions.

Moreover, HomeLight brokerage operates by excluding itself from the competition with partner agents. In the United States, it is unlawful for real estate professionals to allocate consumers or organize into broker referral networks by means of blanket referral agreements.

HomeLight is a brokerage and it must compete with other brokers, instead, the company organizes brokers into a network in order to receive a cut of their commission. Real estate professionals working with HomeLight no longer compete for consumers, but rather compete for HomeLight to steer their business.

HomeLight consistently applies a logical fallacy called "Appeal to Authority" where it states that their partner agents are the best simply because the company has done some sort of "black box" research without actionable reasoning to support the claim. HomeLight algorithm is biased by default, simply because it will only match consumers with partner agents, and not all local agents.

HomeLight cannot actually rate all local agents and publically disclose this data, simply because agents who are rated badly will argue that the system of rating is flawed – not all transactions are recorded in the MLS, it is impossible to truly determine the quality of agents based on data provided in the MLS, some agents will underprice homes to sell them quicker, etc. Consumers are legally allowed to rate their experience with services in the United States. Unbiased channels such as Yelp! freely offer unbiased medium with good information where brokers cannot buy their recommendations with referral fees, or offer consumers gift cards to write reviews.

HomeLight only offers three best choices, simply because these agents will not argue with that determination, in fact, they are willing to provide a kickback of their commission for the privilege.

All of these reasons combined are why the editor's review rating is so much different from positive consumer reviews. The editor's rating focuses on the fairness of the process, rather than the individual outcome. In order to promote fair practices in the industry, we place a very different value on pay-to-play steering vs. unbiased match results.

Is HomeLight Free?

HomeLight often proclaims that its "service is 100% free." We find this statement to be false. HomeLight is not free, in fact, this "paper" brokerage adds unnecessary referral fees into transactions that make it more expensive to buy or sell any home.

Eventually, HomeLight is a brokerage and their fees are paid by consumers with higher commissions. HomeLight further claims that "agents don't pay us to be listed, so you get the best match." This is a use of a "Modal Logical Fallacy" because it specifically concludes that because something is true, it is necessarily true, and there is no other situation that would cause the statement to be false. Simply because agents don't pay HomeLight to be listed, doesn't mean that agents don't pay HomeLight at all. In fact, HomeLight actively steers consumers toward agents who pay them, just after the transaction.

As of 2019, HomeLight claims to have made a successful match for about 390,000 people with agents. The median home price of a home in the United States is about $230,000. Multiplying the two figures yields about $100 Billion in home sales. Assuming a 5-6% commission, this yields about $5 to $6 Billion in real estate commission business generated nationwide. In the recent Crunchbase article HomeLight claims to have "driven well over $17 billion of real estate business nationwide," which indicates that HomeLight works with homes above the median price. Simply stated, HomeLight has collected a "standard" 25% (presently, 33%) referral fee on commissions valued anywhere from $5 to $17 Billion since its inception in 2012.

This yields a mind-blowing estimate set at $1.25 to $4.25 Billion in commission kickbacks paid to HomeLight from participating brokers across the United States. Almost all of it is profit since HomeLight doesn't perform any services typically offered by real estate brokers.

HomeLight advertises a 100% free service, yet it subjects consumers to Billions in added fees in one of the most important transactions of their lives.

HomeLight referrals violate RESPA

The primary reason consumers and honest real estate agents should avoid HomeLight is the illegal kickbacks involved. Real Estate Settlement Procedures Act (RESPA) Section 8(a) and CFPB Regulation X maintain firm prohibitions against kickbacks and unearned fees. In the United States, the law firmly reads that no person shall give, and no person shall accept any fee, kickback, or thing of value pursuant to any agreement or understanding, oral or otherwise, that business incident to or a part of a real estate settlement service involving a federally related mortgage loan shall be referred to any person. See 12 U.S.C. 2607(a).

HomeLight attempts to utilize 12 U.S.C. 2607(c)(3) and 12 C.F.R. 1024.14(g)(1)(v) exemptions (or carve-outs) from the RESPA’s kickbacks ban. These exemptions allow payments under cooperative brokerage and referral arrangements between real estate agents and brokers. This limited exemption on kickbacks only applies to fee divisions within real estate brokerage arrangements when all parties act in a real estate brokerage capacity. (A bona fide brokerage sometimes needs to refer a client to another broker, where cooperative fee arrangements between bona fide real estate brokers may help facilitate a home purchase transaction more efficiently for both the home seller and the homebuyer.)

However, the so-called no upfront costs agent-matching services (or referral platforms) are not genuine brokerages acting in a brokerage capacity. This legal question was recently decided in my civil lawsuit with HomeLight. In this lawsuit, the United States District Court for the Northern District of California had reasoned that HomeLight acts in a vertical servicer-customer relationship on a different level of the supply chain with +/-28,000 partner agents. The federal court had reasoned that HomeLight is an upstream supplier of paid referrals to downstream real estate brokers (as opposed to a real estate broker acting on the same distribution level.) Specifically, the court reasoned that … even though HomeLight is a licensed brokerage, in the context of this [referral] agreement HomeLight and agents are not acting as horizontal competitors … where … real estate agents [are] referral platform’s intermediate consumers … HomeLight, Inc. v. Shkipin, 22-cv-03119-PCP, 4 (N.D. Cal. Sep. 27, 2023).

This determination made by the federal court precludes 12 U.S.C. 2607(c)(3) exemption applicability for any of HomeLight’s referrals to partner agents. The publisher of this review does not have standing to raise a claim against HomeLight under RESPA in federal court, however, consumers who used HomeLight may have standing to sue, depending on when they were steered toward a partner agent who paid kickbacks to HomeLight. (The statute of limitations for a violation of RESPA is one year from the date of the violation. However, the statute of limitations can be extended under certain circumstances through the doctrine of equitable tolling.)

HomeLight is not even licensed as a brokerage in most states, so they could not even possibly be acting in brokerage capacity in those jurisdictions where they are not licensed, to begin with. Setting aside all other facts, where their Section 8(c)(3) defense (that HomeLight holds a real estate license in California, therefore it is eligible for 12 U.S.C. 2607(c)(3) exemption) immediately fails in jurisdictions where HomeLight holds no real estate licenses at all, yet they claim to operate in. Even in California, HomeLight holds a license with a single Salesperson listed, for all practical reasons, a shell entity.

There is a cardinal legal difference between a referral platform and a real estate brokerage. The Supreme Court, in Ohio v. Am. Express Co., 138 S. Ct. 2274, 201 L. Ed. 2d 678 (2018) recognized a two-sided platform to facilitate a single, simultaneous transaction that offers different products or services to two different groups who both depend on the platform to intermediate between them. In other words, all agreements between two-sided platforms and their customers are established between firms at different levels of distribution offering entirely different products or services. The term real estate broker is codified under 24 C.F.R. 3500.2(b) as a settlement service provider. A mere possession of a shell real estate license does not meet this designation. The 12 U.S.C. 2607(c)(3) exemption only allows real estate agents or real estate brokers where all parties deliver services provided in connection with a prospective or actual settlement … for which a settlement service provider requires a borrower or seller to pay to share cooperative broker commissions between one another. See 12 C.F.R. 1024.2(b)(29)(14). As a referral platform, HomeLight violates RESPA because it collects a 33% kickback from real estate brokers, a conduct that is outlawed by the United States Congress.

A referral platform may, of course, easily sell customer leads to real estate brokers. However, such sales must never be tied to the outcome of the successful transaction or based on a percentage of real estate commissions. The US-CFPB Advisory Opinion issued on February 7, 2023, further confirms that any operator of a settlement services digital comparison-shopping platform receives a prohibited referral fee in violation of RESPA Section 8 when the operator receives a thing of value for referral activity. In the United States, anyone violating the RESPA’s referral fee ban commits a crime 12 U.S.C. 2607(d)(1). HomeLight is orchestrating a wire-enabled nationwide scheme that constitutes 1,200,000+ separate counts of RESPA violations. When prosecuted by the government, Section 8 of RESPA violations are subject to fines of up to $10,000 and a potential prison sentence of one year, for each violation.

HomeLight false advertising violates Lanham Act and FTC Act

HomeLight utilizes false statements to promote itself (such as: Free and unbiased. Our service is 100% free, with no catch. Agents don't pay us to be listed, so you get the best match). This is integrally false advertising, as a matter of law. HomeLight even admits in its legal arguments that it is not free. The scheme steers consumers in a pay-to-play setting, and it cannot be unbiased by the mere definition.

The US-FTC Guide Concerning Use of the Word Free and Similar Representations 16 C.F.R. 251.1 explains meaning of free such that a purchaser has a right to believe that the merchant will not directly and immediately recover, in whole or in part, the cost of the free merchandise or service. HomeLight's false advertising cannot meet this definition because the scheme directly recovers the cost of steering consumers to partner agents via an unlawful referral fee paid upon a successful transaction. This fee is directly recovered from each referral and is paid by consumers with excessive real estate commissions. For certain transactions, HomeLight, Inc. also admits to taking their referral fees directly from consumers’ escrow. HomeLight is NOT free, and it is certainly NOT 100% free. The false advertising damages, as a result of HomeLight's false advertising, can be restituted to harmed consumers and lawful businesses.

Because consumers continually search for the best buy and regard special offers (such as, 100% free, no catch, and unbiased) to be a special bargain, all such offers must be made with extreme care so as to avoid any possibility that consumers will be misled or deceived. HomeLight's false advertising (Free and unbiased. Our service is 100% free, with no catch) do NOT display ALL of the terms, conditions and obligations in close conjunction at the outset of these offers, where disclosure of the terms of the offer is hidden within Terms of Service, is NEVER sufficient according to US-FTC.

In reality, ALL partner agents agree to pay HomeLight a referral fee on all closed transactions through their employing broker. Partner Agents must also sign a referral agreement with HomeLight before consumers' referrals become accessible. Even where HomeLight admits that it receives a portion of the agent's commission as a referral fee as an explanation on its referral fee model, this explanation is materially deceptive because it falsely and deliberately describes that (1) there is no cost to consumers to use HomeLight, (2) Agent Match service has no catch, and (3) 100% free service for everyone involved. HomeLight's referral fee is not only an unlawful kickback, but it is also never free to any consumers, very much meant to catch consumers with hidden kickbacks, and it makes home buying or selling more expensive by tens of thousands in junk fees.

HomeLight price-fixing violates Sherman Antitrust Act

HomeLight's model is also materially deceptive because it aims to stabilize real estate commission rates for ALL partner agents at 5%-6% of the sales price as the standard range. According to US-FTC Guide to Antitrust Laws, price fixing is an agreement (written, verbal, or inferred from conduct) among competitors to raise, lower, maintain, or stabilize prices or price levels.

HomeLight falsely represents to consumers on its website that: (1) A commission rate of 5%-6% of the sales price is the standard range, (2) Homesellers can expect to pay 5% to 6% of their sale price as total commission, (3) Sellers typically pay a 6% commission, (4) The average total commission on a home sale is 5% to 6% of the total sale price, which is typically paid by the seller, (5) 1.5% [commission] savings may actually cost you more in profits than simply paying the higher commission, (6) When asking an agent to lower their pay, you limit the pool of agents willing to work with you, (7) The downsides to working with a low-commission agent can be steep, (8) Buyer agent commissions are most often covered by the seller, meaning this service is typically 100% free for buyers, (9) HomeLight would be happy to put your commission worries to rest by introducing you to several agents in your area who are well worth it., etc.

None of these statements about commissions are true. All real estate commissions must always be individually-negotiable, and, under law, there are no standard real estate commissions anywhere in the United States. Further, a cooperative buy-side offer of compensation made toward buyer brokers' fees cannot be mandated upon home sellers via MLS, or otherwise (although, real estate professionals may offer optional cooperative Buyer Agent Commissions in (40) state jurisdictions where buyer agent rebates are allowed by state law, as long there are no false claims made that buyer brokers services are free to homebuyers and home sellers are fully informed that all such offers are optional.)

While it is true that HomeLight does not explicitly mandate that all of +/-28,000 partner agents charge consumers 5% to 6% commissions as part of their referral agreement, it blatantly suggests that they do, where the series of horizontal price-fixing agreements to stabilize prices between spokes can be inferred from HomeLight's conduct. In other words, all partner agents (acting on the same distribution level) sign up into the referral network administered by HomeLight on the understanding that other partner agents using the referral platform will also likely be asking for 5% to 6% of the total sale price.

HomeLight maintains full control over selected partner agents who are being referred to consumers (typically, no more than three (3) partner agents are recommended as the best match to consumers), and because HomeLight knows what partner agents from past referrals charge historically, and because HomeLight makes it known to all partner agents that the standard commission is 5% to 6% - a series of horizontal agreements to stabilize prices between spokes is plausibly used as the vehicle to safeguard partner agents from fierce competition, thereby the hub creates collusive efficiency by reducing the need for horizontal coordination through communications from hubs to spokes regarding other spokes' intentions.

According to US-FTC, HomeLight is allowed to argue that it implements no price-fixing agreements between partner agents in their network, but if the government or a private party proves a plain price-fixing agreement, there is no defense to it. HomeLight may not justify its behavior by arguing that the prices were reasonable to consumers, were typical within the industry, or were necessary to avoid fierce competition or stimulated competition. No court has yet determined if a series of horizontal price-fixing agreements to stabilize standard commission at 5% to 6% across +/-28,000 HomeLight partner agents exists or not, but the statements made by HomeLight on their website can be sufficiently used to prove that HomeLight violates antitrust law by way of stabilizing commissions across a nationwide network of partner agents. In the author’s opinion, HomeLight blatantly fixes commissions for partner agents with a single goal in mind: higher price-fixed real estate commissions rates charged by partner agents simply yield higher kickbacks paid to HomeLight from each home sale or home purchase.